The surge of optimism on Tuesday evening led to the growth of stock indices across the market. The strongest movements were observed in Europe, with the Euro stoxx 50 rising by 3% at once. Indices in US and Asia were also in a positive territory. However, the optimism is based on shaky grounds, that is, the negotiations over the situation in Ukraine. Most likely, this optimism will come to naught in the very near future.

On a different note, the assessment of Fed's degree of aggressiveness is rising. If a couple of weeks ago markets assumed one rise of 50p, followed by a streak of 25%, two consecutive 50p increases were predicted last week. Some, like the Danske Bank, even said there will be three consecutive 50p increases, followed by a 75p rise. That will raise the rate in the range of 2.50-2.75% by the end of the year. The Danske Bank noted that it is because inflation is likely to remain high in the next 1-2 years.

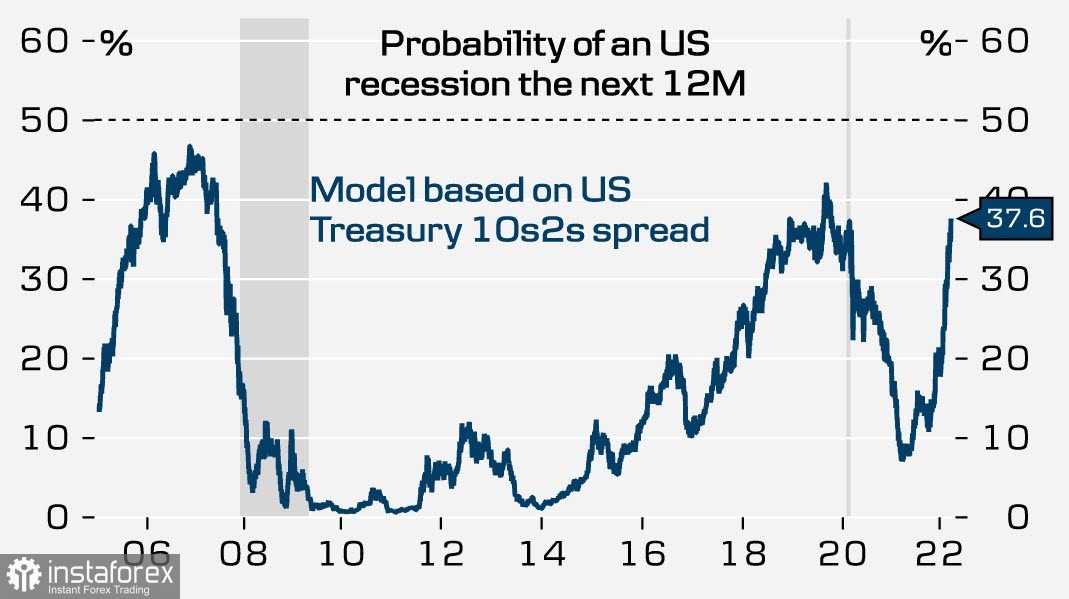

If the Fed fails to curb inflation before the onset of recession, then in 1-2 years the US will be covered by a wave of stagflation. Such a prospect suggests that the Fed will focus on suppressing inflation by any means, which increases the likelihood of a faster rate hike. Then, the most likely result of such a policy is the continued strengthening of dollar.

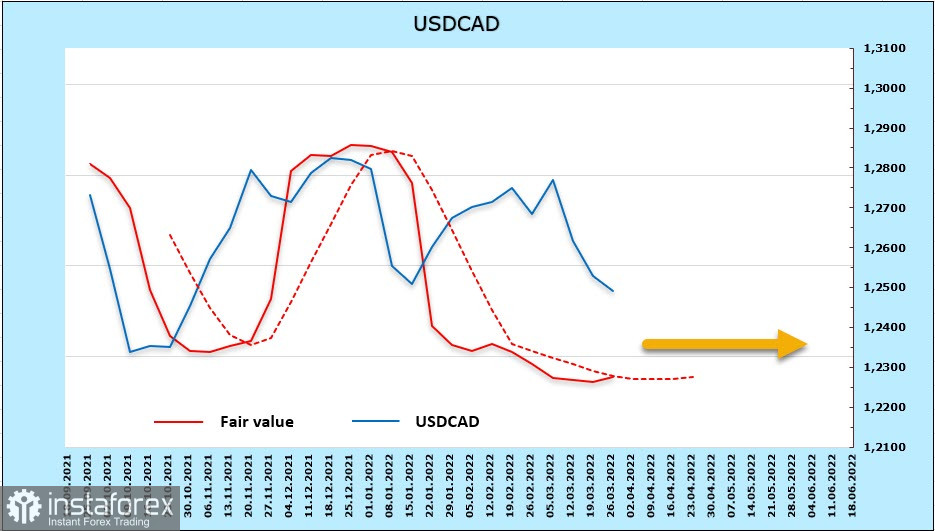

USD/CAD

Macroeconomic data for Canada has not been updated over the past week. No news worthy of attention has been published, so the Canadian dollar continues to follow the prevailing currency trends. As such, according to the CFTC weekly report, the previously established net long position has been liquidated, and the change of -1.783 billion is the maximum among the G10 countries. Meanwhile, a short position of -393 million has formed. The estimated price also turned down and equaled the long-term average, which means that there is no movement in CAD.

In any case, USD/CAD went lower as expected, a little short of the target of 1.2450. The possibility that it will reach the local low of 1.2462 is quite high, so traders better prioritize the rollback to 1.2570/90. Buy from current levels and set stop loss just below 1.2462.

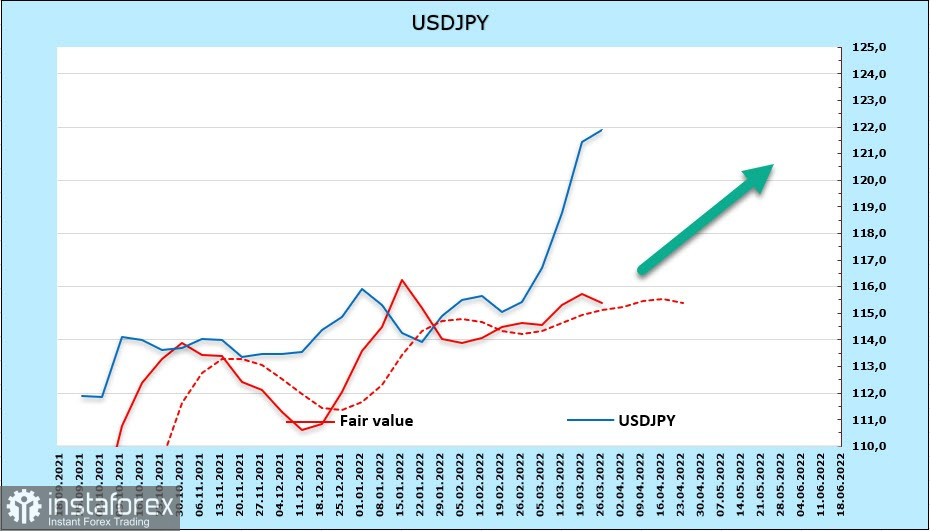

USD/JPY

The sharp rise in yen was provoked by the policy of the Bank of Japan, which is trying to manage the yields of long-term bonds. Three times in the past week, the Bank of Japan has made fixed-price bond purchases to keep the upper end of the yield range at 0.25%. The yen has always depreciated sharply whenever the BOJ makes such fixed-price transactions. Apparently, and some officials confirm this, when it comes to choosing between the yen and holding the yield cap, the Bank of Japan chooses the latter.

Selling of the yen can stop only in two cases - either the Bank of Japan moves to a more hawkish position, or the Fed reaches its maximum hawkish position. The first is extremely unlikely, while the second is still far from being fulfilled, which means that the sale of yen will continue. As such, according to the CFTC weekly report, the net short JPY position rose by 1.534 billion over the reporting week, reaching -8.121 billion. The bearish edge is strong, but JPY received significant support from rapidly depreciating oil, making the settlement price lose momentum. This made the main trend remain bullish.

And even though the yen did not reach the main target of 125.90, its rapid rise to 125 is impressive. The closing of positions led to a slight correction, so there is a chance of a decline to 119.80/120. But since there were no grounds for a full-fledged reversal, it is likely that USD/JPY will rally after a short period of consolidation.