On Friday, the Bureau of Labor Statistics released encouraging news. In March, 431,000 U.S. workers acquired paid jobs and the unemployment rate was 3.6 percent. Economists had projected that more than 500,000 jobs should have been created. However, this had little significance to Friday's report, which said that the labor market in the United States was robust. Friday's report showed that the labor force in the US is now only 1.6 million jobs or 1% of pre-pandemic levels. Notably, higher employment is a side benefit of a tight labor market that has had to offer higher wages to attract new workers. This solid report is likely to provide the Federal Reserve with the necessary data to continue raising rates more aggressively.

Inflation remains at its highest level since 1981. This extremely high level is the result of a series of events following one another. Combined, these events and factors, according to the Federal Reserve Bank of Cleveland, are expected to lead to an inflation rate of 9.01% in Q1 2022. The annualized consumer price index may rise to 8.41% in March, according to their research.

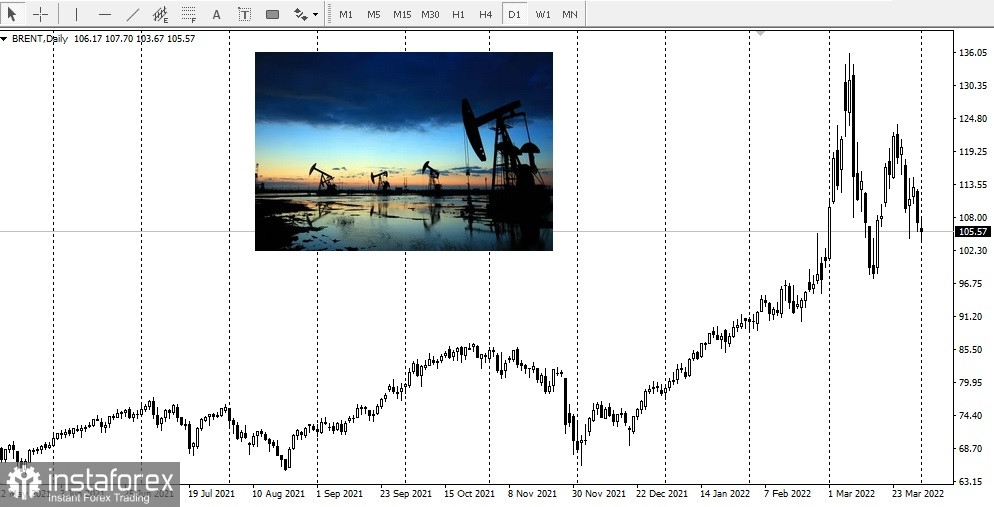

The extremely high inflation rate, which was a consequence of the all-country lockdown and the ensuing recession, has now increased because of the geopolitical situation in Ukraine. This has affected Europe more than the U.S. because of its dependence on agricultural imports from Ukraine and Russia, as well as oil, natural gas, and gasoline from Russia.

For the European countries, Ukraine has been one of the main suppliers of wheat and other agricultural products.

In Ukraine, production has halted. While Russia is still producing oil and its derivatives for export, the United States, along with the European Union, are boycotting Russian exports.

Amid a more normal inflation crisis, the measures necessary to reduce inflation can be achieved by aggressively raising rates. However, many reasons have led to the 40-year high in inflation, and the problem cannot be solved by itself. Without a resolution of the military conflict in Ukraine, inflationary pressures in Europe will continue to rise.

The current geopolitical tensions in Europe and the US inflation rate approaching 9.1% require central banks to execute their policies perfectly.