Bitcoin paused its upward movement in the $48k area after a two-week rise. The market perceived this pause as a need for local consolidation for further upward movement. However, during the consolidation near $47k, the asset began to test the local support zone. Subsequently, the price broke through the key defense level and fell into the winter accumulation channel. And judging by the current trends, there is a high probability of a worsening corrective pullback.

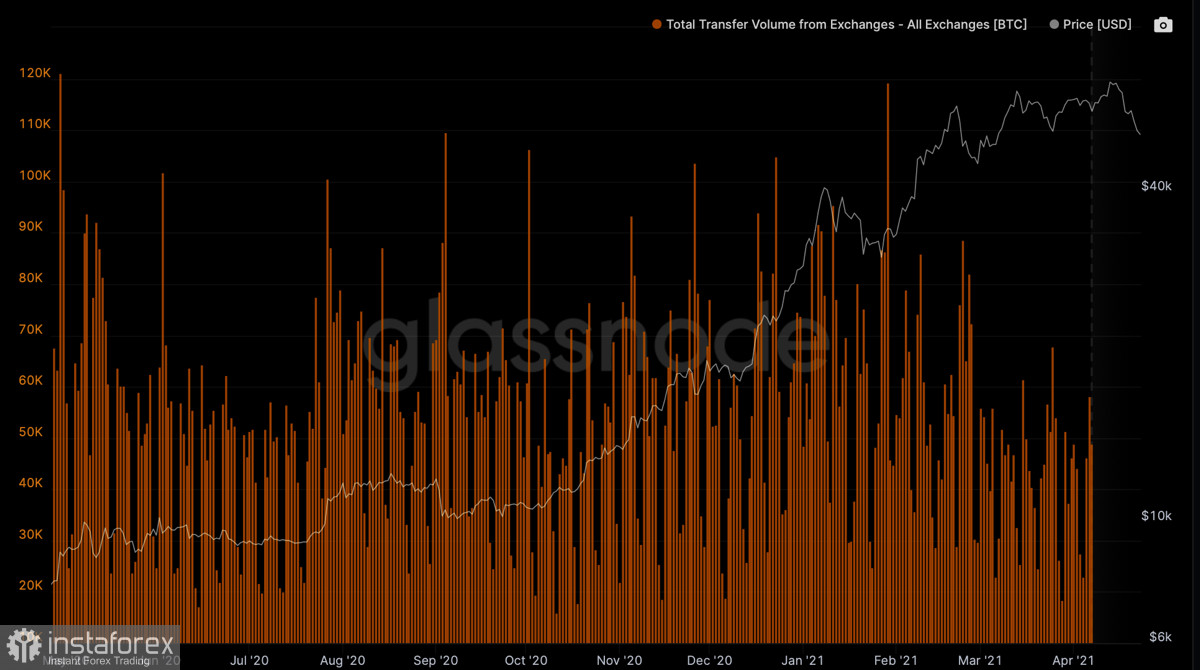

For two weeks, there has been a significant inflow of capital into the cryptocurrency market. More than 14,000 BTC coins were withdrawn from crypto exchanges weekly. However, this trend subsequently changed as the asset approached the $48k mark. What happened there? It all started with local attempts to fix profits. A solid part of the market decided to take advantage of the gradual revival of Bitcoin quotes, and invested in the asset for short-term purposes. Later, a cohort of investors holding BTC for more than a year joined the speculators. As a result, there was a surge in mass profit-taking, as well as bear pressure from the top of the $48k mark.

Subsequently, there was another important reason why Bitcoin began to lose ground. It turned out to be a derivative of the stock market, where investors read the report on the Fed meeting on March 16 and saw signals of an imminent reduction in liquidity in the market. Recall that then it was decided to tighten monetary policy by raising the key rate by 25 basis points. What does this mean for the market and why did this reaction occur? The situation is starting to turn in favor of sellers, as the Fed report talked about the imminent launch of a quantitative tightening program.

This suggests that most of the $5 trillion that was printed between 2020 and 2021 will be withdrawn from circulation. In other words, a significant tightening of access to liquidity is expected in May, and the bubble inflated by the Fed due to the coronavirus crisis will begin to deflate. The stock markets will look for new liquidity and financial instruments to preserve current capital. The change and significant reduction in investment flows in the stock markets will directly affect the cryptocurrency market.

Bitcoin maintains a high level of correlation with stock indices. This suggests that investors continue to perceive the asset as a high-risk financial instrument. Even despite the growing interest in Bitcoin as an inflation hedge and reserve asset, it cannot be argued that the cryptocurrency will not suffer from a reduction in liquidity. A likely way out of the situation could be the end of the current accumulation period and the appearance of a BTC deficit. 19 million BTC coins have already been mined with an issue of 21 million. In the medium term, this will positively affect the quotes of the cryptocurrency, but right now we should expect a further pullback in the value of BTC/USD, due to the uncertainty of investors in interpreting its qualities.

There are no significant changes on the daily timeframe of the cryptocurrency. The price failed to close above $45k, which means that the decline to the round mark of $40k remains relevant. Yesterday, April 7, the cryptocurrency spent with relative equality of bulls and bears. Technical indicators are starting to recover and turn sideways. RSI and stochastic resumed their movement in the bullish zone after the fall, which indicates an increase in buying activity. There is a local period of consolidation, which will last until the end of the weekend, after which BTC/USD will try to return to the previous levels, to the $45k-$48k area.