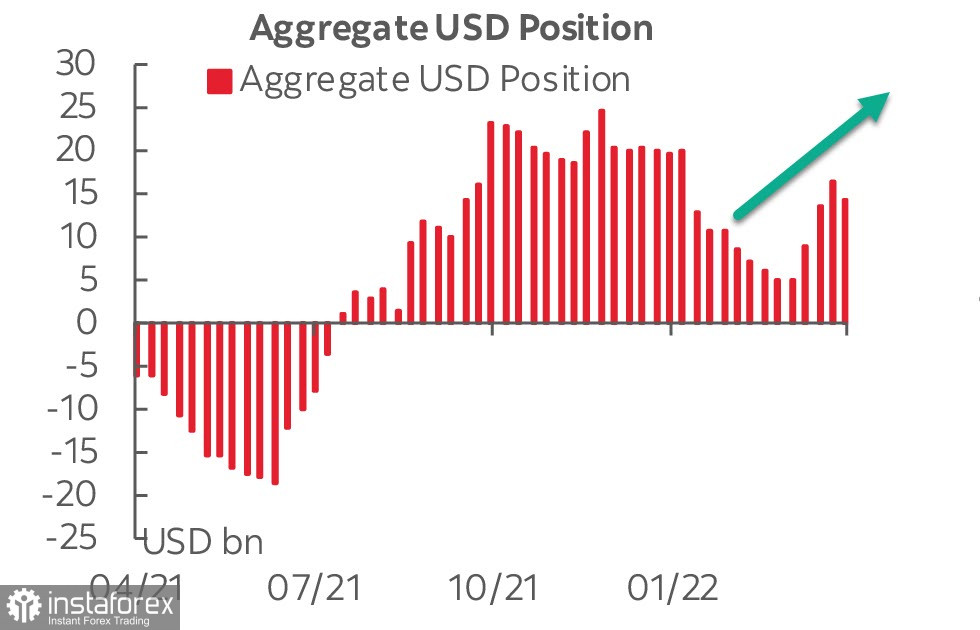

The CFTC report reflects some reduction in the overall bullish bet on the US dollar, which 3 weeks earlier won back a significant part of the two-month decline. The bullish lead has shrunk by 2.151 billion to 14.233 billion, but it's unlikely that dollar weakness will continue, and here's why.

Almost from the reduction, there were only 2 currencies – Canadian and Australian dollars. Obviously, this is a consequence of pressure on Russia, which is conducting a special military operation in Ukraine. It is assumed that Russia will lose the opportunity to sell oil and a number of other raw material positions to Western countries due to the blockage, and the falling volumes will be compensated by Canada, Australia, Mexico, and several other countries. This is the only reason why some commodity currencies are receiving increased attention from speculators, which, in turn, has put some pressure on the dollar.

We assume that the general upward trend in the dollar will continue, as the Fed intends to implement the program of tightening financial conditions as quickly as possible – faster than other central banks. Yes, at the same time, the threat of a recession increases significantly, but the players will seriously think about it closer to autumn, now it should be assumed that the dollar will remain the favorite, even despite the obvious problems in the US economy.

The US Treasury yield continues to grow, reaching 2.780% on Monday morning, bonds of other countries are also growing, but with some lag. The sell-off of bonds, however, is not accompanied by an increase in stock indices, which is an alarming sign of investors going into cash amid the expected increase in volatility. Fed officials Charles Evans and Raphael Bostic spoke at the Fed's event on Friday and reaffirmed their position on the need for a quick transition to neutral rates. Fed calculates this to be around 2.40%, which is significantly lower than the inflation rate, and its achievement, most likely, will be clearly not enough to stop the price increase.

The US inflation data for March will be released on Tuesday, which is expected to rise to 8.3%. This means that the market does not expect a slowdown in inflation yet.

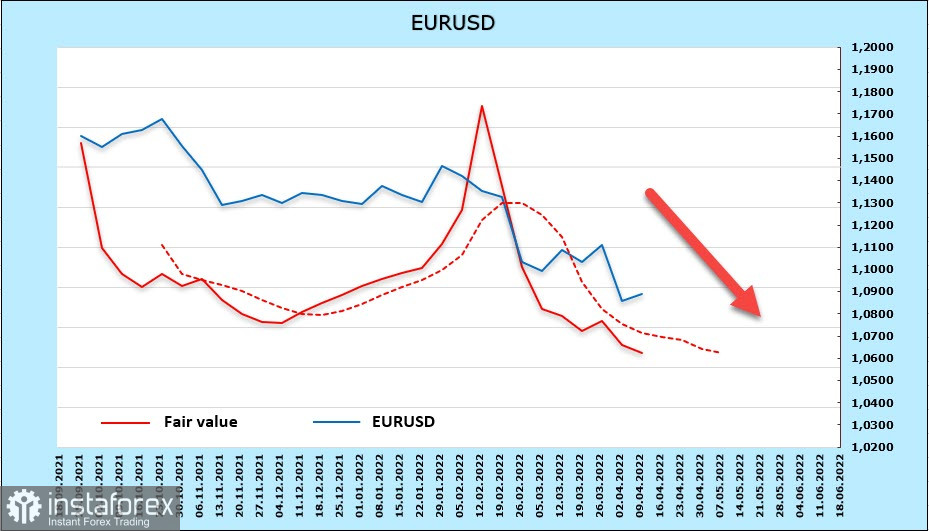

EURUSD

On April 14, the ECB will hold a regular meeting. Risks are growing – inflation continues to grow steadily, economic prospects against the backdrop of deteriorating logistics, and the threat of energy starvation are getting worse. While the players do not expect the ECB to abandon its intention to end the APP in the 3rd quarter, the reaction to rising inflation should follow, which means that a specific date for the start of the rate increase cycle may be announced.

The net long position on the euro, as follows from the weekly report of the CFTC, increased over the reporting week by 769 million, to 3.7 billion. We can say that in general the situation in the euro has stabilized. The settlement price is directed downwards, the trend for the euro remains bearish, and there are no signs of a reversal yet.

The euro is trading near 1.08, the lower border of the triangle, the breakdown of which will mean a high probability of a move to 1.0637. The euro has every chance to fall to 1.0320 if the issues of European energy supply are not resolved in the next month.

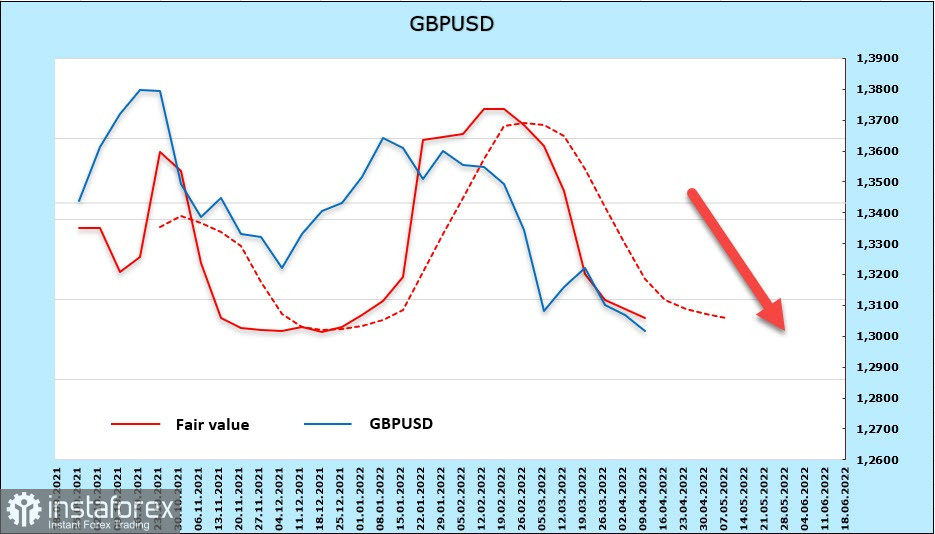

GBPUSD

The week began negatively for the pound, GDP growth in February amounted to 0.1% against the forecast of 0.3%, industrial production showed a contraction of 0.6% (-0.4% in manufacturing), and the trade balance went deeper into minus. On Tuesday, a report on the labor market will be published, investors are waiting for confirmation on the forecast for an increase in average wages by 5.7%, if the forecast is confirmed, then the pound will get a little respite, but if the report turns out to be worse than forecasts, its fall will accelerate.

The main movements are expected on Wednesday, the key parameter will be published – inflation in March, while the forecast is +6.7% (+6.2% in February), any deviation from the forecast may cause increased volatility.

The pound added 133 million to the short position, which is now -3.412 billion dollars, the Settlement price continues to fall down, and the likelihood of a bullish reversal is minimal.

The March low at 1.2998 has been updated, the probability of an upward reversal is minimal, the long-term target is moving towards support at 1.2650/80, where the 2020 low at 1.2673 is located, and the lower border of the bearish channel is also passing.