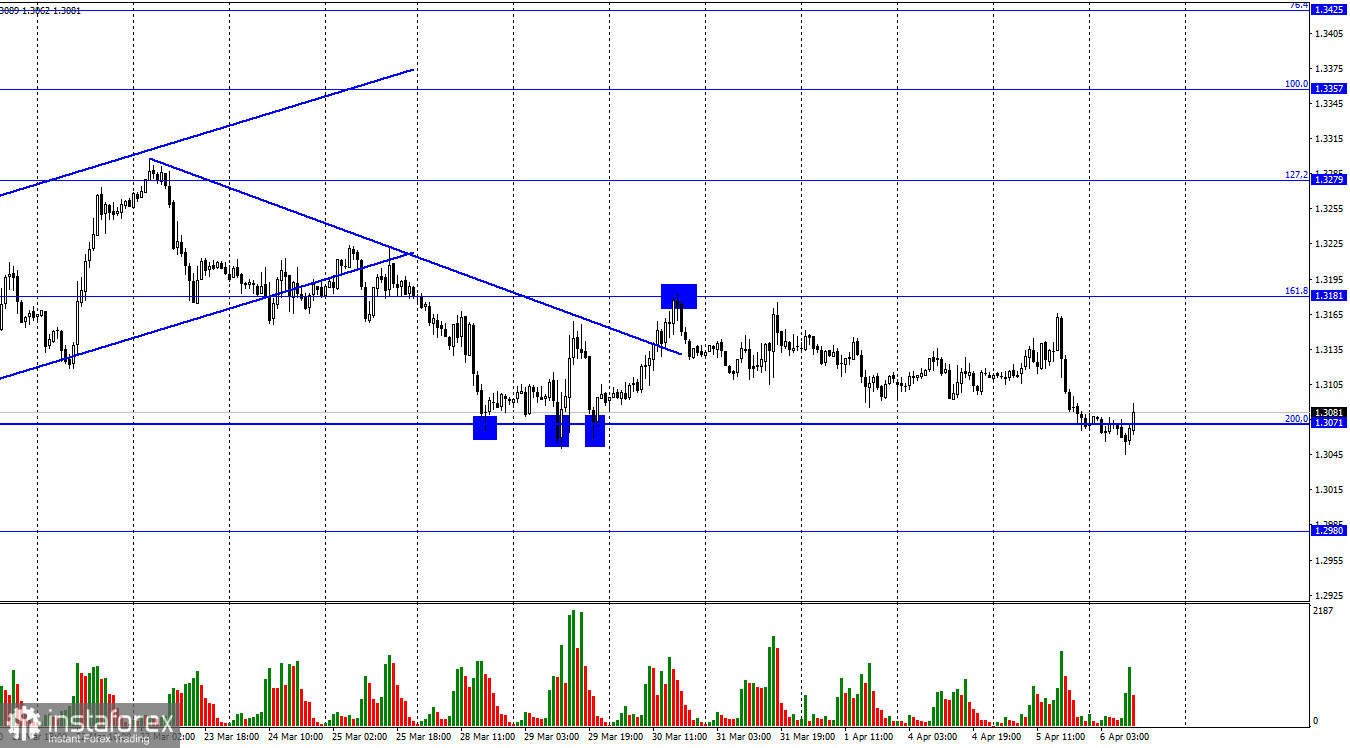

According to the hourly chart, the GBP/USD pair on Tuesday performed a drop to the corrective level of 200.0% (1.3071) and even closed below it, but stumbled upon the Fibo level of 1.3044 on the 4-hour chart, from which the rebound was performed. As a result, the pair has now performed a reversal in favor of the British and has begun the process of growth in the direction of the corrective level of 161.8% (1.3181). Yesterday, the pound also made an impressive drop after the speech of the president of the Federal Reserve Bank of Minneapolis, Lael Brainard. However, before the start of this performance, the pound showed growth, so the final drop of the day was small. Bear traders failed to close below the 1.3044 level, and this is the most important thing right now. The pair has been trading near this level for two weeks now, and the pound cannot continue falling without closing below it. The indices of business activity in the UK, which were released yesterday morning, slightly supported the bulls, but in general, the information background remains not on the side of the pound.

Yesterday, it became known that the European Union is introducing a new package of sanctions against the Russian Federation. This time, the import of coal from Russia, the export of various technologies and goods to Russia, and the transit of goods to Russia through the EU territory are banned, and new sanctions against Russian banks have been introduced. At the same time, in the UK, Liz Truss and Boris Johnson said that sanctions should continue to increase since only this method can stop the aggression of the Russian Federation in Ukraine. Thus, I do not rule out that Moscow will receive several more packages of sanctions in the near future. In Moscow itself, restrictions from the West have even stopped commenting. Moscow's official statements now concern only the refusal to accept various fake news, which is part of the "anti-Russian policy of the West." Moscow does not impose retaliatory sanctions, but at the same time tries to play with the European Union on an equal footing, threatening to cut it off from oil and gas. If Moscow manages to agree on redirecting supplies to China and India, then there will be few losses from severing business relations with the EU.

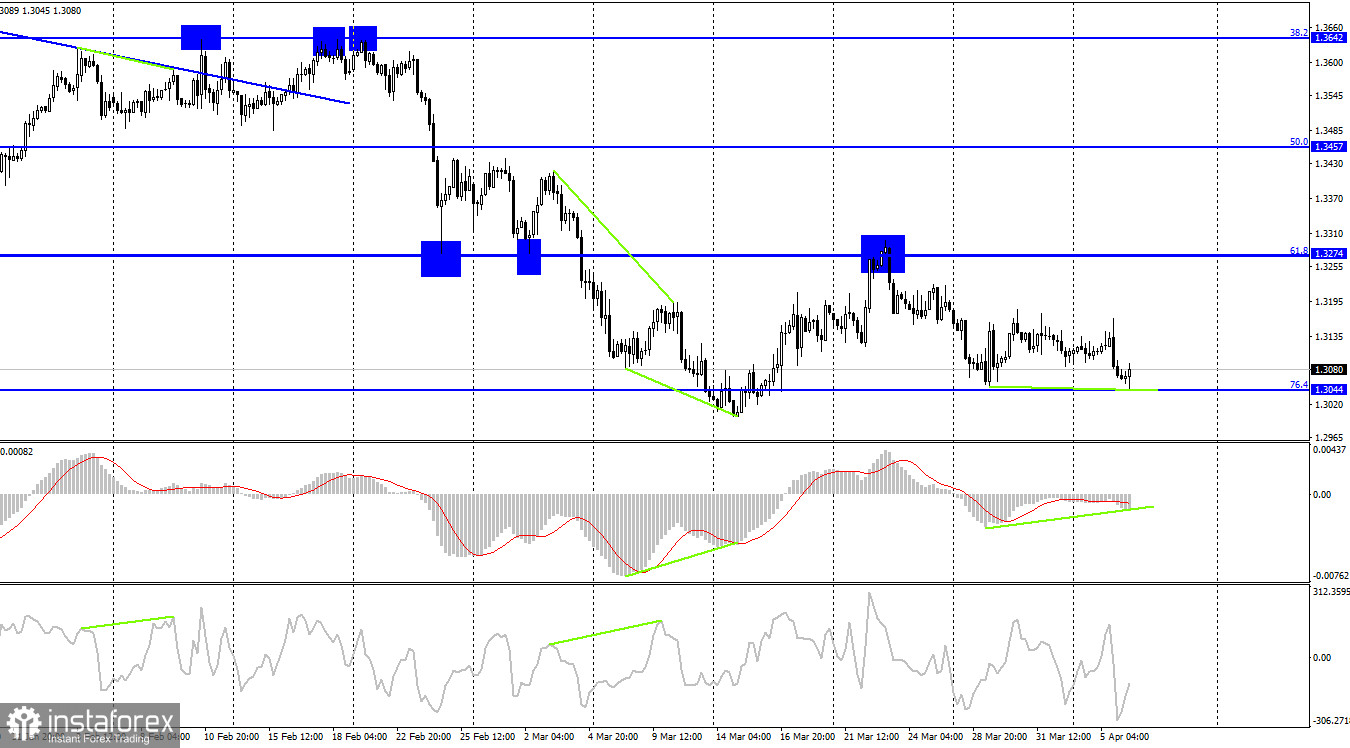

On the 4-hour chart, the pair performed a drop to the corrective level of 76.4% (1.3044). The rebound of the pair's quotes from this level will allow traders to count on a reversal in favor of the British and some growth in the direction of the corrective level of 61.8% (1.3274). Fixing the pair's exchange rate below the 76.4% level will increase the probability of a further fall in the direction of the next Fibo level of 100.0% (1.2674). The brewing bullish divergence of the MACD indicator increases the chances of a rebound from 1.3044.

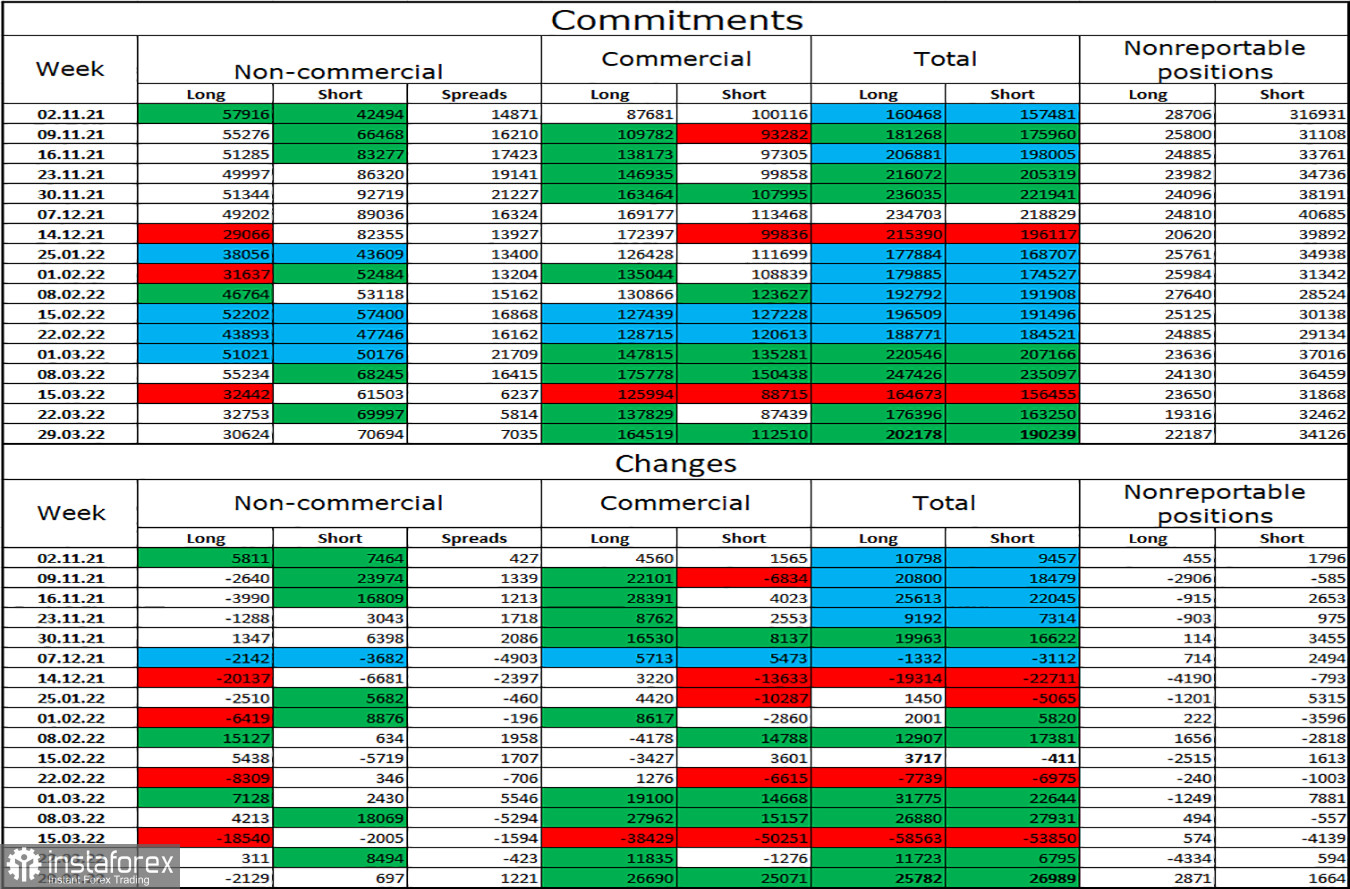

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has not changed much over the last reporting week. The number of long contracts in the hands of speculators decreased by 2,129, and the number of short contracts increased by 697. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators already corresponds to the real state of things - longs are 2.5 times more than shorts. The British dollar is falling, and the big players are selling the pound more than buying it. Thus, I expect the pound to continue its decline. This forecast is based on geopolitics and based on COT reports.

News calendar for the USA and the UK:

UK - PMI index for the construction sector (08:30 UTC).

US - Treasury Secretary Janet Yellen will deliver a speech (14:00 UTC).

US - publication of the minutes of the Fed meeting (18:00 UTC).

On Wednesday, the calendars of US and UK economic events contain only a few entries that can easily be ignored. Business activity indices are of little interest to traders now, so all attention is on Janet Yellen's speech and the Fed minutes. And the hope is that there will be important information in these events.

GBP/USD forecast and recommendations to traders:

I now recommend selling the British dollar with targets of 1.2980 and 1.2895, if consolidation is performed below the level of 1.3044 on the 4-hour chart. I recommend buying the British when rebounding from the 1.3044 level on the hourly chart with a target of 1.3181.