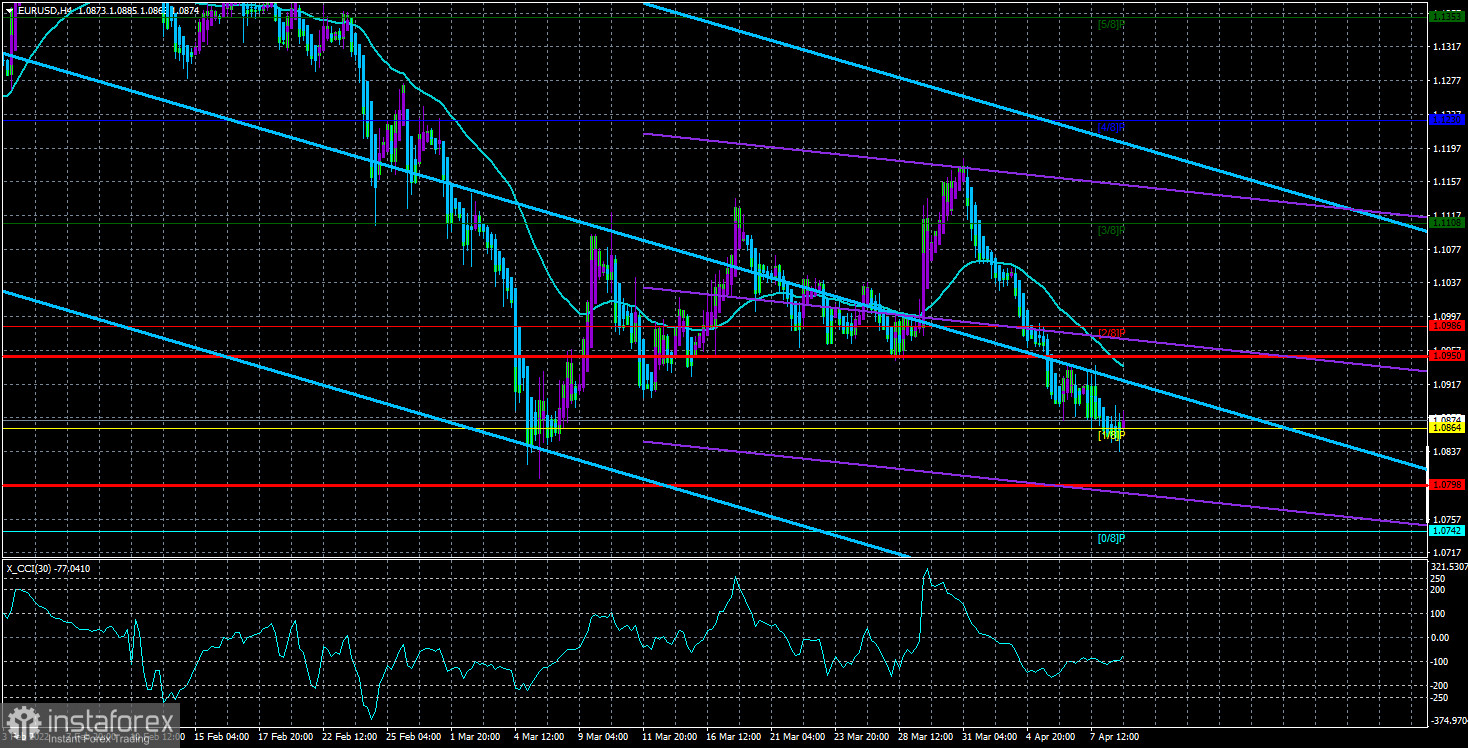

The EUR/USD currency pair continued its downward movement at a leisurely pace on Friday and eventually completed the week near its local lows, from which 15-month lows are just around the corner. So far, everything looks like there are no special chances for the growth of the European currency, and it is not expected in the near future. Recall that almost all the most significant factors are now on the side of the US currency. Here is the difference in the monetary policies of the ECB and the Fed, and the geopolitical conflict in Eastern Europe, which affects the interests and economy of the EU to a much greater extent than the United States. And the fact that the pair can't even really adjust against the dollar says a lot. Thus, very briefly, we expect a further fall in the European currency. Now both linear regression channels on the 4-hour TF are directed downwards, so all technical indicators indicate a new fall in the euro currency.

We have already tried recently to at least hypothetically understand what can stop the fall of the euro. However, the list turned out to be very small. Of course, first of all, this is the end of the Ukrainian-Russian military conflict. In this case, the situation with energy prices may stabilize, which will slightly extinguish inflation. However, it is completely unclear with what final sanctions against Russia the whole world will come out of this conflict. Already, world leaders almost unanimously declare that the cessation of hostilities on the territory of Ukraine and the withdrawal of troops beyond its borders will not be the basis for the lifting of all imposed sanctions. And even in the context of this moment, it is completely unclear what to do with Crimea and Donbas? If Moscow withdraws its troops from Ukraine, will it be considered that the conflict is over if the LPR, DPR, and Crimea belong to Russia? Perhaps it will be a "frozen conflict". Thus, it is very difficult to count on the completion of hostilities before the end of 2022. This means that Europe is almost guaranteed to face an energy and food crisis.

Macron's chances of winning are high but ambiguous

The first round of presidential elections in France took place yesterday. There are no results yet, so for now we will talk about who can win them at all and what will change for the European Union after they are completed. Almost no one doubts that the main struggle, as in the last election, will unfold between Emmanuel Macron and Marine Le Pen. Macron will try to leave for a second term, which has not happened in France since the days of Jacques Chirac. However, on the eve of the elections, almost all social studies spoke only about a small advantage of Macron over Le Pen. In percentage terms, it looks like 28% versus 23%. But at the same time, the absolute majority of opinion polls also speak in favor of the fact that Macron will win. The French population has certain claims against Emmanuel. Of course, he is not close to Boris Johnson, who has collected a lot of scandals and "dark stories" in his track record. However, Macron is considered a "president for the rich." Naturally, the working class does not support him. Macron promotes the European course of development of the country and is one of the leaders of the EU. At the same time, Marine Le Pen is a representative of the "right" forces and has repeatedly supported Russian President Putin, as well as advocated abandoning the euro and leaving the EU. That is, Le Pen is a president who, if he wins, will probably lead the country out of the European Union and get closer to Russia. Many in France consider her a threat to the state, but many also support her, since she is much closer to the working class than Macron. In general, if Le Pen wins, then the vector of France's foreign policy may seriously change its course. Of course, it is difficult to predict how quickly and how much this course will change, but the European Union may get a problem for itself if Le Pen wins. In principle, today we will find out who has reached the second round of elections, although there is no doubt that Macron and Le Pen will be there.

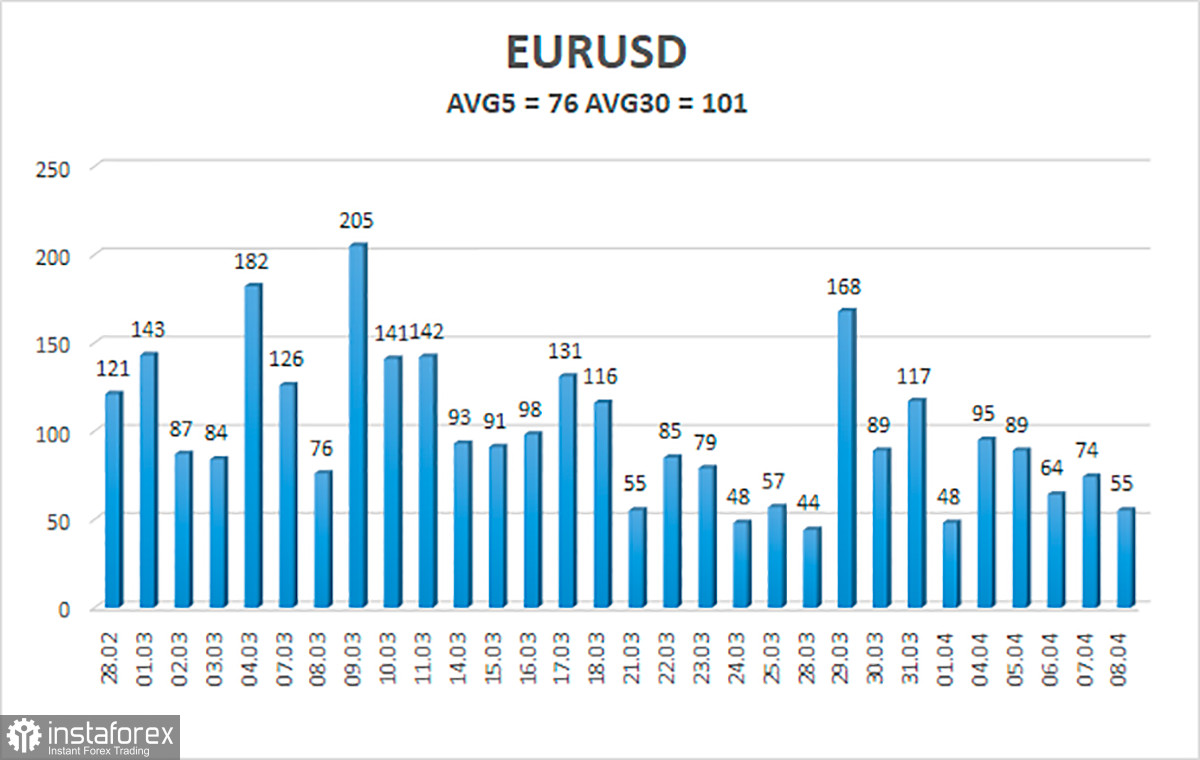

The volatility of the euro/dollar currency pair as of April 11 is 76 points and is characterized as average. Thus, we expect the pair to move today between the levels of 1.0798 and 1.0950. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.0864;

S2 – 1.0742;

S3 – 1.0620.

Nearest resistance levels:

R1 – 1.0986;

R2 – 1.1108;

R3 – 1.1230.

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now it is necessary to stay in short positions with targets of 1.0798 and 1.0742 until the Heiken Ashi indicator turns up. Long positions should be opened with a target of 1.1108 if the pair is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.