The trend is your friend

Hello!

Last week, USD/JPY showed steady-enough growth, which was similar to the one recorded in the two previous weeks. After prolonged consolidation, the uptrend on USD/JPY extended. Notably, the pair was bullish last week due to the statements made by Japan's monetary policy officials. Thus, Governor of the Bank of Japan Haruhiko Kuroda expects inflation to accelerate to 2% in April due to a sharp rise in energy prices. Today, it is a sore spot for all developed economies, not just Japan. Nevertheless, inflation is much lower in the country owing to the low exchange rate of its national currency, the official pointed out.

The Bank of Japan aims at ensuring that corporate profits, jobs, and wages grow in proportion to inflation. Mr. Kuroda also mentioned the forex market, saying the regulator expects to see stable exchange rates. He named the Fed's monetary policy tightening and high demand for the US dollar among Japanese importers as the main driving force for USD/JPY. Overall, the BoJ's governor reminded the market that the weaker yen would benefit the Japanese economy. After Haruhiko Kuroda's statement, the Japanese yen came under stronger pressure. Meanwhile, Minister of Finance Shun'ichi Suzuki focused on the stability of exchange rates and the fight against high inflation in Japan, delivering his speech last week.

Let's now turn to price charts of USD/JPY.

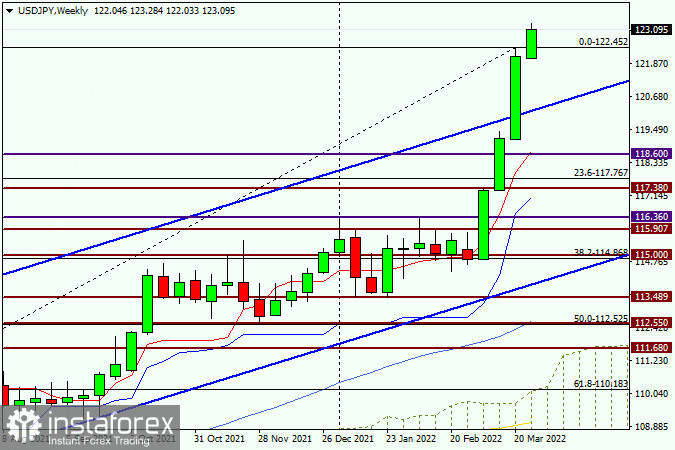

Weekly

The pair has been bullish for the third week in a row, and its last week's growth was even stronger than in the previous two weeks. The quote broke through the important psychological technical and historical level of 120.00 and closed at 122.11 on Friday. The price went that high for the last time in 2016. If the bull run continues, the pair will be able to hit resistance at around 123.75. It would be nice to see a bearish correction after three weeks of growth. All in all, it would be unwise to go long at the very peak and at such a high price.

Daily

According to the daily time frame, the Hanging Man candlestick pattern emerged on Friday, March 25. Given the impending correction and a strong candlestick signal, you could consider going long after a pullback to the 121.10-120.80 price zone. Otherwise, if no pullback occurs, long positions could be opened after a true breakout of resistance at 122.45 on a pullback to this mark. Taking into account the Gravestone candlestick pattern, traders willing to take risks could try selling the instrument near current price levels. At the same time, you could go short if only a corrective move begins. Naturally, selling the pair amid the current uptrend would be riskier. After all, the trend is your friend.

Have a nice trading week!