U.S. nonfarm payrolls increased by 431K in March, slightly below the consensus estimate of 490K, but an upward revision of the data for the previous 2 months (+95 thousand), and the decline in the unemployment rate to 3.6% (forecast 3.7%) give grounds to consider the report as positive. The market reaction led to an increase in U.S. Treasury yields, as well as a revision of the Fed's forecasts. Now the probability that the regulator will raise the rate by 50 basis points in May is 90%. Some Fed members spoke after the release of the report (Evans, Daly, Williams), their comments were similar and emphasized the need for more decisive action.

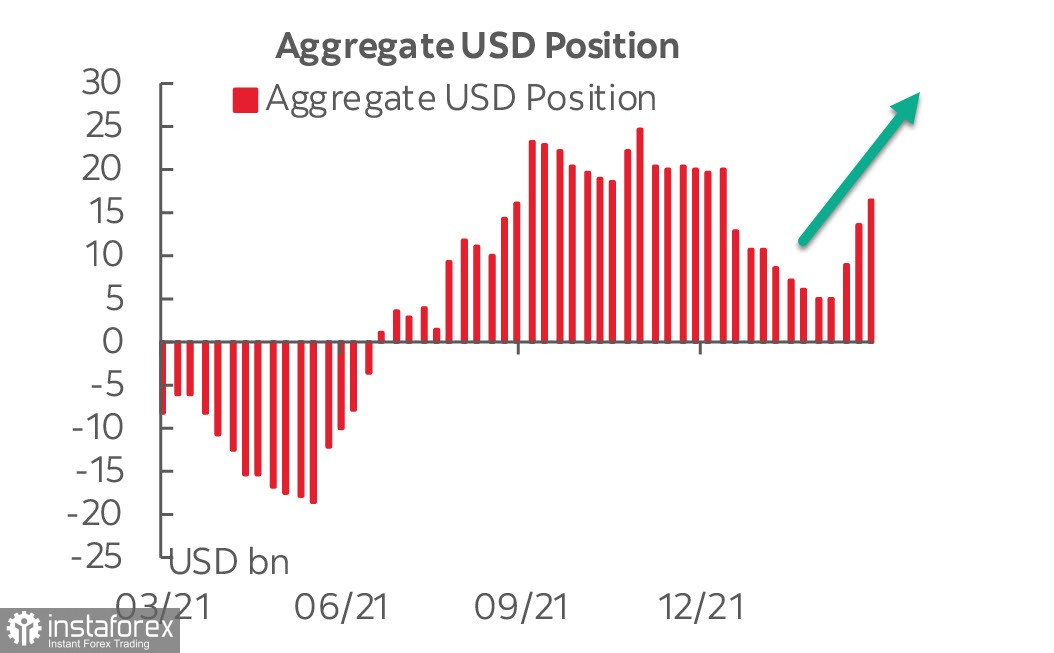

The bullish position on the dollar is growing for the third week in a row, the weekly increase was 2.8 billion, to 16.4 billion, the highest value since January. There is no doubt about the dynamics of buying the dollar, but the structure of demand for risk has changed. Commodity currencies, in general, have gained, the Canadian and Australian dollars, the Mexican peso are in the black, and European currencies are in the red.

Perhaps we are witnessing the notorious vacuum cleaner, which has begun to siphon money from Europe, which suffers more than others due to uncertainty with energy supplies from Russia, disruption of transport flows, and Russia's military operation in Ukraine. Anyway, the trend of the week is the demand for the dollar and the sale of European currencies.

Demand for commodities looks mixed, with increased quarantine measures in China putting pressure on oil and coal, but the overall rise in commodity currencies suggests that this is not for long, and growth in demand for commodities will resume in the very near future.

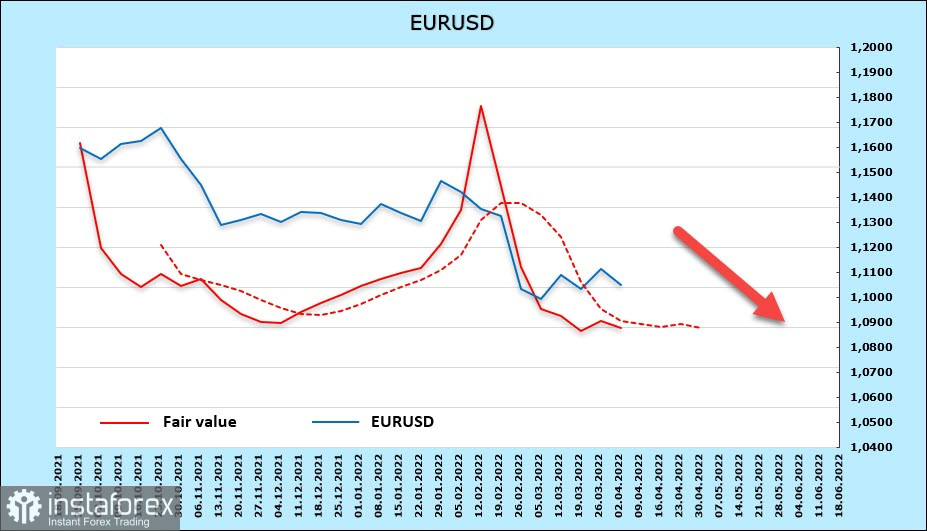

EURUSD

The wave of inflation covers the eurozone, the rise in prices in March reached 7.5% YoY. Uncertainty remains high as Russia announced a new pricing mechanism for gas supplies starting April 1, with which not all eurozone countries have agreed. If no consensus is found in the coming weeks, inflation will continue to skyrocket as energy prices spiral out of control.

High inflation will hit the purchasing power of consumers in many eurozone countries hard, wage demands will intensify and GDP growth will slow. The pressure on the ECB is increasing, and it will have to raise rates in the near future, that is, plans to start the cycle in December, in all likelihood, will be canceled.

According to the CFTC report, the net long position on EUR decreased during the week by 325 million to 2.96 billion, the estimated price remained below the long-term average, directed downwards.

Despite the fact that the euro managed to win back the fall a little, there are no reasons to count on a trend reversal. The euro remains in the bearish channel, the correction was about 23.6% of the annual fall, the bearish momentum is strong, and there are no technical signs of a reversal. The nearest target is the recent low of 1.0941, in case of passing the second target of 1.08, further movement to the lower border of the channel is possible.

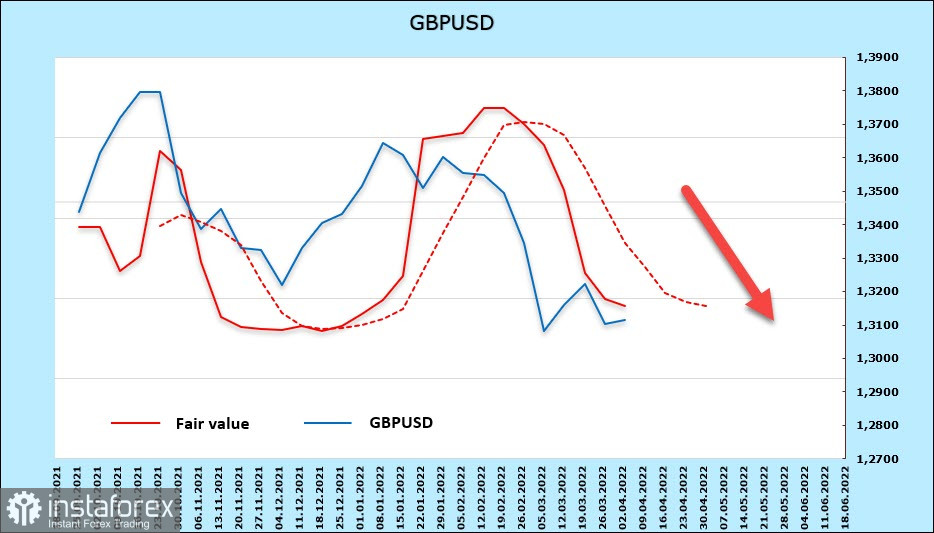

GBPUSD

The pound added another 192 million to the short position, a bearish margin of -3.279 billion, there are no signs of a bullish reversal. The settlement price is confidently below the long-term average and is directed downward.

The pound is trying to stabilize, pulling back slightly from the March 15 low of 1.2998, the chances of a reversal up are minimal. When trying to grow to 1.3297, sales are justified with the target of 1.3045/50, then the update of the minimum at 1.3297 and movement to the lower border of the bearish channel.

The forecast may be changed by a more decisive attitude of the Bank of England, which considers it expedient, along with the RBNZ and the Bank of Canada, to accelerate the exit from stimulus programs "sooner rather than later," that is, to get ahead of the Fed in reducing the balance sheet. If this happens, then the pound will begin to strengthen against the dollar, but to implement such a scenario, you need to wait for official data.