The outlook for crude oil demand in the world's second-largest consumer darkens amid the extended lockdown in Shanghai.

Demand for oil in China has already declined by approximately 1.2-1.3 million barrels per day, according to the data from FGE energy consultancy.

Half of the lost demand comes from jet fuel, the data shows.

Before the latest outbreak of the coronavirus, China's daily demand averaged 13.7 million barrels per day in both January and February.

Even if the lockdown in Shanghai ends, half a million barrels of daily oil demand will remain at risk of new restrictions in other parts of the country, Bloomberg reports.

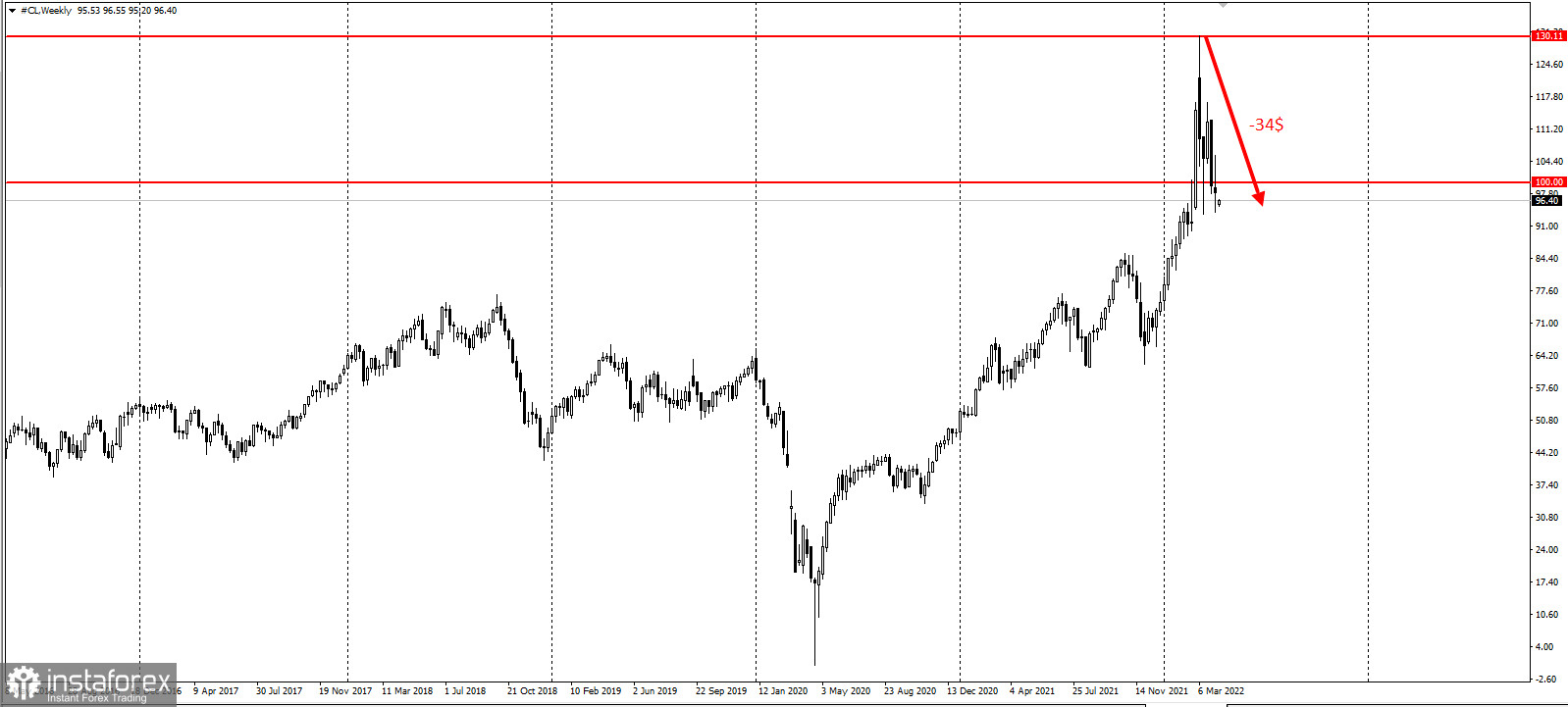

Since March this year, oil has lost about 30% in value:

Lockdowns in China have spooked oil markets several times over the past two years, given the country's heavy dependence on oil imports. This time, the first sign of alarm appeared in March when a traffic decline of 36 percent was reported in Shanghai, while in Shenzhen, it went down by 26 percent.

An inevitable drop in oil prices came amid Beijing's zero-covid policy based on immediate quarantine measures.

These lockdowns, in turn, affect oil consumption and, apparently, scare oil traders. In March, China's authorities closed Shenzhen, a city with a population of 17.5 million, immediately sending oil prices lower. Last week, crude prices dropped as well as there was a strong additional factor in the form of oil reserve release announced by the US.