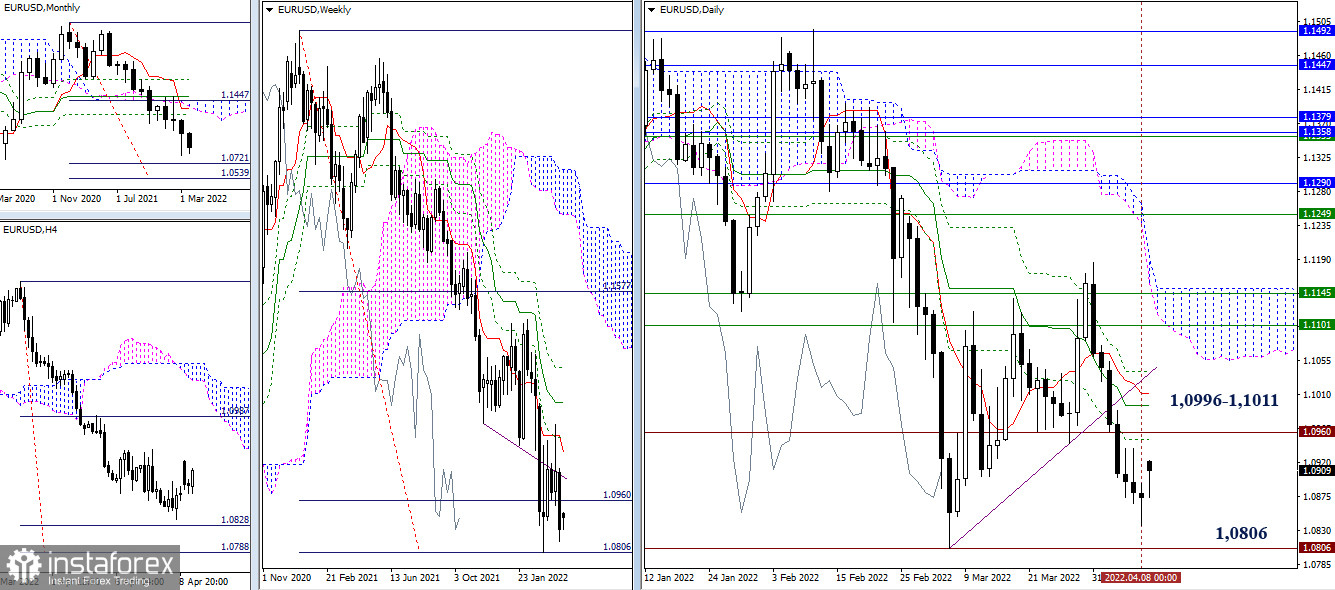

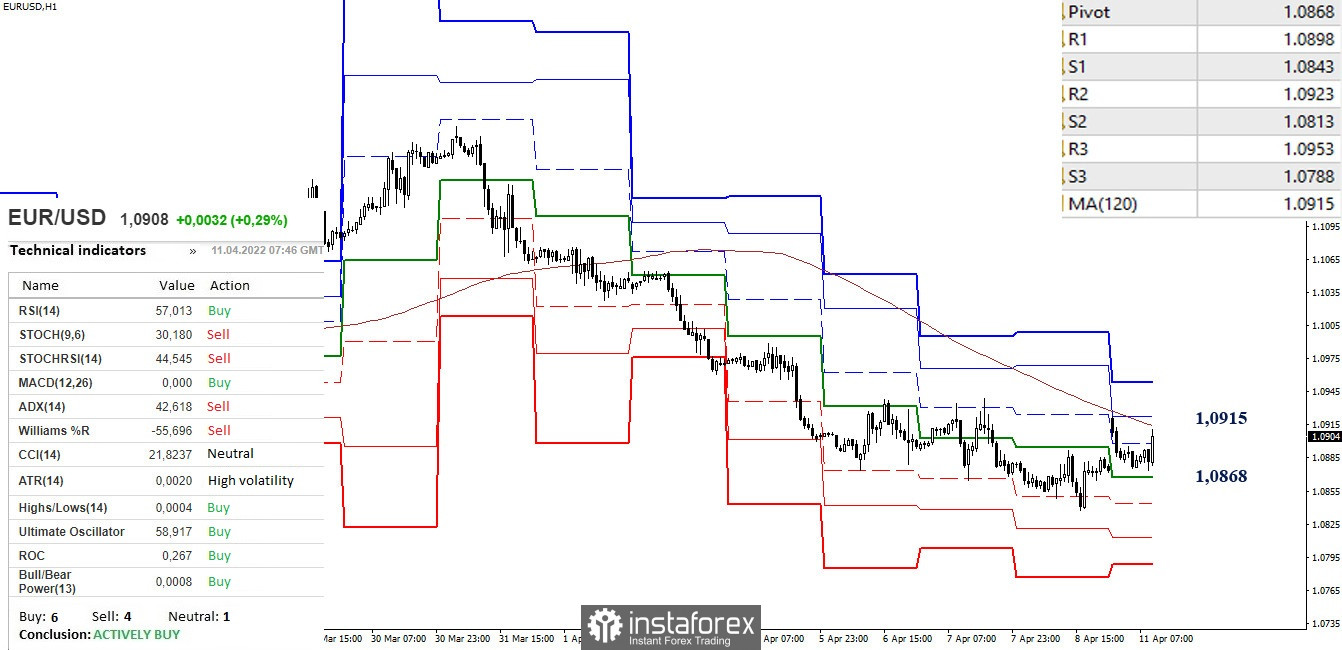

EUR/USD

Last week failed to update the March low (1.0806), the long lower shadow of March continues to keep the pair from returning to bearish sentiment. Today, the bears managed to close the gap at the opening of trading fairly quickly. Now we will see whether they will continue to dominate the market, preserving their prospects, or the opponent will regain not only the height of the gap, but also continue to rise. The closest, most important reference point in this area for bears is the March extremum (1.0806), and for bulls, the task is to consolidate above the supports of the daily Ichimoku cloud (1.0996 – 1.1011).

On the lower timeframes, we observe a corrective rise. At the moment, the pair is approaching the resistance of the weekly long-term trend (1.0915). Breakout, consolidation above, and reversal of the moving average can change the current balance of power in the lower timeframes. R3 (1.0953) can serve as an additional reference point in this direction within the day. For bears, the intraday reference points in the current situation are supports 1.0868 (central pivot point) and 1.0843 – 1.0813 – 1.0788 (classic pivot points).

***

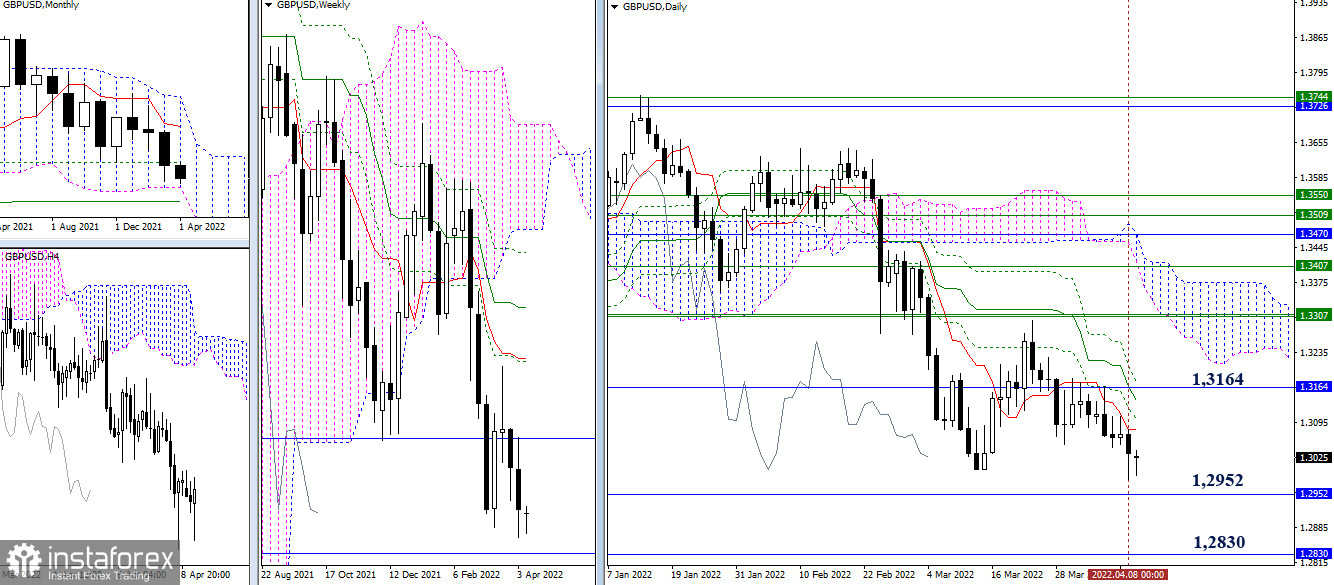

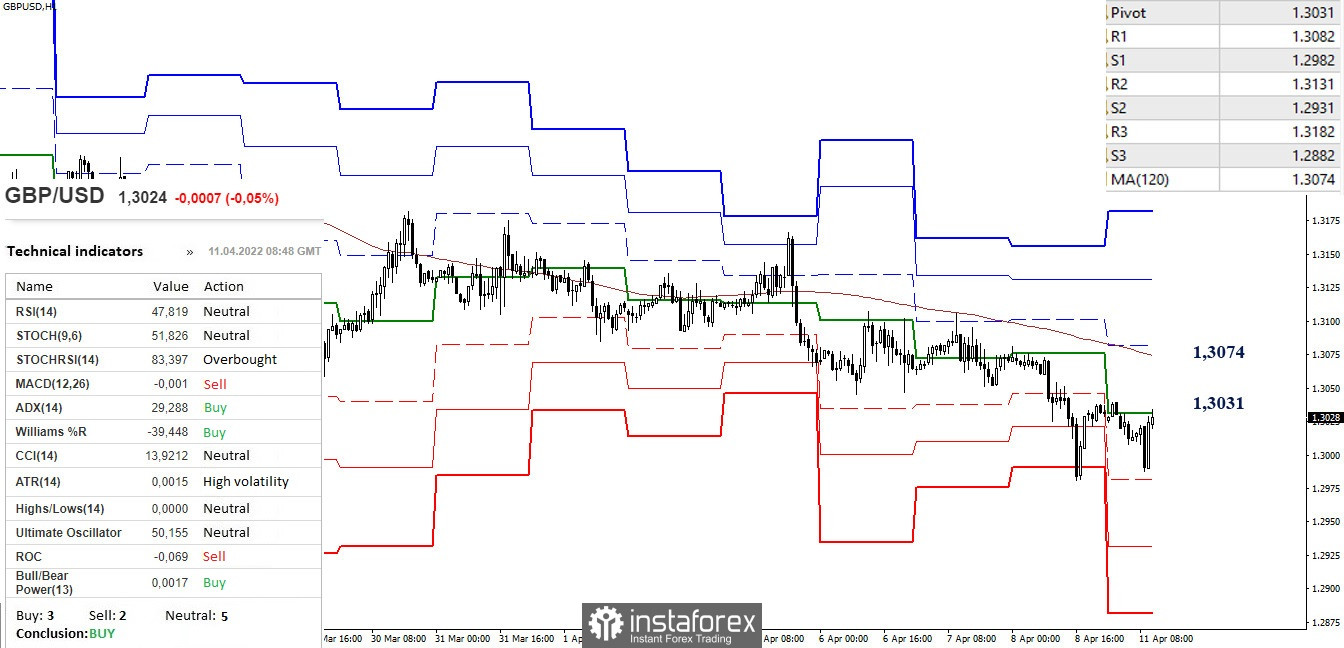

GBP/USD

The pound, unlike the euro, managed to update the March low (1.3000) at the end of last week. But there are two monthly supports in front of bears in this direction: 1.2952 (lower boundary of the cloud) and 1.2830 (medium-term trend). If the initiative switches to the side of the bulls, then the main attention will be focused on passing the resistance levels of the daily Ichimoku cloud (1.3081 – 1.3102 – 1.3140 – 1.3177), which has an increase from the monthly Fibo Kijun ( 1.3164).

The pair remains in the correction zone on the lower timeframes. The key resistance levels today are 1.3031 (central pivot point) and 1.3074 (long-term weekly trend). Consolidation above can change the current balance of power, and the next targets for bulls, in this case, will be 1.3082 – 1.3131 – 1.3182 (classic pivot points). If the bears manage to complete the correction and restore the downward trend, then the attention within the day will be directed to the support of the classic pivot points (1.2982 – 1.2931 – 1.2882).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)