The 10-year US government bond yield jumped to 2.631% on Tuesday, the highest in 3 years. A surge in US Treasuries occurred after Fed Board member Lael Brainard made a speech at a conference in Minneapolis. Market participants were caught off guard by some statements. She said that the Fed would start reducing its balance sheet at a rapid pace as soon as the May meeting. The pace is expected to be faster than in 2017/19.

These remarks signaled quicker-than-expected monetary policy tightening. On the one hand, it may slow down inflation. On the other hand, it increases the likelihood of a recession by the end of the year. Apparently, the Fed has chosen the lesser of two evils. The regulator needs to get inflation under control even at a risk to the economy. Besides, rising consumer prices will ultimately cause much more damage.

Following Brainard's speech, stock indexes went into the red zone, fueling demand for safe-haven assets.

On Wednesday, speculators are anticipating the publication of the FOMC meeting minutes for March. Judging by Brainard's speech, the minutes will once again confirm a faster pace of reduction of the balance sheet than Powell announced at the latest press conference.

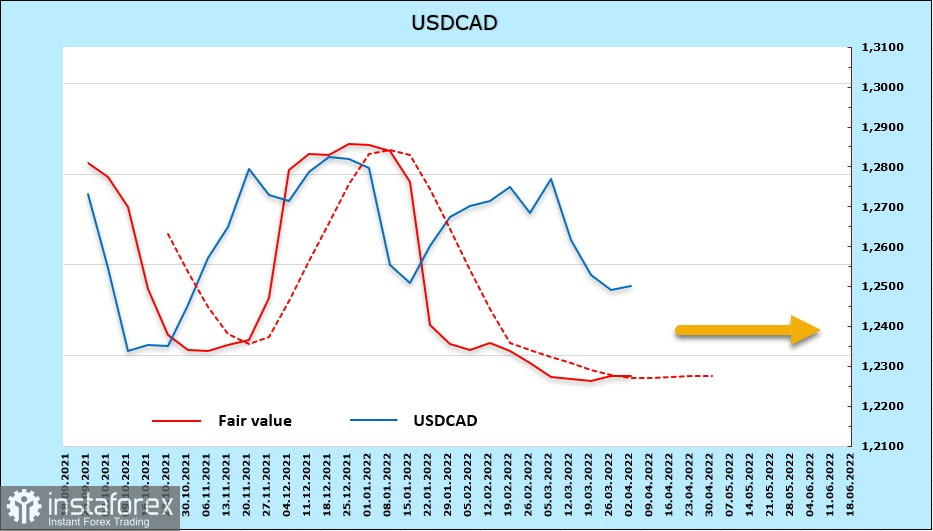

USD/CAD

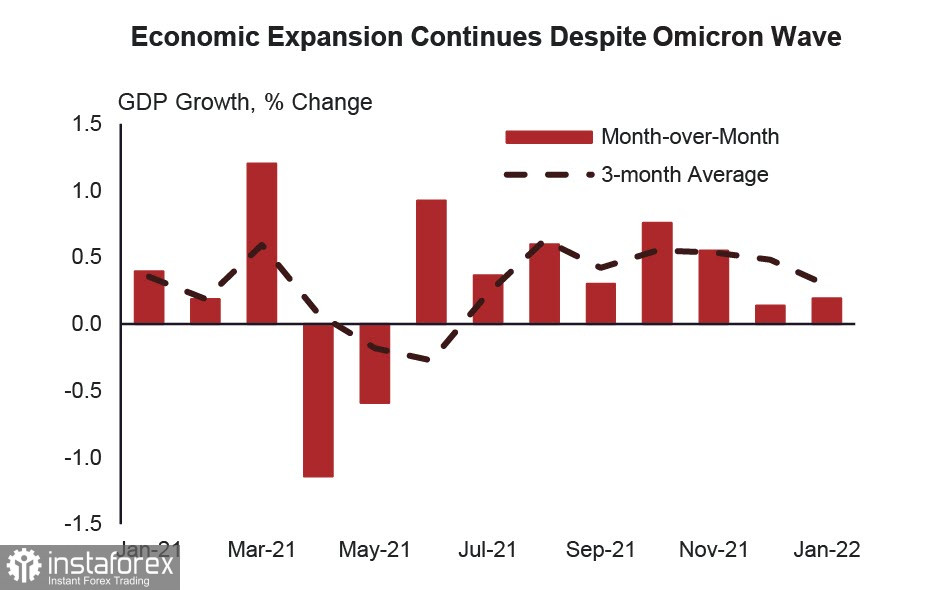

Now, market participants are curious to find out what stance the Bank of Canada will take to combat soaring inflation. GDP data has revealed that the coronavirus no longer has an impact on the economy. It is buoyantly expanding. The labor market is recovering even faster than in the United States.

Therefore, in April, the Bank of Canada is likely to raise the rate by 0.5%. Taking into account approximately equal inflation figures, it is difficult to determine the movement of the yield spread.

The number of long and short positions are more or less the same, according to the CFTC report. Speculative positions showed a weekly increase of 270 million. The gap between long and short positions shortened as short positions amounted to 123 million. The estimated price has no clear direction.

USD/CAD approached a new high. After that, it lost steam and failed to consolidate at the indicated level. The pair is likely to resume an upward movement throughout the week. The nearest resistance level is located at 1.2515/20 and the next one is at 1.2590. The pair will hardly rise higher as after a gradual rise it may enter a sideways channel.

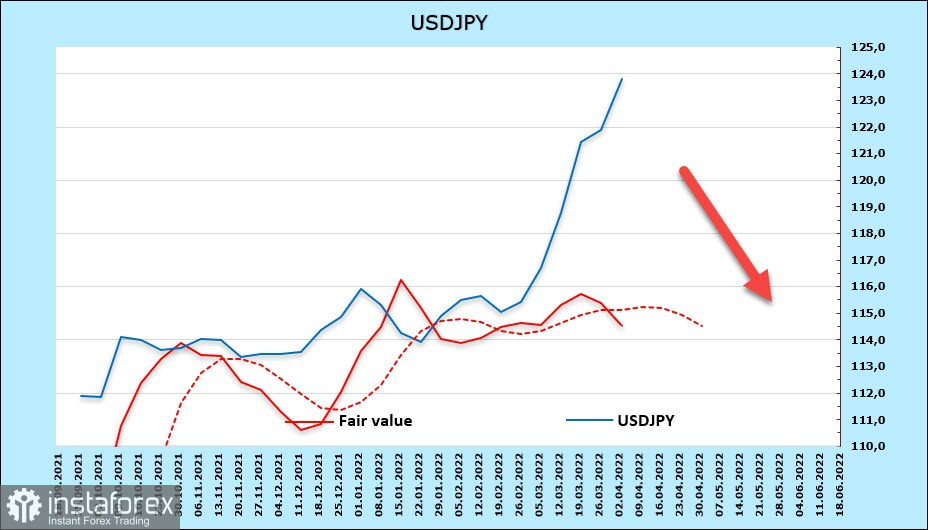

USD/JPY

Unlike the Fed, the Bank of Japan maintains an ultra loose monetary policy. This is why there is no reason to expect a downward reversal of the dollar/yen pair. The pair seems poised to break through a high of 125.90. However, there are server factors that may support the yen.

Despite soaring energy prices, Japan recorded its largest current account deficit. However, it did not affect the yen. Besides, inflationary pressure may also boost the yen. In February, household spending increased by only 1.1% versus the forecast reading of 2.7%. A decrease in spending indicates a slowdown in inflation, which is bullish for the yen as a safe-haven asset.

The net-short position on the yen rose to 10.39 billion, a weekly gain of 2.27 billion. The US dollar is much stronger now. However, the estimated price has stopped growing, which indicates a weakening of the momentum.

The yen is unlikely to break above a high of 125.11. If it is unable to consolidate above this level, a corrective decline is possible. A rise above 125.11 is possible if the Bank of Japan purchases 10-year bonds again at a fixed rate of 0.25%. If so, there will be a large money injection in the market, which is bullish for USD/JPY. As of the morning of April 6, the 10-year Japanese government bond yield does not exceed 0.230%. The yield is unlikely to rise higher. Therefore, the likelihood of a corrective decline increases.