The GBP/USD currency pair updated its local lows on Friday, dropping to the level of 1.2981. This minimum is not only local but also 15-month. The pound has also failed to adjust properly over the past few weeks. On the 24-hour TF, it failed to get even to the critical line. Therefore, we believe that all factors speak in favor of a new fall in the British currency. Of course, the positions of the pound sterling look more confident than the positions of the euro currency. First, the British economy is much less dependent on Ukraine and Russia. Britain quite easily refused to import energy from the Russian Federation, and its government needs to take into account only the interests of its own country, and not another 27 countries, as in the European Union. Second, the state of the British economy is much stronger than the state of the European economy, which allows the Bank of England to raise rates and fight inflation not only in words. This factor could provoke the growth of the British currency if all other factors did not speak in favor of the growth of the American currency. For example, COT reports show how the major players of the foreign exchange market are set up: selling the pound. Thus, it turns out a situation in which the pound feels better than the euro, but at the same time much worse than the dollar, on which the conflict in Eastern Europe has practically no effect at all on the American economy. On the contrary, due to the emergence of a real threat of a prolonged war in Europe, demand for the dollar, American stocks, and bonds is growing. It turns out that no matter how resistant the pound is, it still has a high chance of further decline.

Will macroeconomic statistics make any difference this week?

There will be quite a large number of interesting reports and events in the new week. The most important is the consumer price index in the United States. According to experts' forecasts, inflation will rise in March from 7.9% to 8.3-8.5%. I don't even want to talk about another anti-record anymore, everyone has long been used to the growth of this indicator. Thus, if the States see a new acceleration in price growth, it may further increase the "hawkish" sentiment within the Fed. They are already going through the roof, and the fight against inflation is called the main goal of the regulator for the coming years. But the mood can get even tougher. However, this factor already provides serious support to the dollar. According to many respected experts, banks, and analytical agencies, in May and June, the Fed will raise the rate by a total of 1%.

In addition to inflation, new speeches by representatives of the Fed will take place in the United States. In particular, Bostic, Bowman, Evans, and Brainard. If they also make it clear once again that the Fed will fight inflation to victory, it will only strengthen the "dollar sentiment". But there will be practically no important reports, apart from inflation. Retail sales, data on applications for unemployment benefits, consumer confidence indices, and industrial production are not what the market is ready to pay attention to right now.

In the UK, the week will start shockingly. Already on Monday, data on GDP, industrial production, and trade balance will be published. Of course, the most important will be the GDP report in various time intervals. Retail sales, unemployment rate, and wages will be published on Tuesday. On Wednesday - inflation. Thus, the first three days can be very active in the market. Inflation in Britain is also a very significant report at this time, as BA has shown a willingness to tighten monetary policy in response to rising prices. In March, this indicator may grow from 6.2% to 6.7-7.0% y/y. Therefore, if we start from it, we can assume that the British regulator will also raise the rate in 2022. But, as we said above, this factor may not save the pound from a new fall. Also, do not forget about geopolitics. In the coming week, military experts expect a new escalation of the conflict in Ukraine. It is unlikely that the market will stay on the sidelines and ignore it.

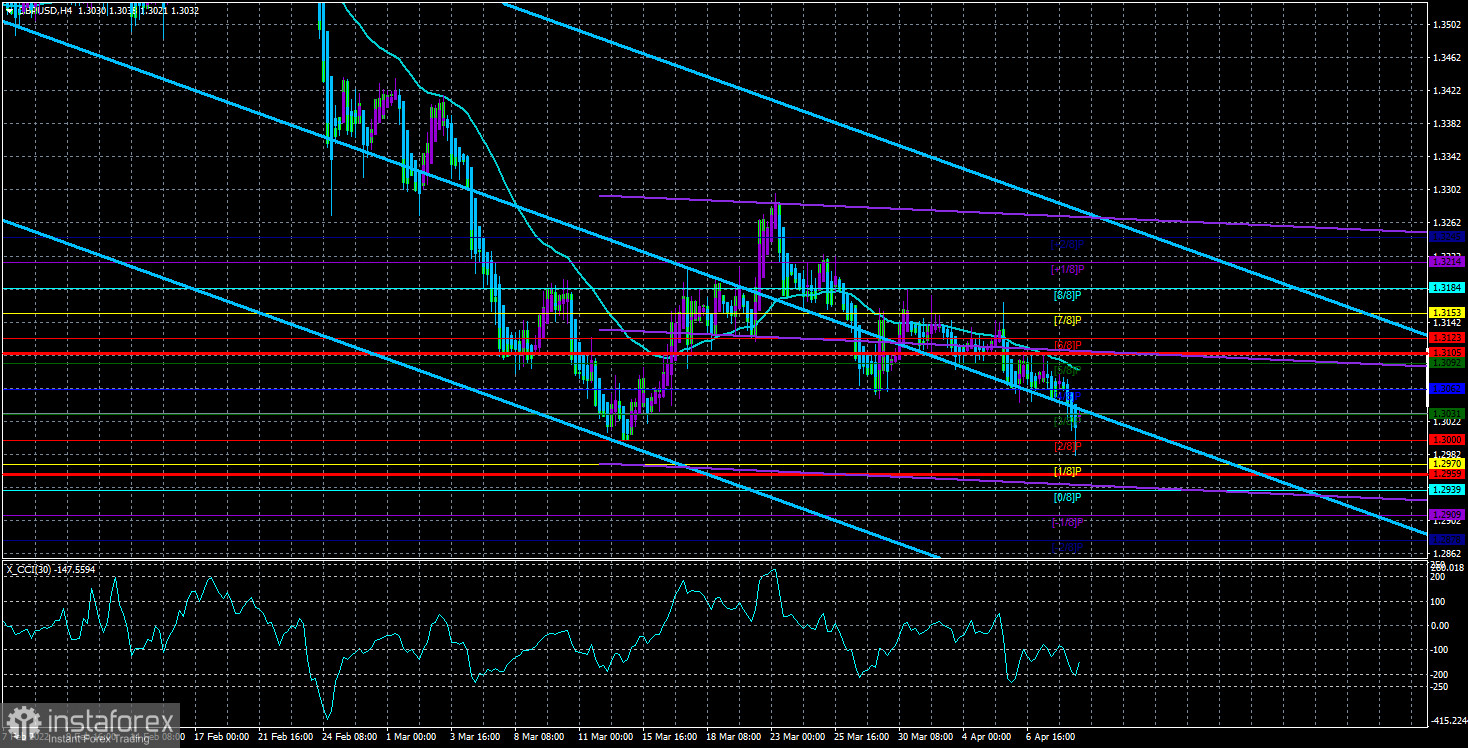

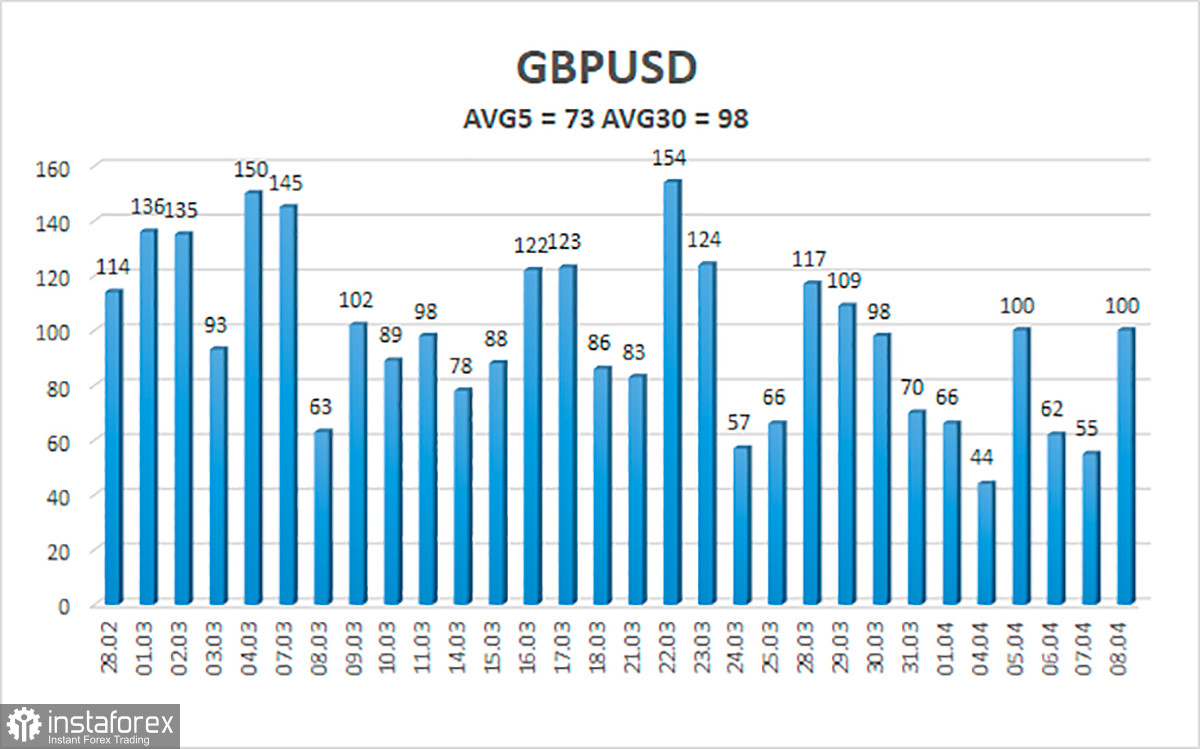

The average volatility of the GBP/USD pair is currently 73 points per day. For the pound/dollar pair, this value is the average. On Monday, April 11, thus, we expect movement inside the channel, limited by the levels of 1.2959 and 1.3105. A reversal of the Heiken Ashi indicator upwards will signal a round of corrective movement.

Nearest support levels:

S1 – 1.3000;

S2 – 1.2970;

S3 – 1.2939.

Nearest resistance levels:

R1 – 1.3031;

R2 – 1.3062;

R3 – 1.3092.

Trading recommendations:

The GBP/USD pair continues its downward movement in the 4-hour timeframe. Thus, at this time, sell orders with targets of 1.2970 and 1.2959 should be considered before the Heiken Ashi indicator turns upwards. It will be possible to consider long positions no earlier than fixing the price above the moving average line with targets of 1.3123 and 1.3153.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.