EUR/USD

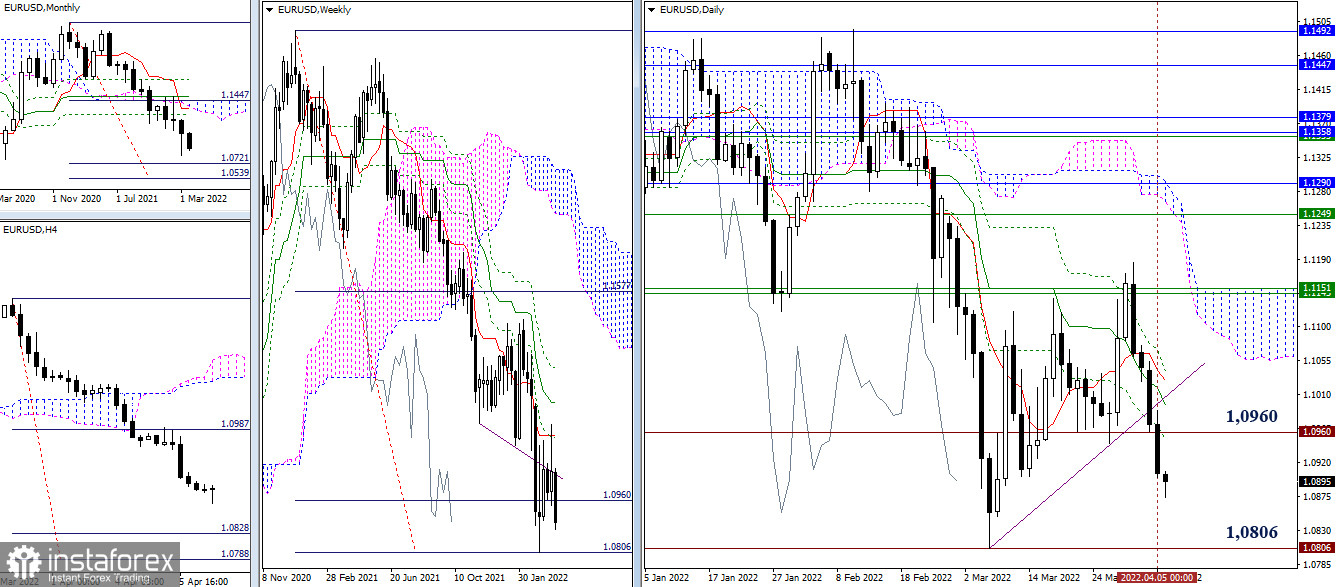

EURUSD continued to decline yesterday. Today, the nearest important benchmarks for the bears are the area of 1.0788 - 1.0828 (target for the breakdown of the H4 cloud + minimum extremum + weekly target level). The levels passed the day before (the line of 1.0960) has now been turned into resistance, which will be the first to meet the euro in the higher timeframes, in case the bulls restore their position.

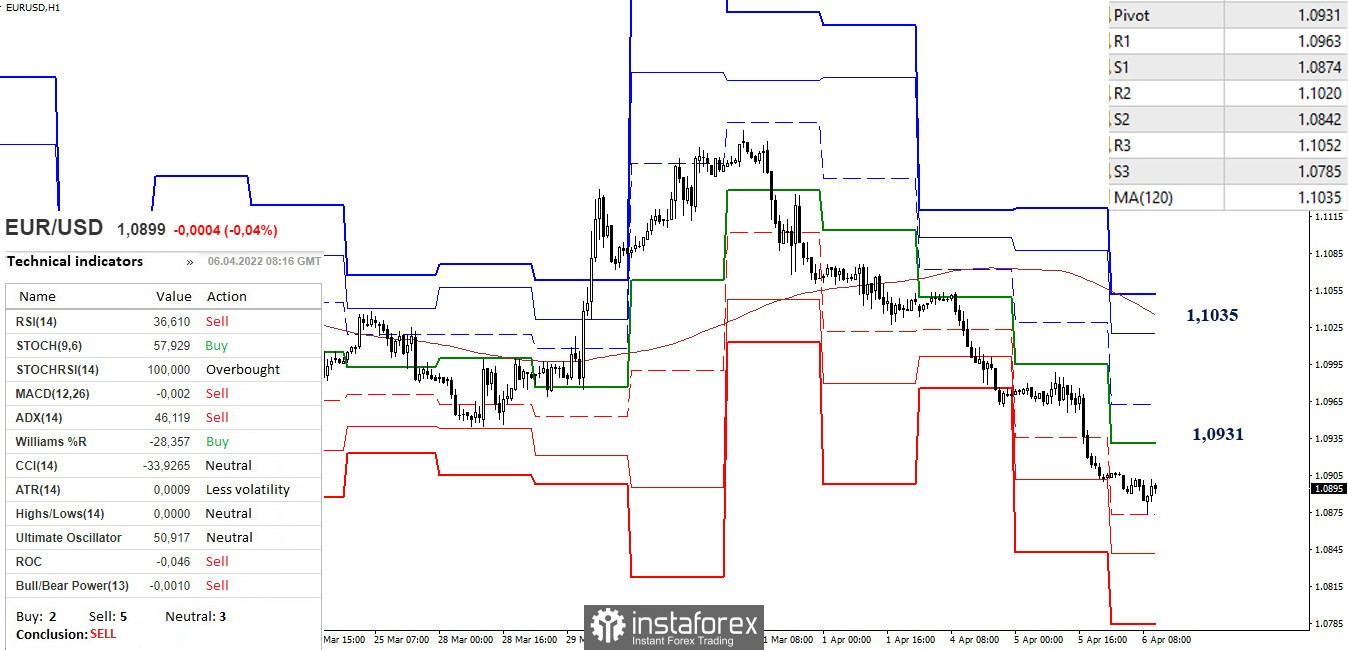

On the lower timeframes, the advantage is on the side of the bears. The first support of the classic pivot points (1.0874) was tested, further supports, which are reference points for the intraday decline, are located at 1.0842 and 1.0785. The key levels of the lower timeframes today form the boundaries of resistance in case of the development of a corrective rise. They can be seen at 1.0931 (central pivot point) and 1.1035 (weekly long-term trend), with intermediate resistance levels along the way at 1.0963 and 1.1020.

***

GBP/USD

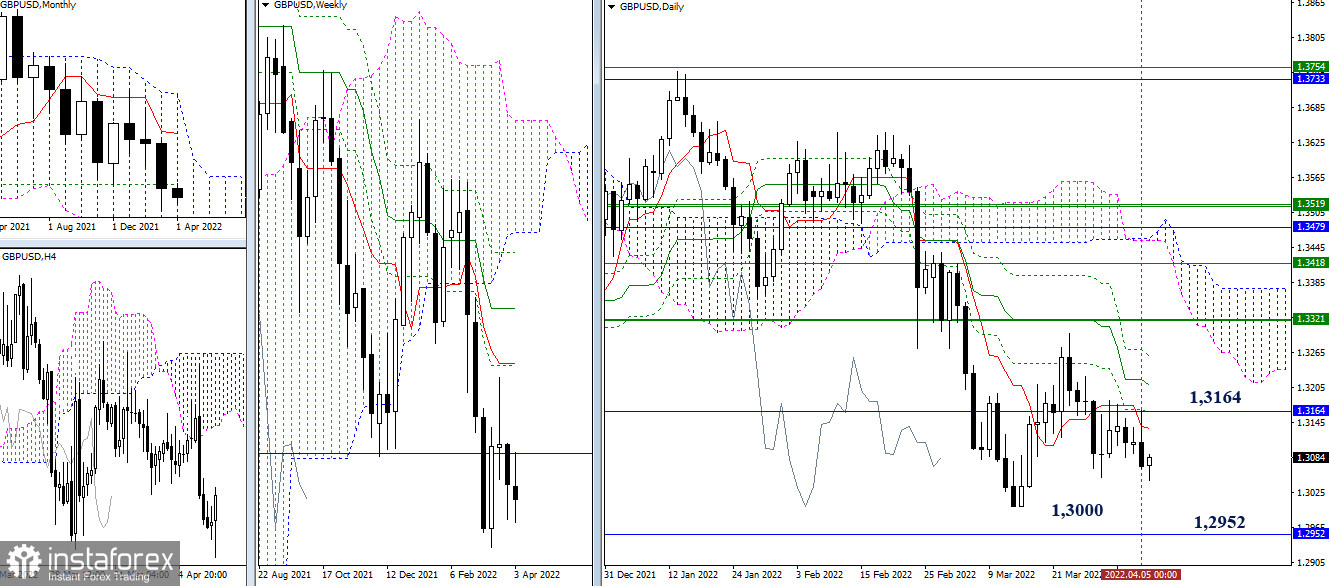

The deceleration remained, but bearish activity still dominated in the past day. The nearest downward references today remain the same, the minimum extremum (1.3000) and monthly supports of 1.2950 and 1.2830. And the accumulation of levels, led by the monthly Fibo Kijun (1.3164), continues to block the way forward on the bullish front.

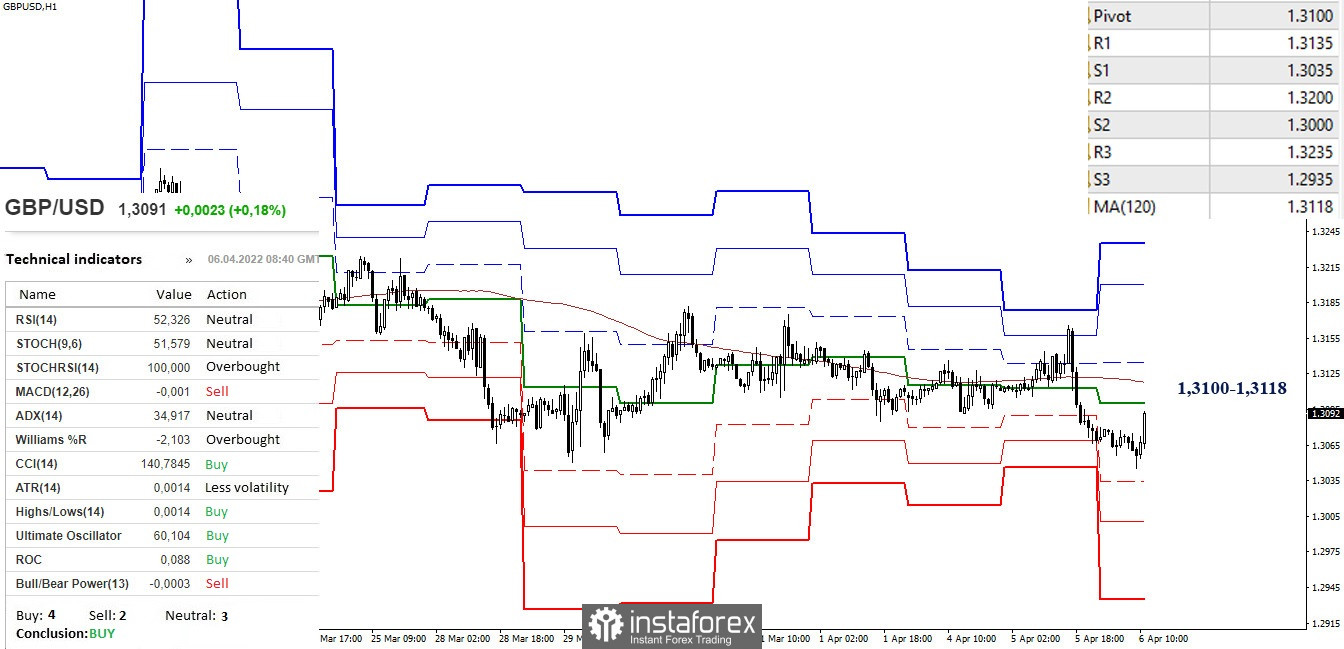

The main advantage is now on the side of the bears. Nevertheless, we are witnessing the recovery of positions by the opponent, while the key levels serve as a reference point, which today have joined forces in the area of 1.3100 – 1.3118 (central pivot point + weekly long-term trend). Consolidation above will change the current balance of power. In addition to the key levels, resistance (1.3135 - 1.3200 - 1.3235) and support (1.3035 - 1.3000 - 1.2935) of the classic pivot points can serve as reference points within the day.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)