EUR/USD bears stay in control of the market

Today, the euro/dollar bears continue to set the tone in the market. I will focus on the technical side of the analysis later and now I would like to pay more attention to the fundamental background and the macroeconomic calendar.

Due to the ongoing military operation in Ukraine, the sanctions pressure on Russia is getting stronger. It is reported that the UN General Assembly decided to expel Russia from the Human Rights Council. The reason for this was the alleged crimes of the Russian military against the civilian population of Ukraine. The question is very controversial. Unfortunately, there are still no signs of improvement in the negotiations between Russia and Ukraine.

Apart from the obvious political outcomes, the situation in Ukraine has its detrimental effect on the economy as well. For example, disruptions to the supply chain are getting more severe as it has already been weakened by the COVID-19 pandemic. But let's go back to the factors directly influencing the euro/dollar pair. As I have already mentioned in my previous reviews, in addition to the already published FOMC minutes, the members of the US Federal Open Market Committee made several statements this week. Most of the statements display a very clear hawkish stance of the Fed's officials. Thus, St. Louis Fed President James Bullard said he expected to see the funds rate at 3.5% by the end of this year.

Sometimes it seems that the members of the FOMC are competing with each other in an attempt to show whose rhetoric is tougher. Thus, James Bullard stated that he would favor raising the interest rate by 50 basis points at the meeting in May. He outlined that the conflict in Ukraine would lead to serious changes in the global financial markets. In general, it was another hawkish statement by James Bullard. As for the macroeconomic events, there is nothing important for the EUR/USD pair today. Based on this, I can assume that on Friday the trajectory of EUR/USD will be mostly shaped by the market sentiment and the technical factor.

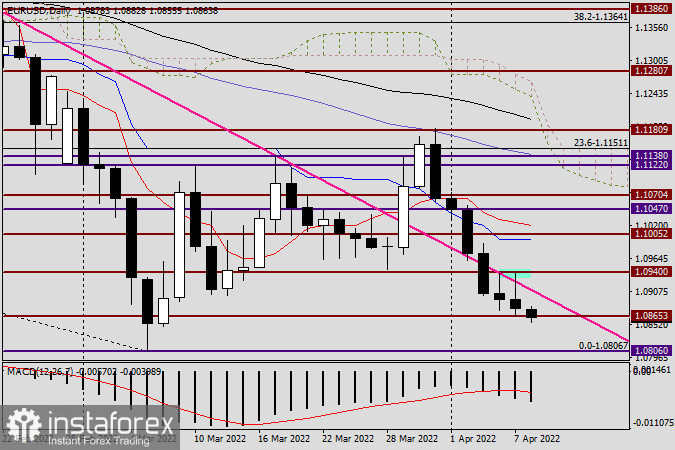

Daily chart

Yesterday, the euro bulls failed to push the quote above the broken key support level of 1.0945. As can be clearly seen on the chart, the level of 1.0940 serves as strong resistance for the pair. The same is true for a falsely broken pink resistance line built between 1.1495-1.1138. On Monday, I will rebuild this line using a new point. Although more than three daily candlesticks had formed above this line, the breakout still turned out to be false. This happens sometimes as the market cannot always strictly follow certain patterns. Otherwise, everything would be clear at the very beginning. Given a clear bearish sentiment in the EUR/USD market, the key support at 1.0800 is in the focus of traders now. At the moment of writing, the pair is retesting yesterday's low at 1.0865 and is trading near 1.0860.

In my opinion, today is not the best day to open new positions. First of all, the trading week is coming to an end. So, market participants will be taking profit which may cause a corrective upside pullback. Secondly, I would like to stress that the price zone of 1.0850-1.0800 is very strong from a technical point of view. Bears are unlikely to break through this area on the last trading day. I think it is better to wait for another corrective pullback to the area of 1.0900-1.0940 and open short positions from there. It seems that this scenario will become possible only on Monday. For those who still want to trade today, I recommend waiting for the pair to rise to the price area of 1.0895-1.0925 and try to go short from there. Bearish candlestick patterns appearing on the H4 and (or) H1 charts will serve as a signal for opening short positions.

Good luck!