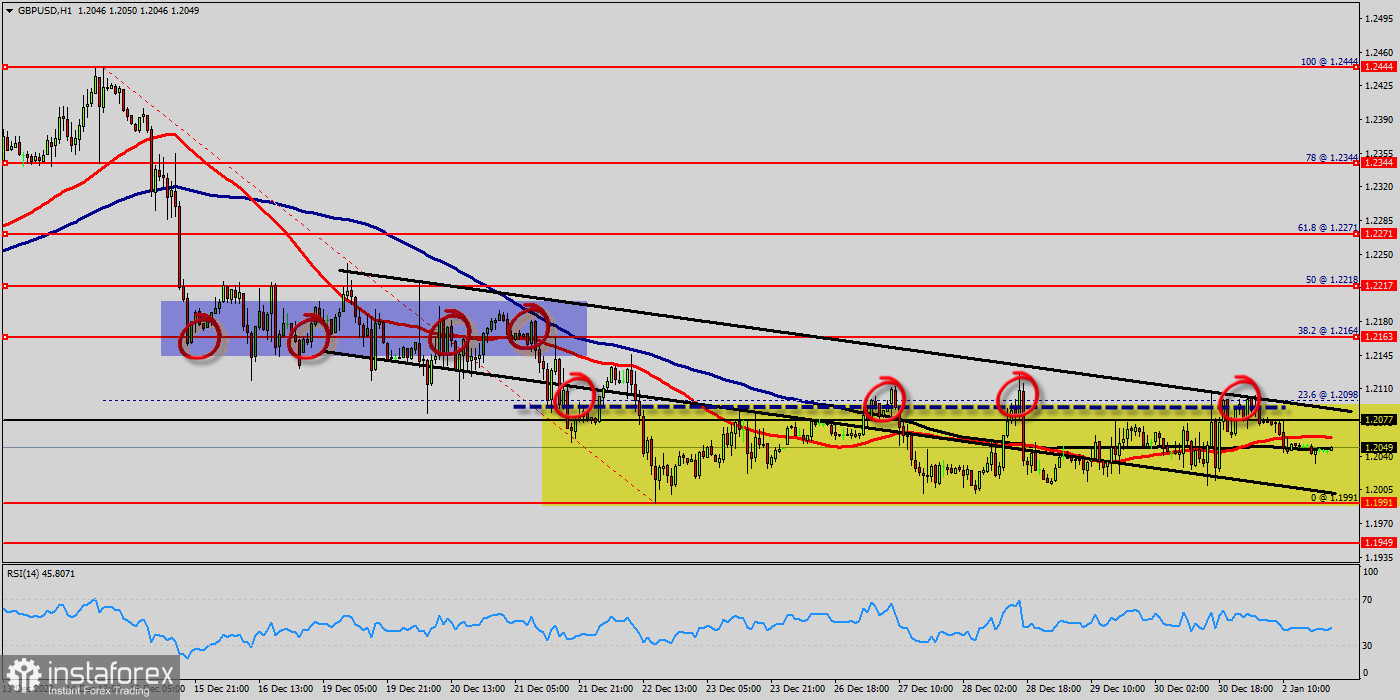

The GBP/USD pair broke resistance, which turned into strong support at 1.1991. Right now, the pair is trading above this level. It is likely to trade in a higher range as long as it remains above the support (1.1991), which is expected to act as a major support today. Therefore, there is a possibility that the GBP/USD pair will move upwards and the structure does not look corrective.

The trend is still below the 100 EMA for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. From this point of view, the first resistance level is seen at 1.2077 followed by 1.2163, while daily support 1 is seen at 1.1991 (last bearish wave - 00% Fibonacci retracement).

According to the previous events, the GBP/USD pair is still moving between the levels of 1.1991 and 1.2163; so we expect a range of 172 pips.

Consequently, buy above the level of 1.1991 with the first target at 1.2077 so as to test the daily resistance 1 and further to 1.2100. Besides, the level of 1.2163 is a good place to take profit because it will form a double top.

On the contrary, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.1991, a further decline to 1.1949 can occur, which would indicate a bearish market.

Overall, we still prefer the bullish scenario, which suggests that the pair will stay above the zone of 1.1991 - 1.1949 in coming three days.

In the same time frame, resistance is seen at the levels of 1.1991 - 1.1949. The stop loss should always be taken into account for that it will be reasonable to set your stop loss at the level of 1.1949 (below the support 2).

Forecast:

- The market opens above the daily pivot point. It continues to move downwards to hit the daily pivot point. Consequently, buy at the daily pivot point (1.2040).

- Take profit: It should set take profit at R1 (1.2077), R2 (1.2100) and R3 (1.2163) .The previous range was large (185pips).

- Stop loss: Stop loss should set depending on the money management. In this case, we prefer setting the stop loss depending this formula <=> Take profit = 3/2 x Stop loss. Thus, if a breakout happens at the support level of 1.1949, then this scenario may be invalidated.