Having reached the local high of $48k, Bitcoin stopped its upward movement as it faced a strong resistance zone. After failing to break through this level, the market launched several sell-off cycles. As a result, the asset fell to the local support zone of $45k-$46k, reaching $44.2k at some point. As of April 4, the cryptocurrency has stabilized near $46k, and apparently, BTC is poised to move higher.

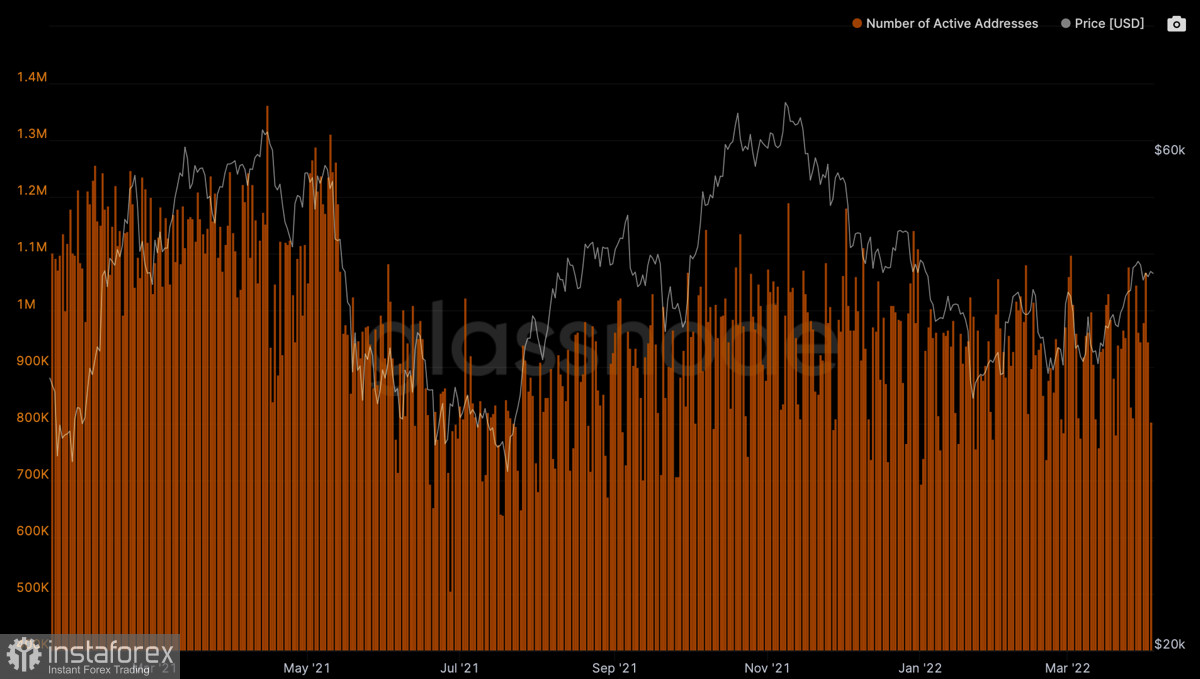

The cryptocurrency is set to continue its uptrend which is supported by the growing number of unique addresses. At the same time, we can see that more than 50% of the entire trading activity comes from institutional investors. However, Bitcoin is also attracting retail investors. On April 4, the number of unique addresses stands at around one million, which is a bullish signal for the crypto asset. The activity of big market players is also high. Thus, MicroStrategy purchased another $205 million worth of BTC, while LunaFoundation increased its investment to $1.4 million. This indicates growing demand for the crypto asset that is still relevant amid the current geopolitical background.

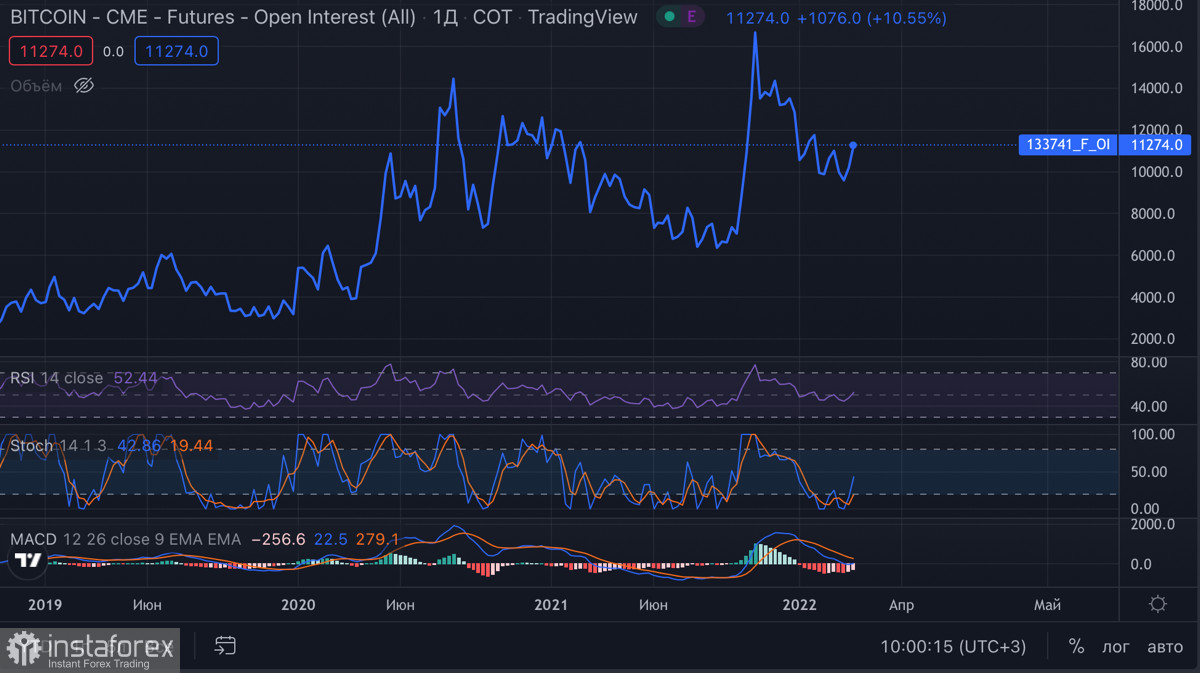

Bitcoin has reached a local high at the mark of $48k. At the same time, in the spot market, the demand for Bitcoin is gradually decreasing, which indicates a corrective movement of the asset. As we could see on the chart, the coin dropped to the local support zone and began to consolidate. However, at the start of the new trading week, Bitcoin futures open interest has gone up, indicating the end of the consolidation phase. So, investors have a few days to buy the asset before the second stage of growth starts within the current medium-term uptrend.

The news background also serves as a bullish factor for Bitcoin. In addition to monetary tightening and the start of the cryptocurrency regulation, Western sanctions against Russia played an important role in the development of Bitcoin. Strong economic pressure on the country is shaping a new investment and macroeconomic environment. Previously, BTC/USD was used as a diversification tool or an inflation hedge, but now the situation has changed.

Thanks to blockchain technology and anonymity, the scope of BTC usage is expanding. The combination of high yield and inflation hedging properties makes Bitcoin a full-fledged reserve asset. Conventional markets are only starting to accept BTC in this role. However, the more sanctions are imposed on Russia, the stronger the demand for Bitcoin will be.

Meanwhile, the crypto asset spent this weekend in the consolidation phase. Notably, when declining to the Fibonacci level of 0.382, which also coincides with the 200 EMA, the price quickly bounced back, forming a long lower shadow. This confirms a strong bullish bias and the eagerness of buyers to push the price higher. The asset also managed to close the weekly candlestick above $46k, which is another indication of the bullish sentiment in the market.

On April 4, the asset is consolidating at the Fibonacci level of 0.236. Judging by the vague candlesticks formed over the weekend, the cryptocurrency will continue to accumulate volumes for several days, approaching the level of $48k. As the market is lacking volume, the retest is likely to be smooth, and the volume of long positions will increase as the price moves higher. Technical indicators also confirm the consolidation phase. Key metrics support the flat movement with no hints of upward momentum. So, after several days of consolidation, we can expect an upward movement to $48k and a further rise to $51k.