GBP has limited bullish potential

Hello, dear traders!

Before analyzing GBP/USD, I'd like to talk about British Prime Minister Boris Johnson first. He is perhaps the most enthusiastic advocate for anti-Russian sanctions. Recalling the recent NATO summit, I noticed Mr. Johnson's striking behavior: his tousled hair, hands in the pockets of his jacket, as well as a condescending expression on his face. He looked as if being at home and not at a NATO summit. Mr. Johnson acted as if the host of the meeting. Why am I telling you this? Because the UK and Russia have had a difficult relationship throughout history.

That is why the UK will always be in favor of anti-Russian sanctions among other European nations. Meanwhile, its European allies will have nothing else to do but support British initiatives. If so, economic risks in the region will only increase. Once again, no one will benefit from such developments. Meanwhile, some progress was achieved during the latest round of peace talks between Russia and Ukraine in Turkey.

Let's now turn to today's macroeconomic calendar and see what events could affect GBP/USD. At the moment of writing, Q4 GDP was released in the UK. The final results were upwardly revised to 1.3% from the previous quarterly forecast of 1%. The figure also rose by 6.6% y/y, exceeding the market consensus of 6.5%. During the North American session, data on personal income and spending, as well as the core PCE and initial jobless claims, will be released in the US.

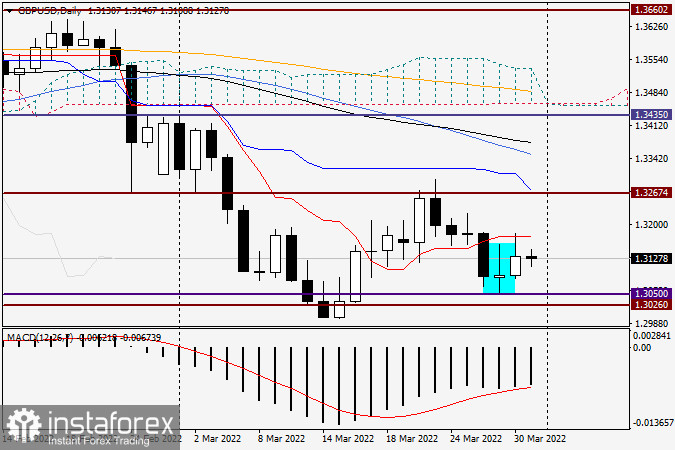

Daily

Speaking of the technical picture of GBP/USD, we may notice its limited growth potential. It may be that the pair trades under the influence of the cross pair EUR/GBP, which is commonplace. As for GBP/USD, a decrease in bullish activity is confirmed by the Doji candlestick formed on March 29. Yesterday, however, bulls did better. They were able to form a white candlestick. However, due to the fact that the pair encountered resistance at 1.3181, the candlestick then acquired a long upper shadow. There is no doubt that the red Tenkan Line of the Ichimoku indicator provided resistance to the price, too. In spite of positive macro results in the UK, the pound is unlikely to show a steep rise. This factor additionally proves the weakness of bulls. So, it would be unwise to go long on GBP/USD.

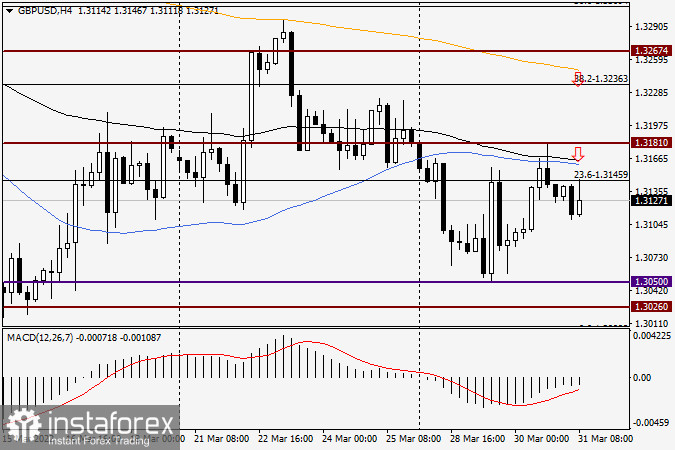

H4

Taking the account of the current technical picture on the H4 chart, short positions on GBP/USD could be opened from the strong technical level of 1.3165 after the price has approached the blue 50-day MA and the black 89-day EMA. You may look for sell entry points from 1.3250, another strong technical level, in line with the 80-day EMA. If bullish sentiment turns bearish and the price goes down from the current levels, you should focus on the price movement in the area of the support zone of 1.3050-1.3025. The formation of bullish candlestick patterns there will signal to open long positions on GBP/USD.

Have a nice trading day!