Hi, dear traders!

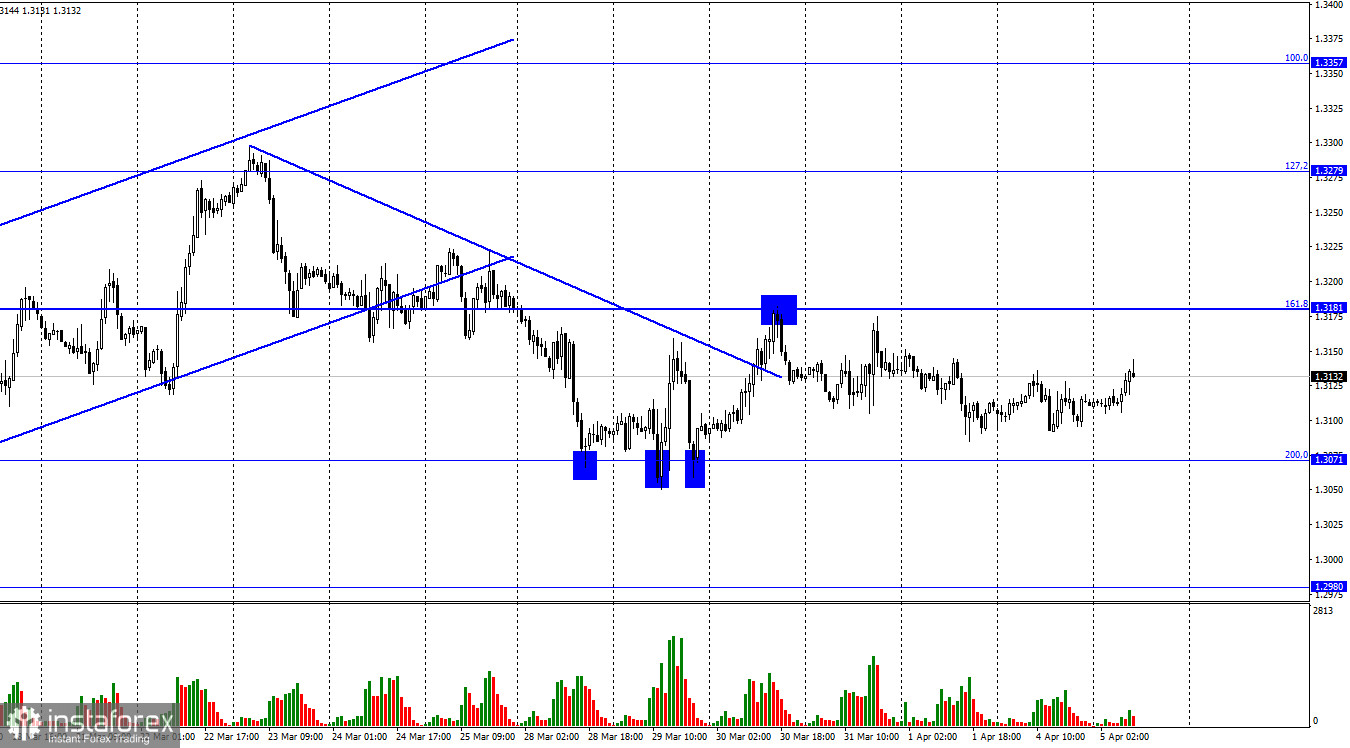

According to the H1 chart, GBP/USD did not move significantly in any direction on Monday. The pair remains close to the key retracement level of 200.0% (1.3071). Despite the efforts of bearish traders, GBP/USD tested this level 3 times last week, but failed to settle below it. Bears are likely to test the retracement level again this week, as positions of bullish traders remain weak. The geopolitical situation is also undermining the pair. The EU plans to impose duties on Russian energy imports, affecting oil and natural gas, news agencies reported yesterday. While these reports are not directly affecting the pound sterling, geopolitical tensions still weigh down on the pair.

Russia is expected to launch a new offensive against Ukraine in the Donbass, as Moscow plans to expand its control of Ukrainian territory after the failure to take Kharkiv, Kyiv, Mykolaiv, and Mariupol. While some military experts claim the active phase of the conflict could end in the near future, the war itself is far from over. This situation is detrimental to both the euro and the pound sterling. Recent data releases, such as today's services PMI data in the UK, are unlikely to give support to these currencies. GBP/USD could trade in the 1.3071-1.1381 range for some time. However, an escalation in Ukraine could push the pair below 1.3071.

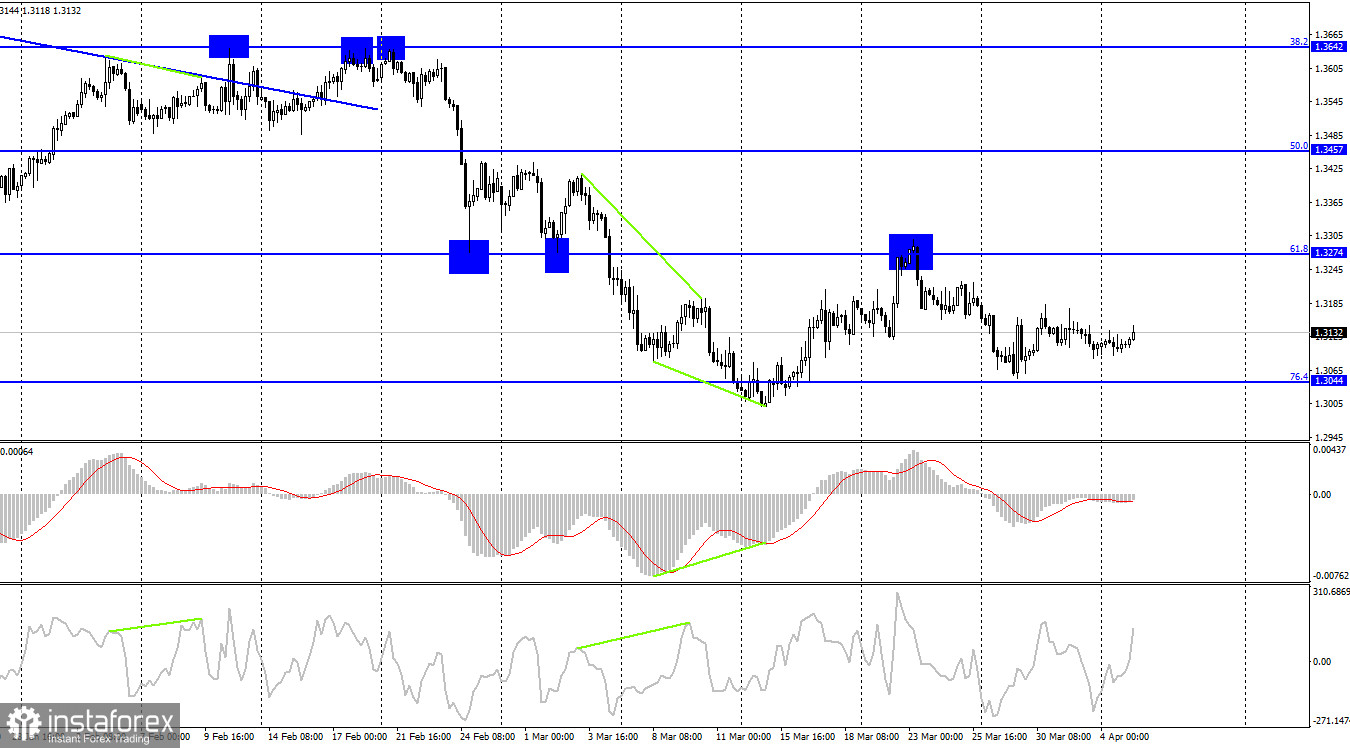

According to the H4 graph, the pair resumed falling towards the retracement level of 76.4% (1.3044). If the pair bounces off this level upwards, it could rise slightly towards the retracement level of 61.8% (1.3274). If the pair settles below the Fibo level of 76.4%, it could decline further towards the next Fibonacci level of 100.0% (1.2674).

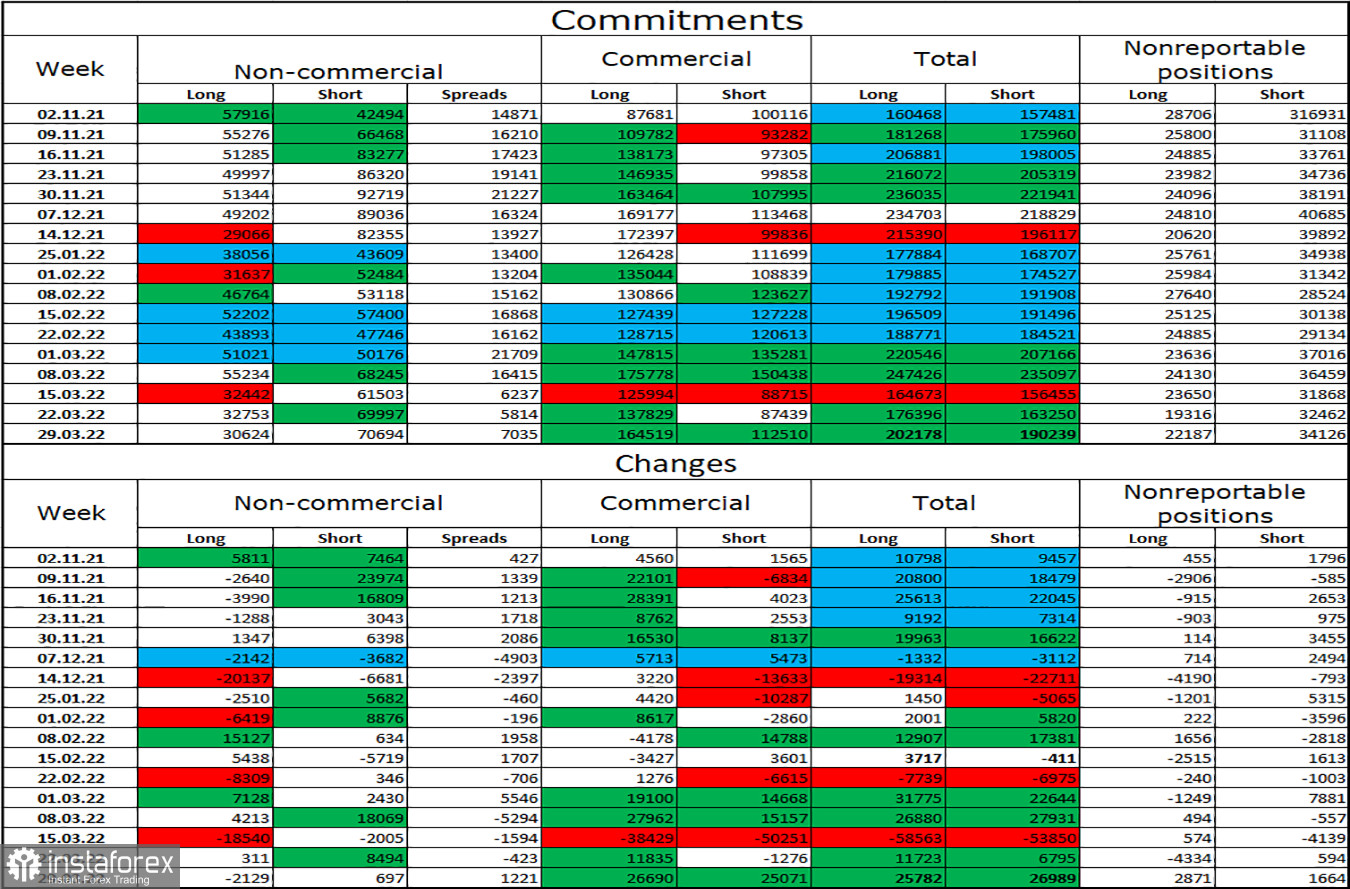

Commitments of Traders (COT) report:

In the last week covered by the report, the mood of Non-commercial traders did not change significantly. Traders closed 2,129 Long positions and opened 697 Short positions. The sentiment of traders has become more bearish, and the amount of open Long and Short positions now match the current situation - there are 2.5 times more open Long positions than Short ones. Geopolitical factors and COT reports indicate the pair is likely to fall further.

US and UK economic calendar:

UK - Services PMI (08-30 UTC).

US - ISM services PMI (14-00 UTC).

Today's data releases in both the UK and the US are unlikely to influence traders.

Outlook for GBP/USD:

Traders are recommended to open short positions targeting 1.3071 - the pair bounced off 1.3181 on the H1 chart. New short positions can also be opened if the pair closes below the Fibo level of 76.4% (1.3044) on the H4 chart, with 1.2980 being the target. Long positions can be opened if GBP/USD bounces off 1.3071 on the H1 chart, targeting 1.3181.