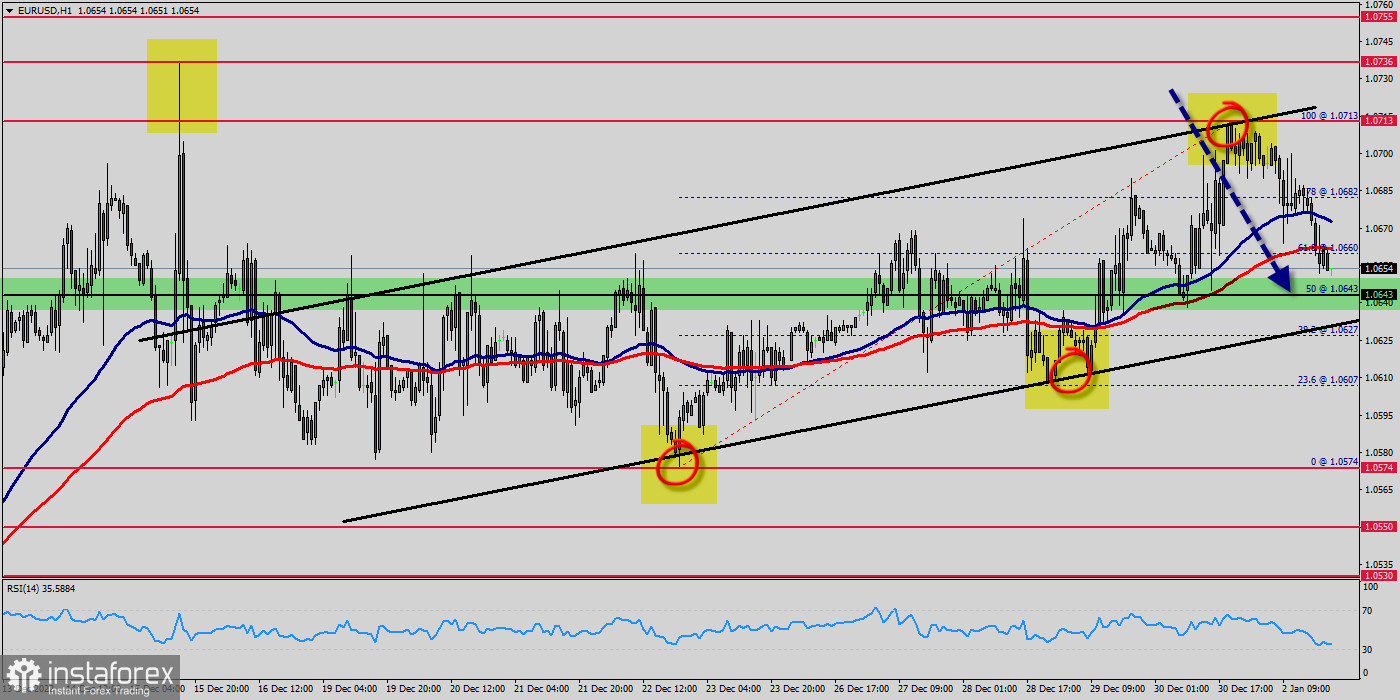

The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel. Due to the previous events, the price is still set between the levels of 1.0713 and 1.0682. Thus, it is recommended to be careful while making deals in these levels because the prices of 1.0713 and 1.0643 are representing the resistance and support respectively.

Yesterday, the EUR/USD pair dropped sharply from the level of 1.0713 towards 1.0650. Now, the price is set at 1.0658. On the M1 chart, the resistance of EUR/USD pair is seen at the level of 1.0713 and 1.0682.

It should be noted that volatility is very high for that the EUR/USD pair is still moving between 1.0682 and 1.0643 in coming hours. Moreover, the price spot of 1.0682/1.0713 remains a significant resistance zone.

Therefore, there is a possibility that the EUR/USD pair will move downside and the structure of a fall does not look corrective.

What is the secret of the strength of the U.S. dollar?

The foundations of the global financial system.

- United States of America founded the global financial system, which means continued American economic hegemony.

The central determinants of the U.S. dollar.

- The most important components of the dollar's centrality in global markets were the following:

o Easy conversion.

o Intensity of trading.

o Stability of the cash reserve since there is global trust.

The trend will be probbaly indicate the bearish opportunity below spot of 1.0682/1.0713, sell below 1.0682/1.0713 with the first target at 1.0643 in order to test yesterday's bottom.

Also, it should be noted that the trend is still calling for a strong bearish market from the spot of 1.0713 - 1.0682 (sellers are asking for a high price).

Additionally, if the EUR/USD pair is able to break out the bottom at 1.0574, the market will decline further to 1.0550 so as to test the weekly support 2. Also, it should be noticed that support 2 is seen at the level of 1.0550.

Forecast:

If the pair fails to pass through the level of 1.0713, the market will indicate a bearish opportunity below the strong resistance level of 1.0713. In this regard, sell deals are recommended lower than the 1.0713 level with the first target at 1.0643. It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 1.0575 in order to test the weekly pivot point. However, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1.0737 (notice that the major resistance today has set at 1.0737). - Please check out the market volatility before investing, because the sight price may have already been reached and scenarios might have become invalidated.