EUR/USD

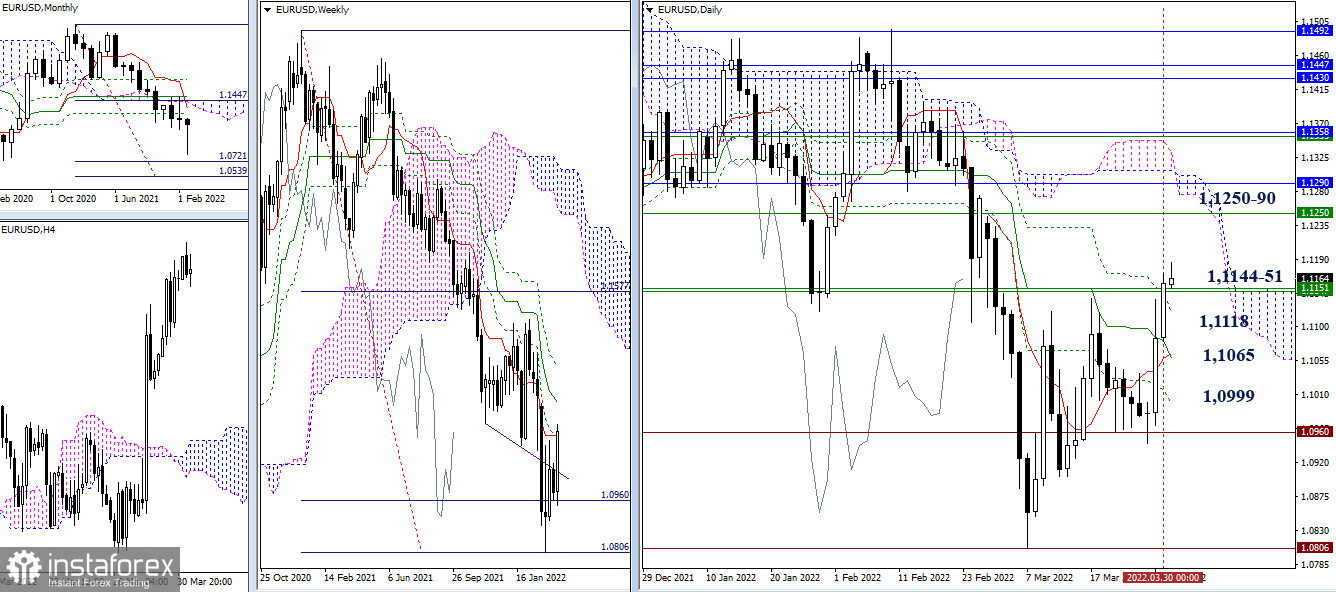

Bullish sentiment dominated yesterday. Today we close the month, tomorrow the week. All the achievements that can be identified and preserved during these two days will be imprinted in history. The dominant sentiment will have a high chance of its continuation and development in the near future. In the current situation, attention is focused on the attraction and strength of the weekly levels (1.1144 - 1.1151). The nearest upside targets are now at 1.1250 (weekly medium-term trend) and 1.1290 (daily cloud + monthly Fibo Kijun). The passed levels of the daily death cross (1.1118 – 1.1065 – 1.0999) can serve as support today.

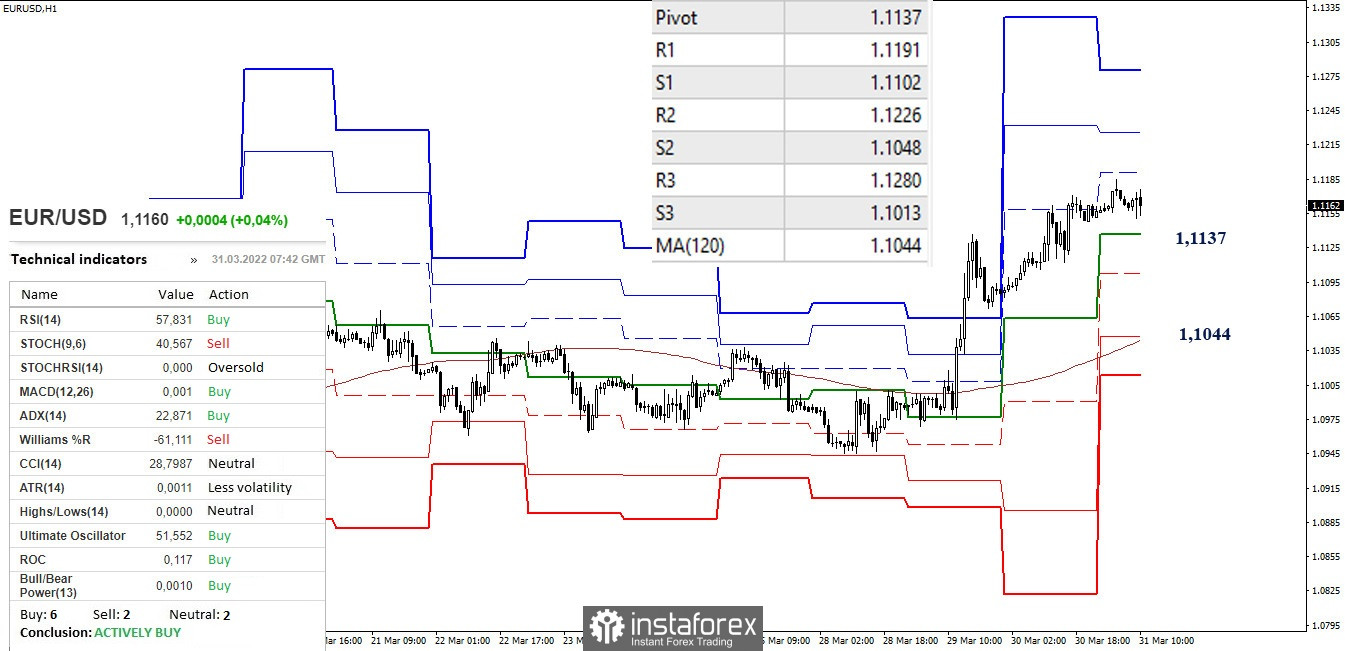

On the lower timeframes, the advantage is now on the side of the bulls. Their intraday reference points are at 1.1197 – 1.1226 – 1.1280 (classic pivot points). If a corrective decline develops, the key supports are now at 1.1137 (central pivot point) and 1.1044 (long-term weekly trend). Intermediate support can be noted at 1.1102 (S1).

***

GBP/USD

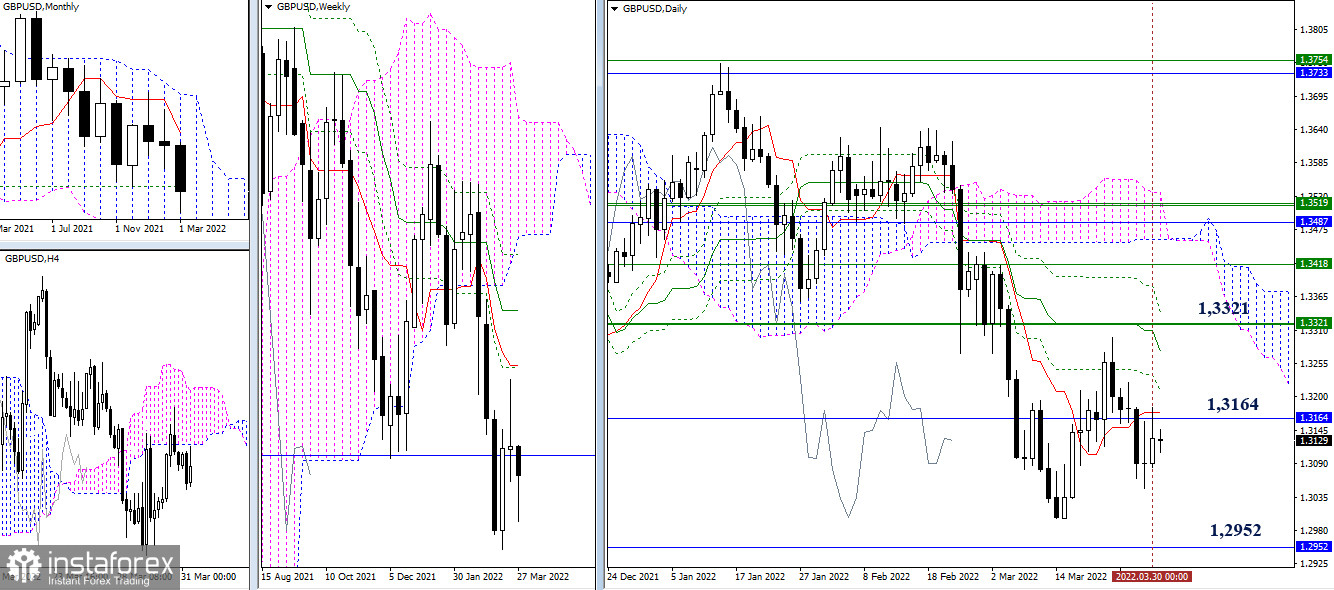

The pair remains tied to the monthly level of 1.3164. As a result of this, the main reference points that make it possible to make changes in the distribution of forces and identify new prospects retain their significance and location at the present time. For bulls, the 1.3321 area (weekly + daily levels) is important. For bears, the targets are 1.3000 (minimum extremum) and 1.2952 (lower boundary of the monthly cloud).

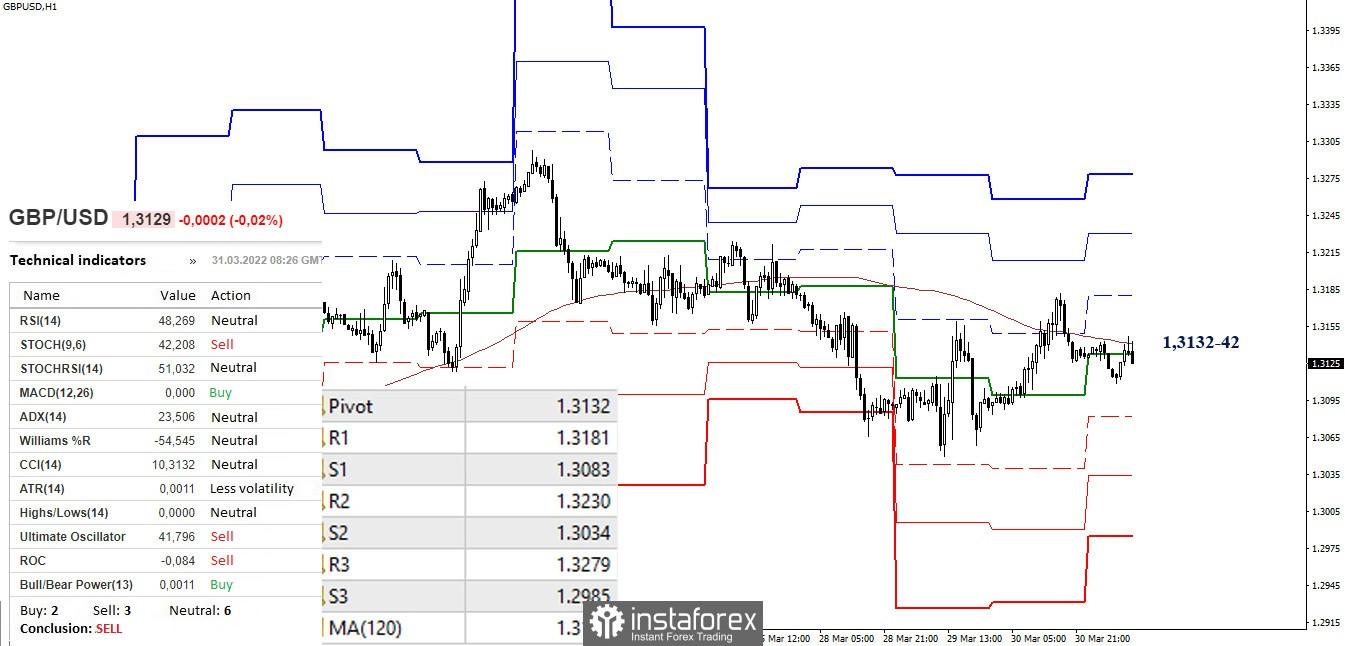

We have been seeing uncertainty for a long time on the lower timeframes, which is expressed in the struggle for possession of key levels, today they have joined forces in the area of 1.3132-42 (central pivot point + weekly long-term trend). Consolidation and work above the levels will give preference to strengthening bullish sentiment. Reference points for the implementation of the upward movement within the day are located at 1.3181 - 1.3230 - 1.3279 (resistance of the classic pivot points). The development of events under the key levels will strengthen bearish sentiment. Their reference points at the current moment can be noted at 1.3083 - 1.3034 - 1.2985 (support of the classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)