GBP/USD still looking for direction

Today's review of the GBP/USD pair will be based mostly on technical analysis. However, let's first discuss some key fundamental events before moving to price charts.

As I assumed in my previous review on GBP/USD, the UK government has come to the forefront of the sanctions movement against Russia. Historically, the UK has usually followed the lead of the US in terms of political, economic, and geopolitical decisions. There was hardly ever any disagreement between the allies. There was just one time when former US President Donald Trump showed disagreement with former British Prime Minister Theresa May. There is no doubt that it is the United Kingdom, together with the United States, that is the main supporter of restrictive measures aimed at hurting the economy of Russia. The current reason is the situation in Ukraine, but before that, there were many other far less serious reasons.

Today, traders are waiting for an important report on the US labor market. This data is among the most significant indicators for the market, especially now amid the aggressive monetary tightening by the Fed. I have already discussed what to expect from this report in my euro/dollar pair review. Here, I would like to note that the US dollar is not so strong to face the mixed data on the labor market. We will later see what the market sentiment toward USD will be in April. In the meantime, let's discuss how the pair closed the previous month.

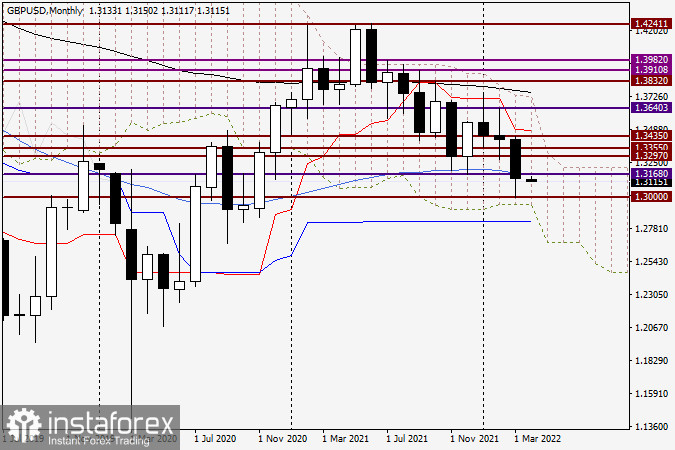

Monthly chart

As we can clearly see on the monthly chart, the GBP/USD pair has notably declined in March. At the same time, the fact that the lower shadow of the March candlestick is not so short and its closing price settled above the key psychological and historical level of 1.3000, bulls still have a chance to regain ground. Moreover, the pair stays inside the Ichimoku Cloud indicator, which signals the state of uncertainty in the market. Yet, the monthly close below the support level of 1.3168 and the blue 50-day simple moving average complicate the situation for the bulls. It seems that bears have finally forced the price to move down. It is no secret that the further dynamic of the pair will mostly depend on specific measures in the monetary policy rather than on the statements made by the Fed and the Bank of England. We are talking about monetary tightening and rate hikes. The reaction of the market also matters: it can be quite unpredictable as in the recent case with the US dollar. To sum it up, the pair has ended the session in March below 1.3168 and 50 MA. Therefore, I would prefer to go with the bearish scenario although I won't be so certain about it.

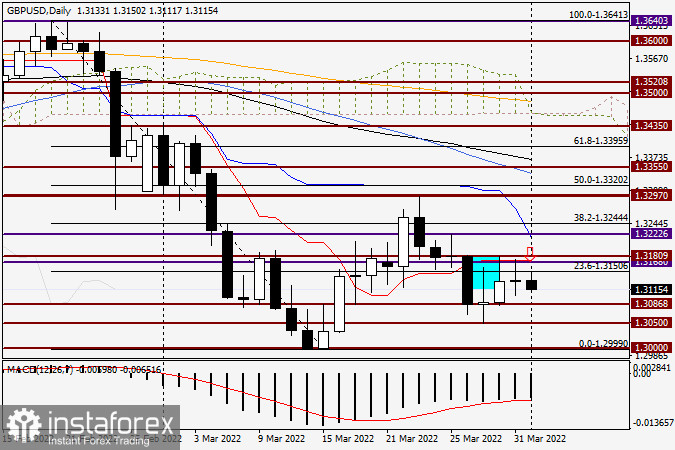

Daily chart

Unlike the euro, the pound sterling did well in yesterday's trading and managed to hold steady. If you want to learn more about what helped the pound, read my detailed technical review of the euro/pound cross rate. I would like to stress once again the price dynamic of this pair has a great influence on majors. As for the daily chart, the pair did not fall like EUR/USD but still failed to rise. It faced an obstacle at the red Tenkan line of the Ichimoku indicator which still acts as very strong resistance. The same can be said about the price zone of 1.3168-1.3193, which keeps pushing the quote to the downside leaving long upper candlestick shadows afterward.

The level of 1.3086 still serves as support together with a strong technical level of 1.3050. As expected, the key support is found at the most important historical and psychological level of 1.3000. On the analyzed time frames, the situation with the pound/dollar pair is not clear. The pair is still looking for direction. Given this factor, as well as the release of the key employment report in the US, I recommend staying out of the GBP/USD market for now. For those who want to open new positions on the last trading day, I recommend waiting for the actual data on the US labor market and the subsequent market reaction. However, you should keep in mind that the price movements can be rapid and unpredictable. So, it is up to you to decide.

Good luck!