AUD/USD continues its uptrend

I will start my review of the AUD/USD pair by discussing the decision of the Reserve Bank of Australia (RBA) on the interest rate. This is the most significant event for the pair along with tomorrow's minutes of the latest FOMC meeting. As expected, the RBA left its monetary policy unchanged and kept the interest rate at 0.10%. At the same time, the Australian regulator noted that inflation would continue to rise in the near future. The RBA will carefully evaluate inflationary factors and will also continue to support the labor market. The unemployment rate is expected to fall below 4%, but not until the next year. To start the rate hike, the RBA wants to see inflation stabilizing in the target range of 2-3%. The RBA considers the uncertainty in the global financial and energy markets to be the main risk factor along with the supply-demand imbalance. The Australian central bank also noted the accelerated wage growth and increased demand for labor. In general, the decision of the RBA and the comments of its head, Philip Lowe, can be described as neutral-positive, which has definitely affected the trajectory of the Australian dollar. Let's start our review by analyzing the technical picture of the previous trading week.

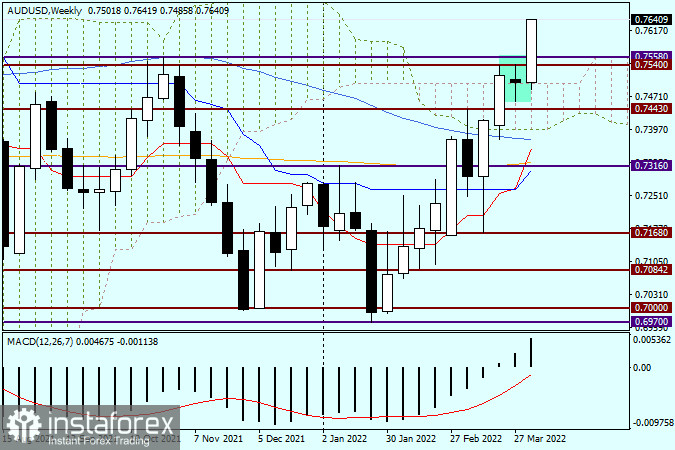

Weekly chart

Judging by the current strong uptrend in the Aussie, traders have simply ignored the reversal candlestick pattern formed at the end of last week. If the uptrend persists, the AUD/USD pair may rise to the resistance level of 0.7891. Of course, this will not happen straight away as the pair has a long way ahead. Let's see how the pair will react to the publication of tomorrow's FOMC minutes. At this stage of trading, we can witness a strong breakout of the key resistance zone at 0.7540-0.7558. Today is only Tuesday, and there is plenty of time for the pair to change its direction by the end of the week. However, given a rather strong bullish sentiment, the trend is unlikely to reverse. The current weekly candlestick may actually form an upper shadow, but a lot will depend on its size.

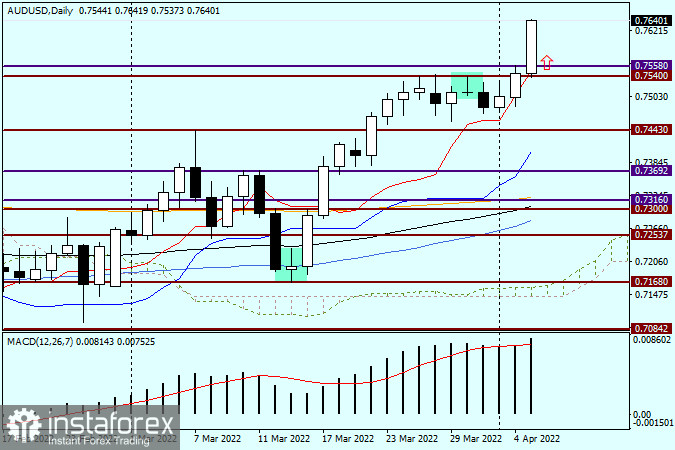

Daily chart

Yesterday, the Aussie bulls tested the key resistance level of 0.7558 but did not rush to break through it, preferring to wait for today's events related to the RBA. Apparently, the market appreciated the rhetoric of the central bank or simply found a reason to continue the upward movement. I would suggest that the main trading idea on the pair will be to buy the Australian dollar after a rebound to the tested resistance level of 0.7558. It is still too early to say whether this is a true breakout. Yet, we can keep this scenario in mind.

Good luck!