Analysis of transactions of the environment:

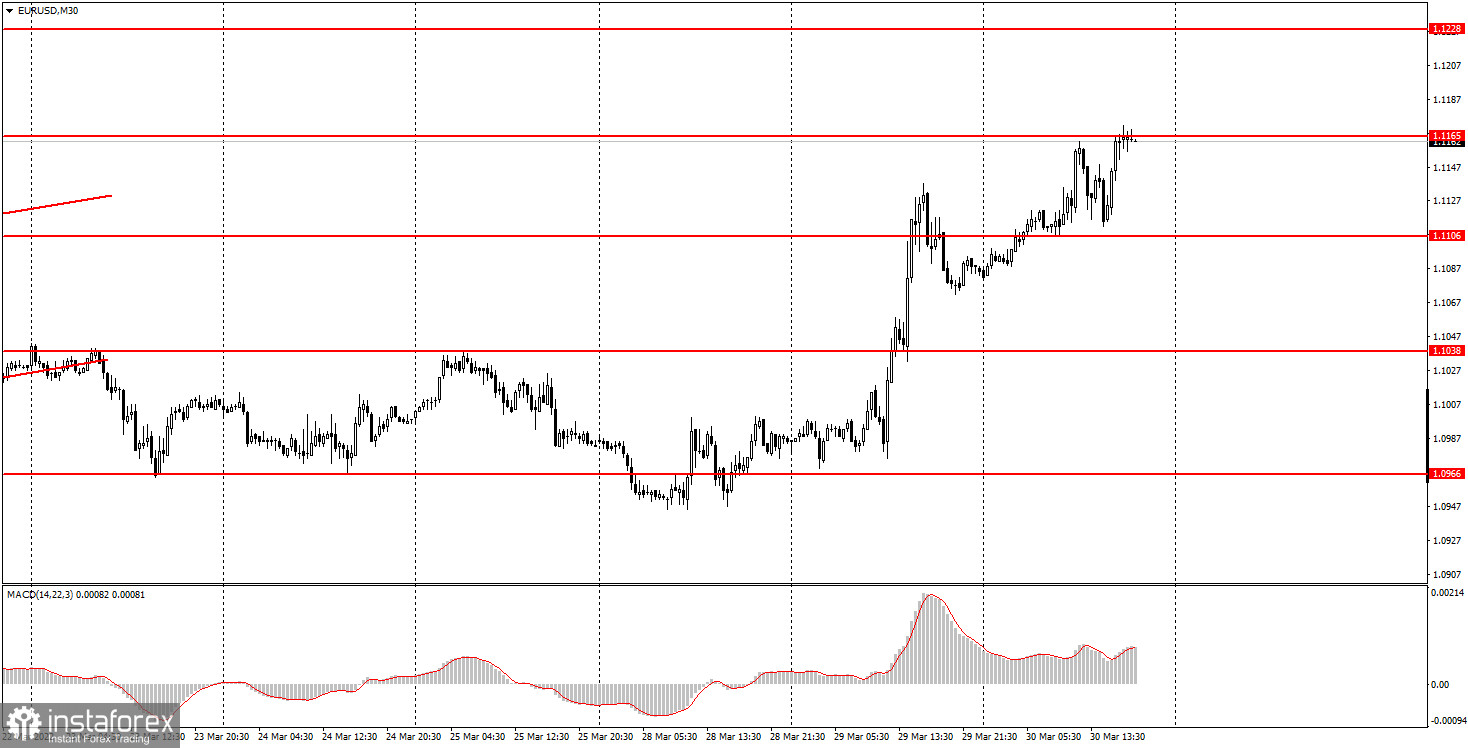

30M chart of the EUR/USD pair.

The EUR/USD currency pair continued its upward movement on Wednesday. However, during the day, it also managed to form a round of downward correction. We believe that the market continued to be impressed by the information that came in yesterday. Information about the progress of negotiations between Ukraine and Russia regarding a peace agreement. Recall that yesterday, the European currency showed strong growth on increasing the likelihood of reaching a peace agreement in the near future. And although we do not see the possibility of signing this agreement yet, the markets probably see it. It seems that today they continued to buy the euro currency based on this information. Thus, all macroeconomic statistics from the United States were ignored today. Traders also ignored the speech of Christine Lagarde, who said that she "hopes for a reduction in inflation in the EU in the near future." Based on what she "hopes" for such an option, Lagarde did not say. From our point of view, this speech could well provoke a fall in the euro. However, in practice, the European currency showed growth again. We still believe that it will not be long.

5M chart of the EUR/USD pair.

On the 5-minute timeframe, the pair was not trading in the best way today. It is visible that it spent the whole day between the levels of 1.1106 and 1.1165. That is, even though the volatility was quite high, the current movement can still be considered flat. The zigzag that formed a few hours before the opening of the American session greatly interfered with the work with the pair. If the pair just traded from 1.1106 to 1.1165 and in the opposite direction, overcoming the level of 1.1136 each time, then there would be nothing terrible. And because of this zigzag, the pair formed as many as five signals near the level of 1.1136, most of which turned out to be false. Nevertheless, let's try to figure out how the pair should have been traded today. The first buy signal was formed at the very beginning of the European session with a rebound from the level of 1.1106. In the future, the pair rose to 1.1165, where it was necessary to close the longs in a good profit. And immediately open short positions. After that, the price first fixed below the level of 1.1136, but then went above it, so the shorts had to be closed in a small profit. At the signal of consolidation above 1.1136, long positions should have been opened, but it turned out to be false. As is the next sell signal. These two transactions brought losses. The last fifth signal near the level of 1.1136 should have already been ignored, and the signal near the level of 1.1165 cannot be called a signal, since the price has not overcome it and has not rebounded from it. But in a small profit, the day could still be closed.

How to trade on Thursday:

On the 30-minute timeframe, the pair continues to form a new upward trend. There is no clear trend on this TF right now, and the whole movement of the last two days is impulsive. Now even a trend line cannot be built. Markets react exclusively not to geopolitics. According to this movement, it is impossible to analyze the entire technical picture, build trends and forecasts. We need the market to calm down first after a crazy Tuesday. On the 5-minute TF tomorrow, it is recommended to trade at the levels of 1.1070, 1.1106, 1.1168, 1.1228. When passing 15 points in the right direction, you should set the Stop Loss to breakeven. There won't be a single important event in the European Union on Thursday, and in the US there will be only a few secondary reports, like applications for unemployment benefits. However, the market may continue to work out the geopolitical factor tomorrow.

Basic rules of the trading system:

1) The strength of the signal is calculated by the time it took to generate the signal (rebound or overcoming the level). The less time it took, the stronger the signal.

2) If two or more trades were opened near a certain level on false signals, then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade transactions are opened in the period between the beginning of the European session and the middle of the American session when all transactions must be closed manually.

5) On a 30-minute TF, signals from the MACD indicator can be traded only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as a support or resistance area.

What's on the charts:

Price support and resistance levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Red lines - channels or trend lines that display the current trend and show in which direction it is preferable to trade now.

MACD indicator (14, 22,3) - a histogram and a signal line; an auxiliary indicator that can also be used as a signal source.

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp price reversal against the previous movement.

Forex beginners should remember that every trade cannot be profitable. The development of a clear strategy and money management are the keys to success in trading over a long period.