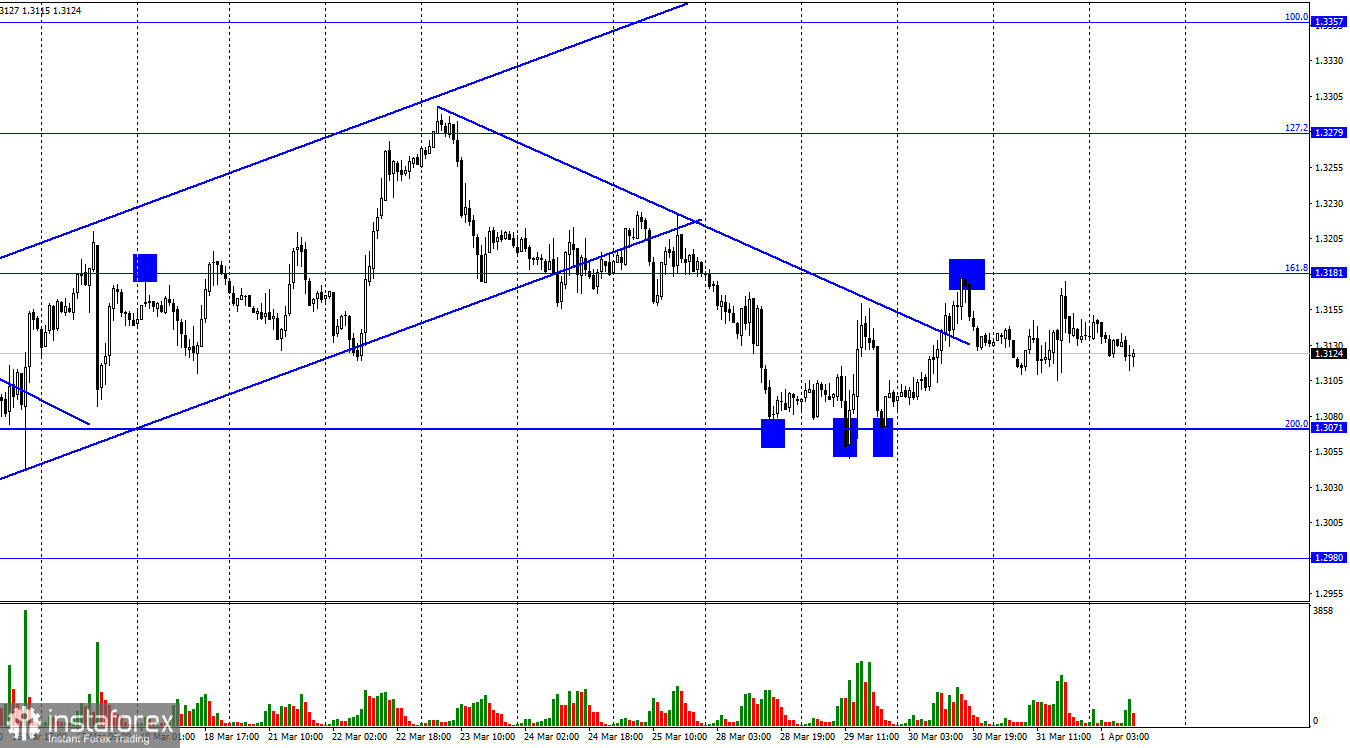

Hello, dear traders! On Thursday, the pair retraced up to the 161.8% retracement level of 1.13181, according to the 1-hour chart of GBP/USD. However, the bullish impulse soon stopped. The quote is now edging down towards the 200.0% Fibonacci level of 1.3071. The Q4 GDP report published in the UK yesterday logged an increase of 6.6% y/y and 1.3% q/q. Nevertheless, the pound was unable to take advantage of strong results. Today, with the release of the disappointing manufacturing PMI, traders' sentiment has not changed. So, it is time to focus on statistics from the US, which are set to be published in a few hours. The US unemployment rate is estimated to drop to 3.7% and NonFarm Payrolls are forecast to amount to 460,000-490,000.

Unemployment in the US has been falling for a while now. Therefore, a new decrease in figures is likely to come as no surprise. As for NonFarm Payrolls, the results will be able to somewhat affect the market depending on how the actual reading will be different from the estimated 460,000-490,000. If it exceeds 490,000, the greenback will strengthen. Conversely, if it comes lower than 460,000, the euro and the pound will rise on Friday. Another important report today will be the ISM manufacturing PMI. It is projected to come in at 58.5-59.0. The pound also trades under the influence of the geopolitical situation. On Tuesday, the currency scored gains amid reported progress in peace talks between Russia and Ukraine. On Wednesday, GBP bulls also tried to push the price further up. However, in both cases, they failed to close above 1.3181. Traders are now focused on the energy conflict between the EU and Russia, which exerts additional pressure on the pound right now.

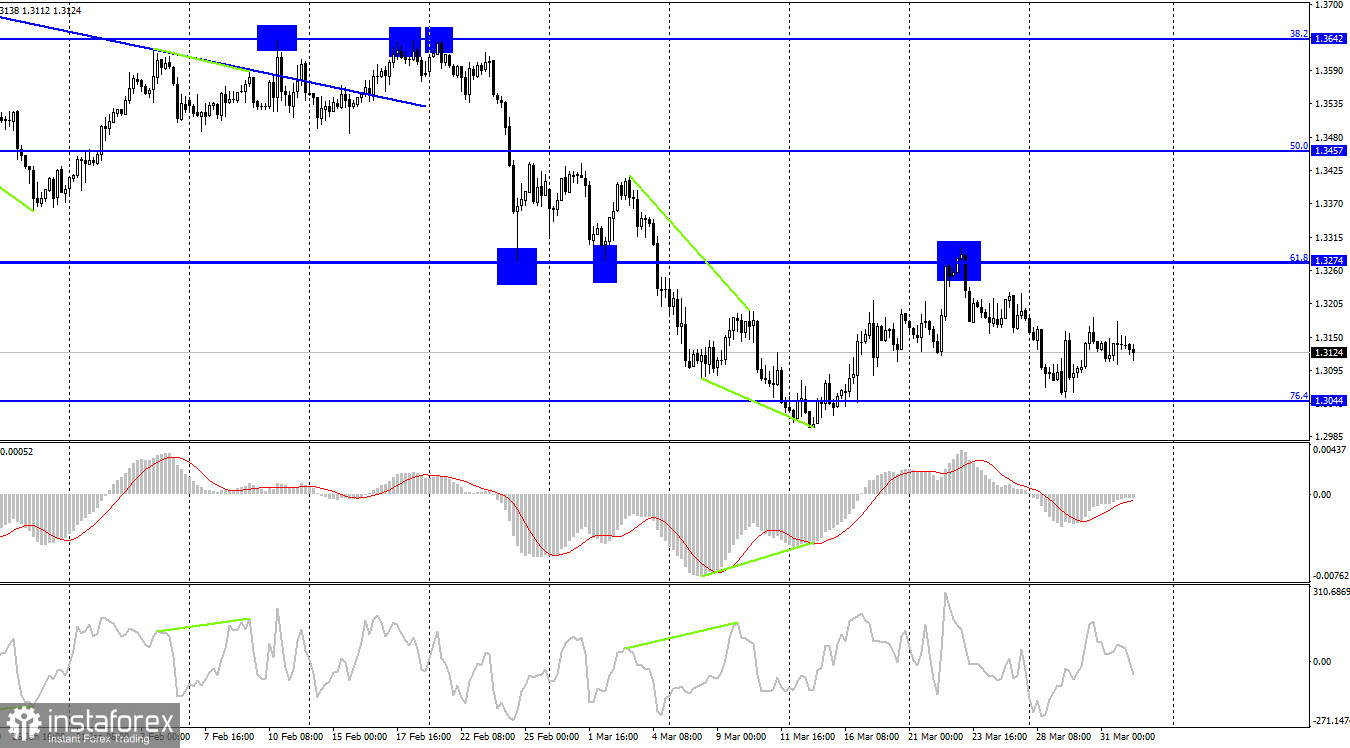

According to the 4-hour chart, the pair may fall to the 76.4% retracement level of 1.3044. A rebound from the mark will allow traders to count on a reversal with the target at the 61.8% retracement level of 1.3274. Should the pair consolidate below the 76.4% retracement level, the downtrend would extend to the 100.0% Fibonacci level of 1.2674.

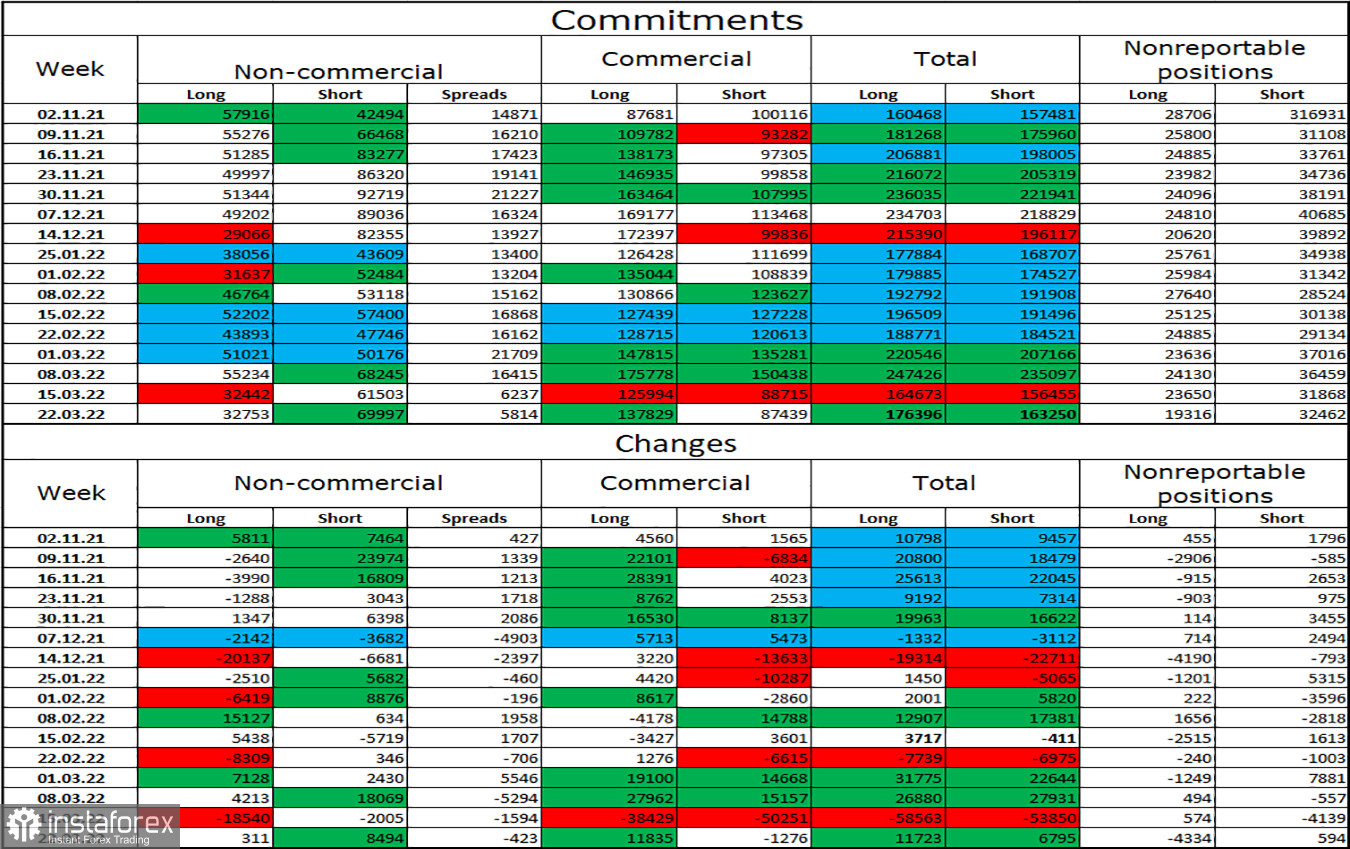

Commitments of Traders (COT):

The sentiment of non-commercial traders has drastically changed over the reporting week. The number of long positions increased by just 311 and short ones rose by 8,494. Overall, bearish sentiment grew. According to the ratio between long and short positions, the number of longs is now two times higher. GBP is bearish, and major players prefer selling it right now. Therefore, the downtrend is likely to continue, especially taking into account geopolitical developments and the results of the COT report.

Macro events in the United States and the Kingdom:

United Kingdom: Manufacturing PMI (08-30 UTC).

United States: Unemployment rate (12-30 UTC), NonFarm Payrolls (12-30 UTC), Average Hourly Earnings (12-30 UTC), ISM Manufacturing PMI (14-00 UTC).

Thursday's macroeconomic calendar is full of releases in the US as well as in the UK. Clearly, US Nonfarm Payrolls will be at the center of attention. Meanwhile, traders will be less interested in other reports. All in all, macro events may have a significant effect on the market today.

Outlook for GBP/USD:

You may look for sell entry points with the target at 1.3071 due to a pullback from 1.3181 on the 1-hour chart. Short positions could also be opened with the target at 1.2980 if the price closes below the 76.4% retracement level of 1.3044 on the 4-hour chart. In case of a rebound from 1.3071 on the 1-hour chart, you may go long, with the target at 1.3181.