Bitcoin closed last week in the bear market. The asset failed to hold at the mark of $43k, and the weekly candlestick closed at $42.3k. This indicates the defeat of the bulls and the end of the two-week uptrend. Apparently, we are dealing with another wave of correction rather than a temporary decline within a consolidation. As of April 11, the number one cryptocurrency may decline to $36.4k, which corresponds to the 0.5 Fibonacci level.

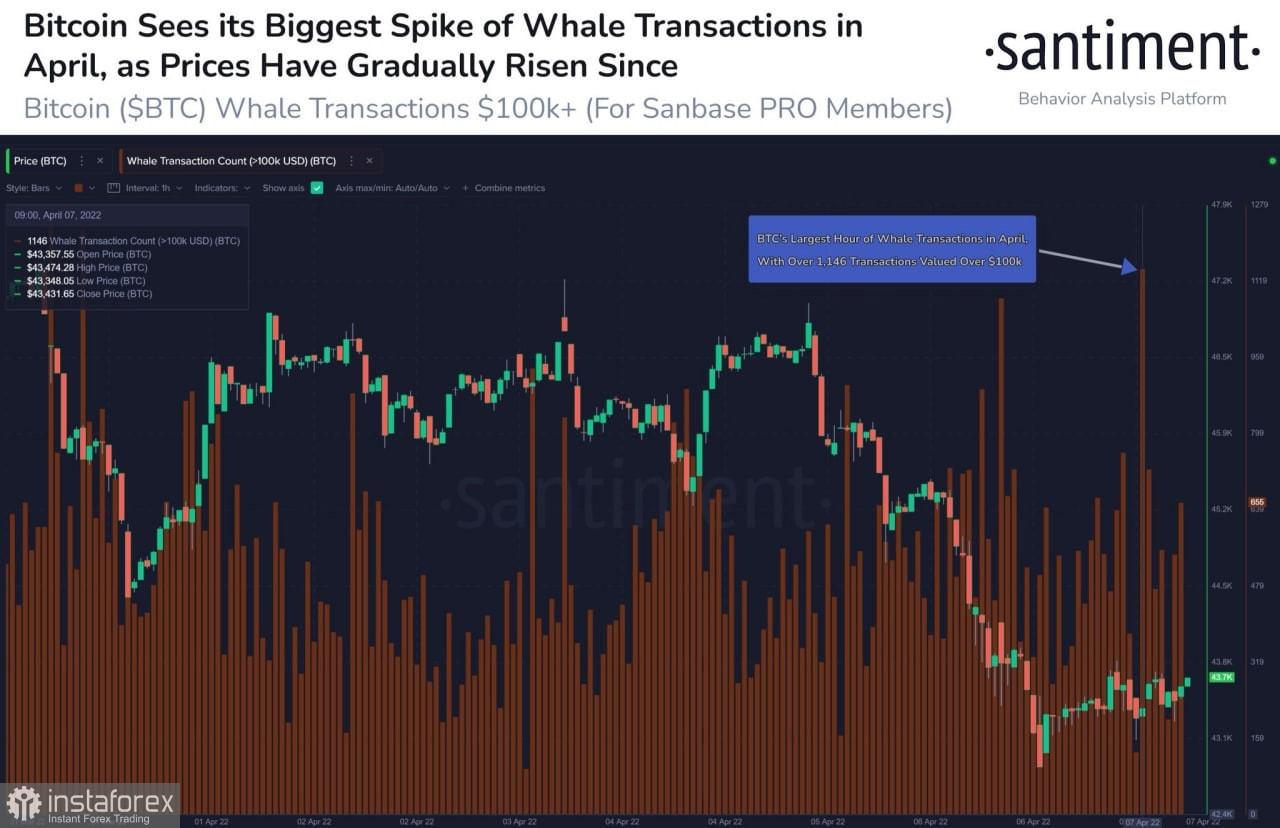

Along with a decline of 8.5% per week, the volume of cryptocurrencies on the exchanges is also getting lower. This suggests that most investors remain optimistic about Bitcoin and are ready to accumulate coins in order to make a profit in the foreseeable future. For example, Santiment recorded the largest spike in whale transactions in Bitcoin on April 7. According to Bank of America, BTC is set to reach $100k in 2022, and the current phase of accumulation is good proof of this.

Bank experts say Bitcoin has good prospects for growth due to the monetary policy tightening by the Fed. Over the next 9 months, the key rate will increase to 2.5% -3%. Besides, the quantitative tightening program will start as soon as this May. This suggests that the US stock market, which exceeded 200% of GDP in 2021, will gradually deflate. This is the main ground for Bitcoin's upside potential, bank experts are sure. This can indeed have a positive effect on Bitcoin, given that some major conditions are met.

It is important to understand that BTC was driven by the same factors as the stock market. That is why the correlation between Bitcoin and SPX, NASDAQ has increased. Investors were holding these instruments in a single basket characterized by high returns and high risks. Now the Fed's new policy will be aimed at reducing capitalization and investment in stocks and other high-risk assets. This is done to increase demand for Treasury and mortgage-backed securities, which back the US dollar. As of April 11, we can clearly see that the market perceives BTC/USD as a high-risk asset. This is confirmed by the BTC, SPX, and NASDAQ charts.

Yet, Bitcoin is gradually losing its correlation with stock indices and becoming a reserve asset. However, it will take time for the market to fully change its stance on Bitcoin. At the moment, BTC is at a crossroads. On the one hand, it serves as a hedge against inflation and a safe-haven asset. But on the other hand, investors withdraw funds from the market for safer distribution of liquidity. With this in mind, we should be prepared for a further price drop before a new investment strategy on BTC/USD is shaped.

In order to completely lose its correlation with the stock market, BTC will need to become an actively used reserve instrument. However, institutional players are not ready to invest most of their capital in an instrument that has not completely settled in the global financial system. So, it may take up to six months for BTC to get the approval for being a reserve asset. On the other hand, 90% of Bitcoin's supply has already been mined. Given the pace and volume of accumulation, the growing limit of BTC supply can be a decisive factor that would change the investment approach to cryptocurrencies.

Now we can say for sure that Bitcoin has made a false breakout of the $48k level. After failing to settle above it, the cryptocurrency started a decline towards $42.3k where it is now consolidating. The price has broken through an important milestone of $43k, which means that the asset has the potential to fall to $36k. This is unlikely to happen in the coming days as buyers started to fight back. This move is confirmed by the RSI and the Stochastic indicators, which are again signaling a flat movement. In general, the active phase of growth has given way to accumulation. This means that in the coming weeks, the price of Bitcoin is expected to slide below $40k.