Although yesterday's statistics on the US trade balance, as well as on the index of business activity in the services sector from the Institute of Supply Management (ISM), turned out to be worse than economists' expectations, this did not prevent the US dollar from demonstrating a fairly solid strengthening against the single European currency. Let's try to identify the main reasons for this outcome of trading on April 5, and only then we will proceed directly to the consideration of the EUR/USD price charts.

As noted the day before, yesterday was not saturated with important macroeconomic reports, but there was a shortage of speeches by members of the Open Market Committee (FOMC) The US Federal Reserve was not observed. It should be noted here that the speeches of all the high-ranking monetary officials of the Federal Reserve System who spoke yesterday were more or less "hawkish" rhetoric. So, the deputy chairman of the Fed, Lael Brainard, told investors that the reduction of the Federal Reserve's balance sheet will begin in May, and it will happen at a fairly rapid pace. Jerome Powell's deputy also said that in the event of a continued increase in inflation, the US Central Bank will take more drastic measures to curb it. In general, the speech of the second person of the Fed can be considered quite "hawkish" for the demand for the US currency to grow even more. In this regard, I wonder what the FOMC protocols will be, the publication of which will take place today, at 19:00 London time?

Also, the strengthening of the US dollar was helped by an increase in the yield of ten-year bonds to 2.56%, and this is the highest indicator since mid-2019. If we return to the harsh rhetoric of the Fed, then if it remains in the March protocols, the US currency will have every chance of its further strengthening, not only against the euro but also across the entire spectrum of the market. Another factor that has caused an increased demand for the US dollar as a safe asset in recent days is the situation in Ukraine, which remains very tense. So, the other day, the president of this country Zelensky in his speech ruled out the possibility of a meeting with Russian President Vladimir Putin. This means that the parties to the military conflict are still very far from normalizing the situation. As I mentioned earlier, only a meeting of the presidents of both opposing sides can put an end to the confrontation between the two neighboring countries.

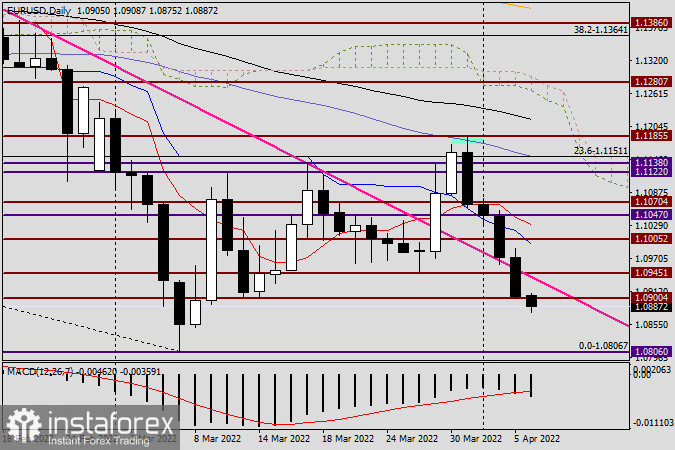

Daily

We turn to technical analysis, and the first thing to note is the return of EUR/USD under the pink resistance line 1.1495-1.1138, which was previously passed up. Now the breakdown of this line, with a high degree of probability, can be considered false, which means that the downward movement of the euro/dollar can continue with renewed vigor. Also, we do not ignore the fact that yesterday the bears broke through an important support level of 1.0945, and the trades closed under this mark. Moreover, yesterday the pair slowed down at another significant level for the market of 1.0900, and Tuesday's trading closed at 1.0904. Today, at the end of the review, the euro/dollar is already trading below 1.0900, near 1.0883. In my personal opinion, only FOMC protocols can save the euro. If the market is disappointed in them, then the US dollar may experience selling pressure, and against this background, a return above 1.0945 and the pink resistance line is not excluded. In the meantime, the EUR/USD pair is confidently looking down, and the key support level of 1.0800 is in focus. If this mark is broken, even more, serious troubles are waiting for players to upgrade the course. Based on this, it is difficult to overestimate the importance of today's trading day and the market's reaction to the publication of the minutes of the March Fed meeting.

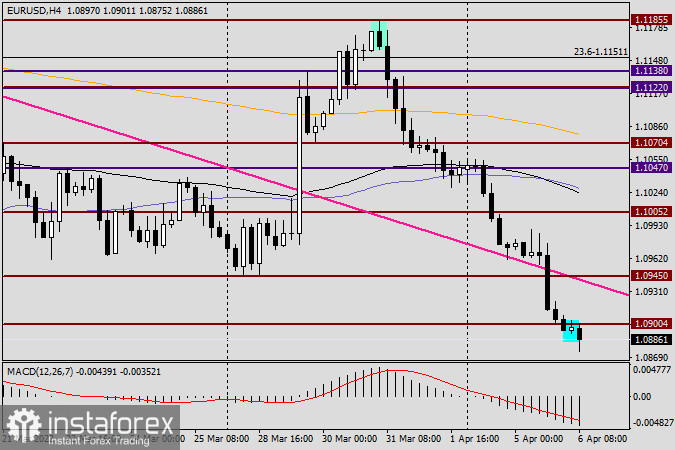

H4

Despite the appearance of the previous four-hour candle, which could reasonably be considered a reversal, the bidders did not even think to pay attention to this signal, which once again underlines the strength of bearish sentiment in the euro/dollar. As expected in one of the previous materials, the recent growth of the pair was caused by the desire of the market to open sales at higher prices. That's exactly how it turns out. However, I will once again emphasize the importance of today's protocols and the reaction of bidders to them. At this stage of time, there are practically no grounds for buying EUR/USD, but sales, which are the main trading idea, I recommend trying after minor and short-term corrective pullbacks to the area of 1.0945-1.0960. If such a pullback does not happen, it is aggressive and risky to try to open short positions on the pair's attempts to return above the significant technical level of 1.0900.

The risk is that after the publication of the protocols, market volatility may rise sharply, and sales from 1.0900 may close at a stop. However, everything will depend on its size. However, the higher the sales plan, the safer it will be for the deposit. Now for purchasing. I do not exclude that the FOMC protocols will be kept in "hawkish" shades and the pair will fall to the area of 1.0820-1.0800. Logically speaking, the market has already taken into account the Fed's tough stance, which means it can quickly win back the protocols, after which investors will begin to take profits. Here, against the background of profit-taking, a rebound may take place from the designated area of 1.0820-1.0800, especially since technically this area is considered very strong. Let's see what will happen in the evening and how today's auction will end. Tomorrow we will return to the consideration of the main currency pair and analyze not only today's FOMC protocols but also the technical picture that has developed after their release.