New trend could begin in April

Hi, dear traders!

First, let us have a look at international events, as well as the forecast for US non-farm payrolls.

In China, a COVID-19 outbreak has occurred in Shanghai. About 200 confirmed infections have been reported. The Chinese authorities have reacted by imposing the largest lockdown in the city since the beginning of the pandemic in 2019. The recent outbreak has somewhat overshadowed the war in Ukraine. The Russian Ministry of Defense has claimed Russian forces were redeployed from Chernihiv and Kyiv, which was disputed by US officials. The war in Ukraine will likely end only when a definite peace treaty would be signed by both Russia and Ukraine, with US and EU involvement.

Today, the US Department of Labor is set to release non-farm payrolls for March. According to consensus estimates, unemployment is projected to decrease to 3.7% from 3.8% in the previous month, The number of new jobs is expected to rise by 492,000, down from 670,000 in February. Economists predict average hourly earnings would increase by 0.4%. This indicator remained unchanged in February. USD's price dynamics have been rather unstable recently, particularly against other major currencies - If any data releases do not match expectations, it could put pressure on the US dollar.

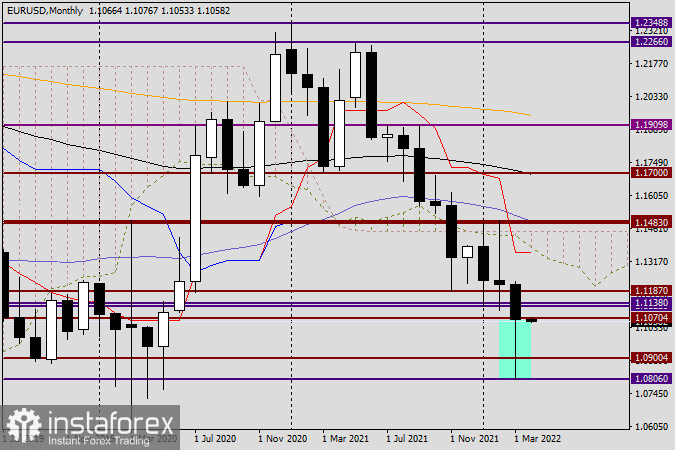

Monthly

Thanks to efforts by EUR bulls, EUR/USD finished March at 1.1070. The March candlestick has a very long lower shadow, indicating that market players do not want EUR/USD to move downwards. There is an opportunity for bullish traders to push the pair higher in the future.

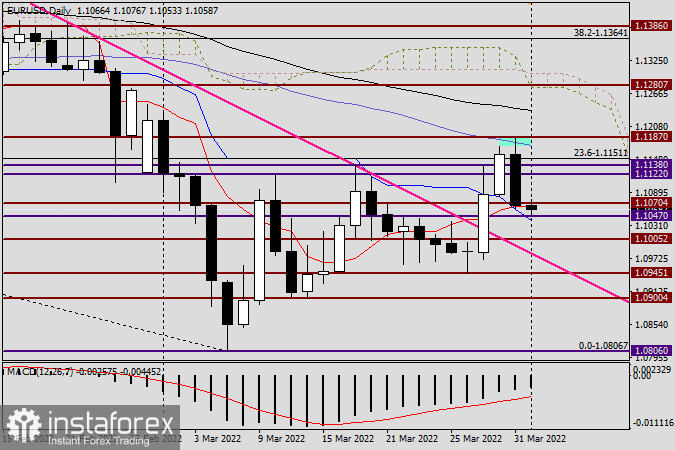

Daily

According to the daily chart, EUR/USD came under pressure from bearish traders and plummeted, resulting in a sizeable bearish candlestick. The 50-day SMA line and the key resistance level of 1.1187 reversed the pair downwards.

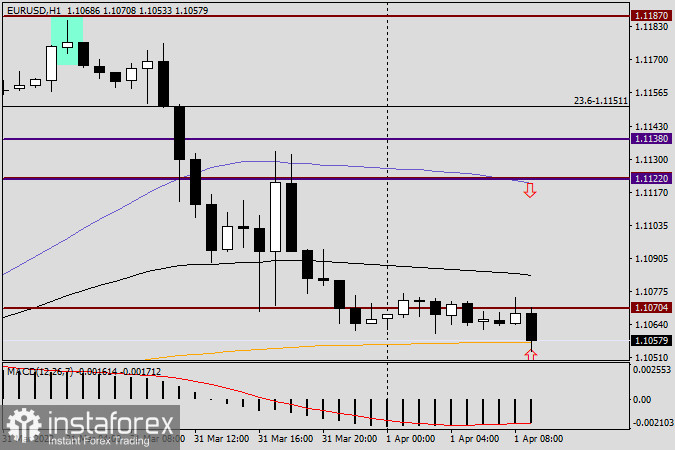

H1

Yesterday, traders were recommended to prepare opening short positions if bearish reversal candlestick patterns appeared at lower timeframes near the 50-day MA. These signals eventually appeared at H1 and H4 charts. In particular, the Gravestone Doji pattern can be clearly seen at the H1 chart - the pair began to drop afterwards. Today is set to be a special trading day due to the non-farm payrolls release in the US, which makes it difficult to provide any specific trading outlook.

In general, the March candlestick suggests EUR/USD could rise in April. Today, the pair could likely experience volatility and move in both directions. Short positions could be opened near 1.1120, while long positions can be considered at 1.1045 or close to the key psychological level of 1.1000. Previously, new trends emerged in spring - it hasn't been the case recently. However, hawkish plans by the Federal Reserve and several other leading central banks, as well as technical factors, suggest a new trend could begin in April.

Good luck!