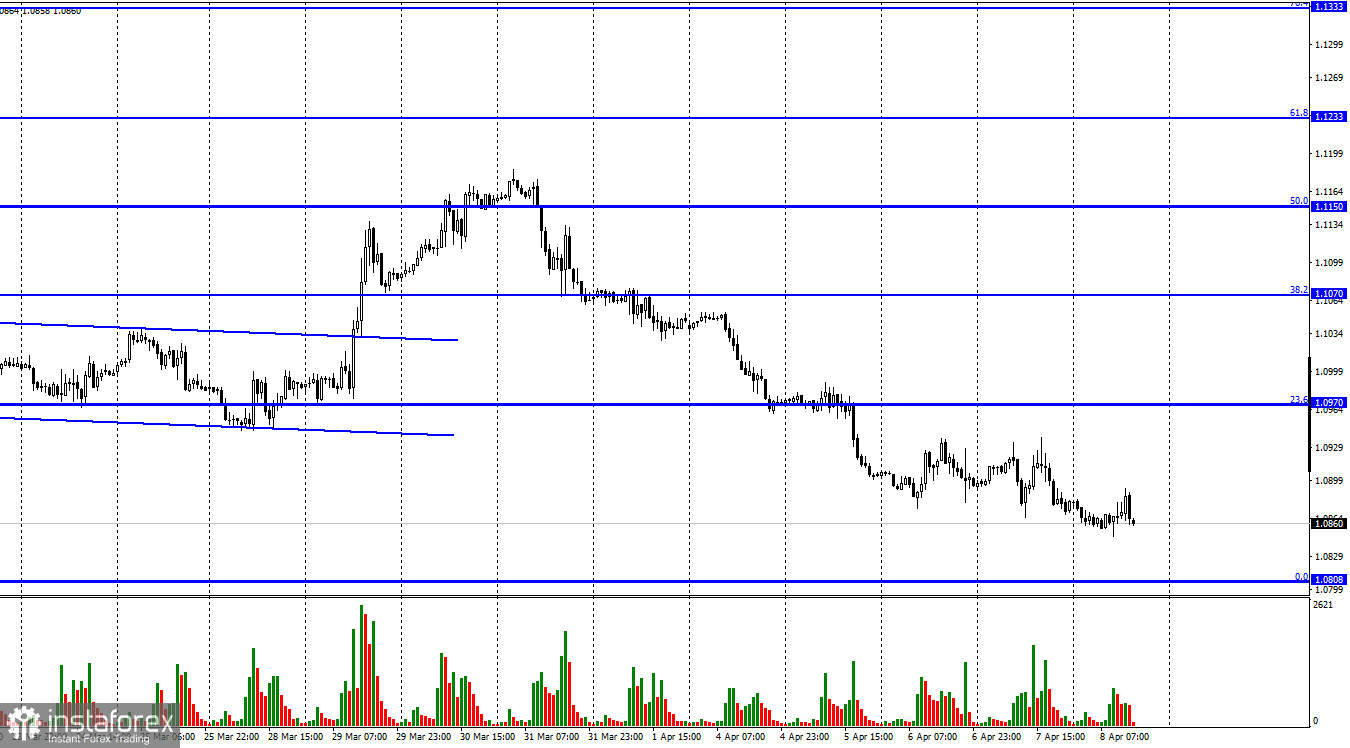

The EUR/USD pair on Thursday and Friday continued the process of falling in the direction of the corrective level of 0.05 (1.0808) at a very slow pace. I want to note right away that during the entire current week, bull traders did not have enough strength even for one attack, thanks to which the euro currency would have shown growth. The euro has been falling for five days in a row, from time to time rolling back a maximum of 40-50 points. The rebound of quotes from the level of 1.0808 will allow us to count on a reversal in favor of the EU currency and some growth in the direction of the corrective level of 23.6% (1.0970). The consolidation of quotes at 1.0808 will allow us to expect a further fall in the euro currency. The information background this week was very weak. There was loud news, but they were mainly concerned with geopolitics and the Fed's monetary policy. It was after the statements of James Bullard, Mary Daly, and Lael Brainard that a new fall in the euro began, which is also the growth of the dollar. Let me remind you that all three members of the FOMC said that in May the rate could be raised by 0.5% at once, which traders have been waiting for a long time from the committee.

There was also talk that the Fed could start unloading the balance sheet as early as May, although earlier it was said about the second half of the year. Well, the Fed minutes on Wednesday made it clear that the regulator's balance sheet can be unloaded at a rate of $ 95 billion per month. This is about as much as it has grown during the duration of the quantitative stimulus program, which has been working in recent years. That is, traders have received a tightening of the rhetoric not only of individual FOMC members but also of the entire organization as a whole. Therefore, the dollar received a new demand for itself, which led it to new growth. And there was no positive news for the European currency this week. Not a single speech by an ECB member, not a single important economic report - nothing. Even in those days when absolutely no information was received, traders at best suspended new sales of the pair. Bull traders are now simply refusing to work with the euro.

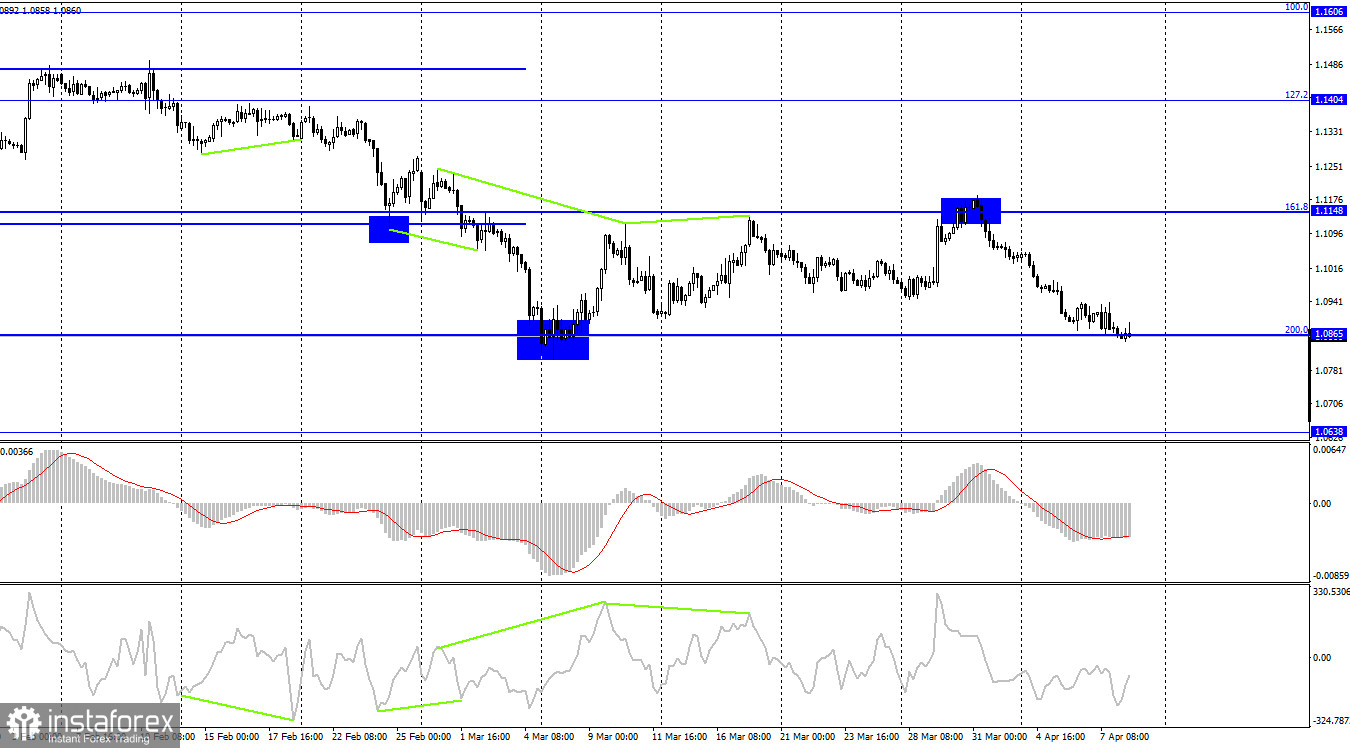

On the 4-hour chart, the pair performed a drop to the corrective level of 200.0% (1.0865). The rebound of the pair's exchange rate from this level will allow us to expect a reversal in favor of the European currency and some growth in the direction of the corrective level of 161.8% (1.1148). The consolidation of quotes below the level of 1.0865 will increase the likelihood of a further fall towards the next level of 1.0638. Brewing divergences are not observed in any indicator today.

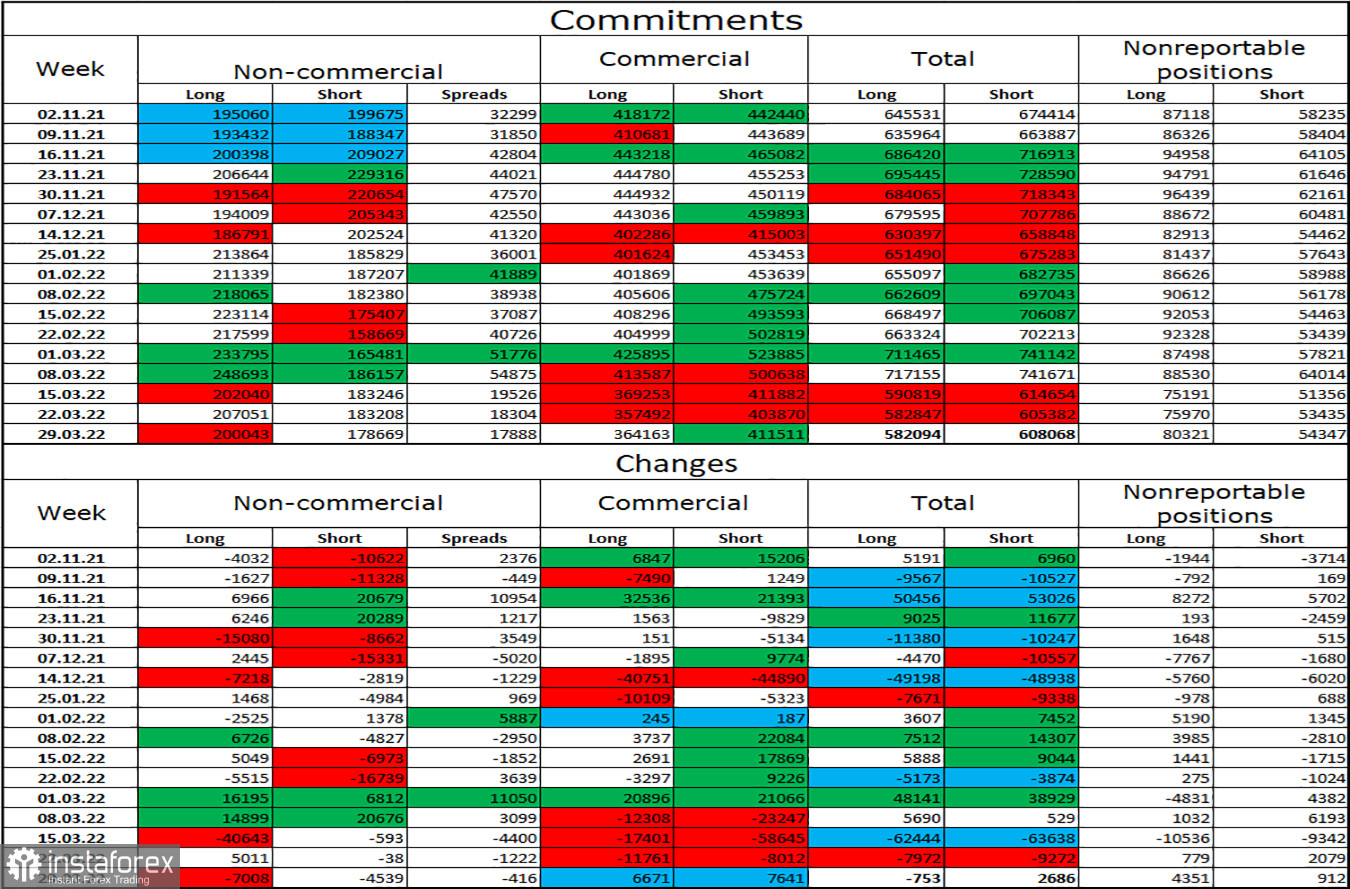

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 7,008 long contracts and 4,539 short contracts. This means that the bullish mood of the major players has weakened slightly, but the changes are generally insignificant for the second week in a row. The total number of long contracts concentrated on their hands is now 200 thousand, and short contracts – 178 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is characterized as "bullish". In this scenario, the European currency should show growth. And it would have shown, if not for the information background, which now supports only the dollar. We are now witnessing a situation where the bullish mood of major players persists, but the currency itself is falling. Thus, geopolitics is now a priority, and the worse things get in Ukraine, the more the euro currency will fall.

News calendar for the USA and the European Union:

On April 8, the calendars of economic events in the United States and the European Union do not contain a single interesting entry. The information background today will not have any effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair with a target of 1.0808 on the hourly chart if consolidation is made under 1.0970. Now they can be kept open. I recommend buying a pair if there is a rebound from the 1.0865 level on a 4-hour chart with targets of 1.0970 and 1.1070.