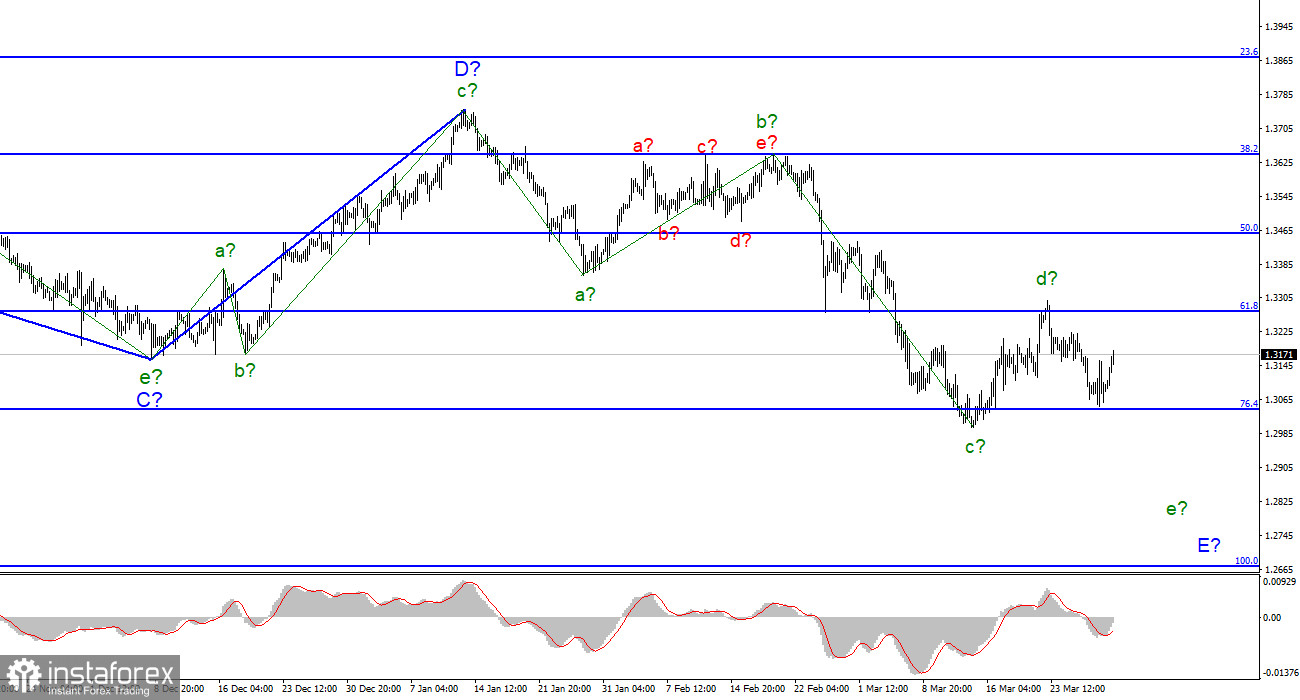

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The assumed wave d in E is completed, and there should be five waves in total inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time. The decline in quotes may resume with targets located around the 27th figure within the wave e in E. Yesterday, there was an unsuccessful attempt to break through the 76.4% Fibonacci level, which led to the departure of quotes from the reached lows. However, this departure does not have the same consequences for the wave markup as in the case of the euro/dollar instrument. This departure to the top may be just an internal wave in the composition of e in E. And at the moment, it doesn't even look like a full-fledged wave, it's so weak. Thus, in the case of the wave marking of the Briton, no changes can be made at all now, and there is no point in this. We need to wait for the resumption of the decline in quotes and a successful attempt to break through the 1.3042 mark.

The pound also grew up a little on the news from Turkey

The exchange rate of the pound/dollar instrument increased by 70 basis points on March 30. The increase in demand for the pound has been much weaker in recent days than for the euro currency. From my point of view, neither the euro nor the pound is ready for stronger growth now. Yesterday, both currencies were rising exclusively on the same news. Information was received from Turkey on the progress of negotiations between Ukraine and Russia, from which the markets concluded that an agreement between the two countries could be reached and signed in the near future. I think this is not the case, but the market believes that the probability of peace has increased over the past two days. It is against this background that the euro and the pound have strengthened their positions.

Today in America, the ADP report on the change in the number of people employed in the American economy was released. This number increased by 455 thousand, as expected by the markets. The final GDP for the fourth quarter was 6.9% quarterly, and not 7.0%, as the previous estimate showed. However, in both the first and second cases, the discrepancy between expectations was minimal. The market did not even pay attention to this data. From this, I conclude that both instruments are moving under the influence of geopolitics. The market continues to wait for positive news from Turkey and believes that they can be. However, both wave markings now say that demand should increase for the dollar, not for the euro. Thus, we have a conflict between the geopolitical factor and wave analysis. So far, I think wave analysis will win. But for this, the decline in quotes of both instruments must resume today or tomorrow.

General conclusions

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located near the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave E does not look completed yet. I propose to consider Wave d in E completed, and I do not wait for the wave marking to become more complicated until the instrument makes a successful attempt to break through the 1.3273 mark, which equates to 61.8% Fibonacci. I note that wave d can take on a three–wave form and lengthen strongly - wave b turned out exactly like this.

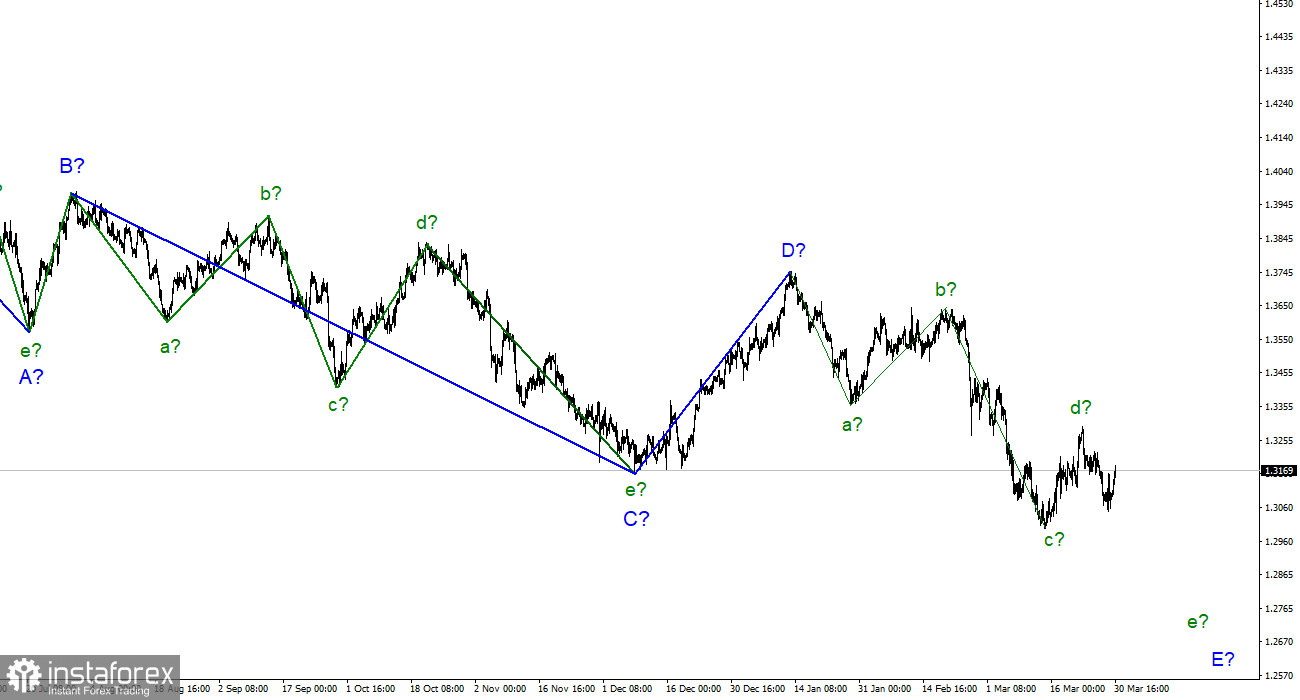

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the quotes of the British near the 27th figure.