GBP/USD changed negligibly

Hi, dear traders!

Yesterday, GBP/USD changed negligibly - the pair remains in the narrow price range of 1.3105-1.3050. The US dollar continues to advance against other major currencies, while the US treasury bond yields decline. There are no significant economic events today. Yesterday, US unemployment data was released - initial jobless claims fell over the week to 166,000, well below the projected 200,000 and reaching the lowest level since 1968. This is another indication that the US labor market is exceptionally strong. The 10-year US Treasury yield is at 2.63%, while the 30-year US Treasury yield is 2.68%.

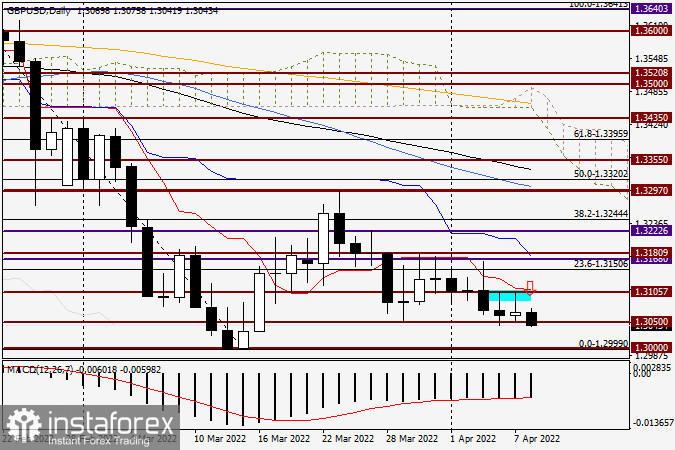

Daily

The pound sterling is holding firm against the USD, despite geopolitical risks and the fiercely hawkish stance of the Federal Reserve. There are many forecasts regarding the upcoming Fed funds rate hike, some of them being unreasonably high. However, these forecasts could backfire - the hike is already priced in by the market, and any Fed decision not matching high market expectations could result in a USD sell-off. Now, investors are focusing on the next FOMC meeting in May, which is quite far away at this point.

On the technical side, the key support of GBP/USD is in the strong area at 1.3050-1.3000. The pair's key resistance level lies in the 1.3105-1.3165 area. As stated earlier, only a true breakout of another key level of 1.3200 would lead to stronger bearish sentiment in the market. Bears would have to steer the pair below 1.3000 - only a true breakout of that level would allow the pair to move lower. However, as the weekend draws near, many traders are currently closing positions, so staying out of the market could be a better option.

Good luck!