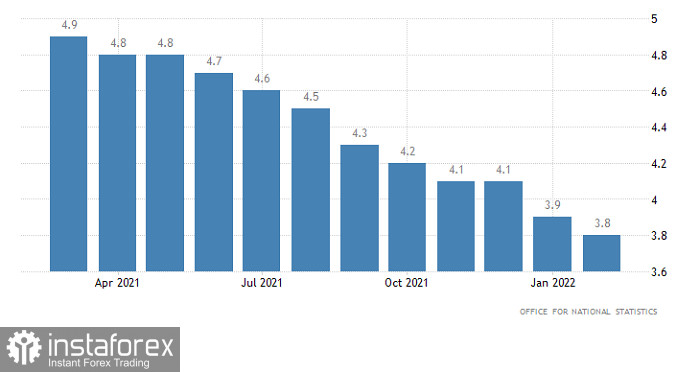

The unemployment rate in the UK fell to 3.8% from 3.9% as widely anticipated. These figures hardly surprised traders as it was the February report. Economists forecast an increase in unemployment only in March. To this end, the report does not reflect the real state of the labor market. However, the pound sterling managed to rise amid at least some positive data given the latest gloomy reports.

UK Unemployment Rate

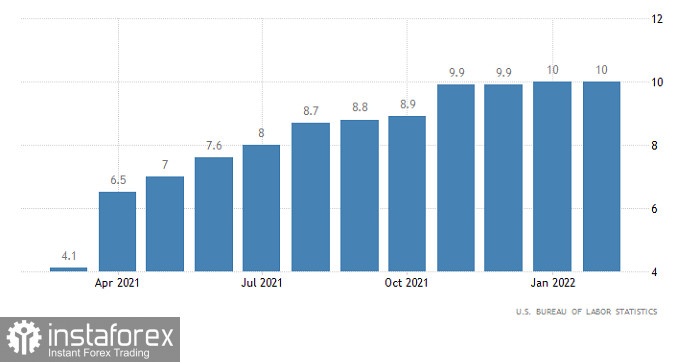

However, after the opening of the US session, the pound/dollar pair sharply changed its trajectory. The US finally released its CPI index. The report showed that consumer prices rose at a faster pace than expected. According to the most pessimistic forecasts, inflation was projected to accelerate to 8.4% from 7.9%. The main outlook suggested an increase to 8.3%. However, it turned out that inflation surged to 8.5%. There is no doubt that inflation is already hurting the economy. At the same time, it keeps growing. In general, the report was rather discouraging. Such grim data should have had a negative impact on the US currency. However, it drifted higher. Traders seem to recall that the Fed would raise the interest rate to the upper limit of the range. Therefore, at every second meeting of the Federal Open Market Committee, the rate will be increased not by 0.25% but by 0.50%. It means that the pace of monetary policy tightening will be higher than the Fed initially stated. Market participants should factor in more than one rate hike.

US CPI

Inflation is high not only in the US but also around the world. For instance, in the UK. consumer prices soared to 7.0% from 6.2%. The indicator coincided with the main forecast. However, unlike the Fed, the Bank of England is unwilling to raise the key rate. Of course, there is a chance that the BoE will hike the rate but a rather slim one. So, the pound sterling showed moderate growth. It looks more like a slight rebound after yesterday's decline.

UK inflation

The majority of analysts are betting on a further rise in US inflation. The Producer Price Index is also expected to jump to 11.0% from 10.0%. This is a leading indicator that gauges inflation. As a result, the US dollar is likely to approach new highs.

US Producer Price Index

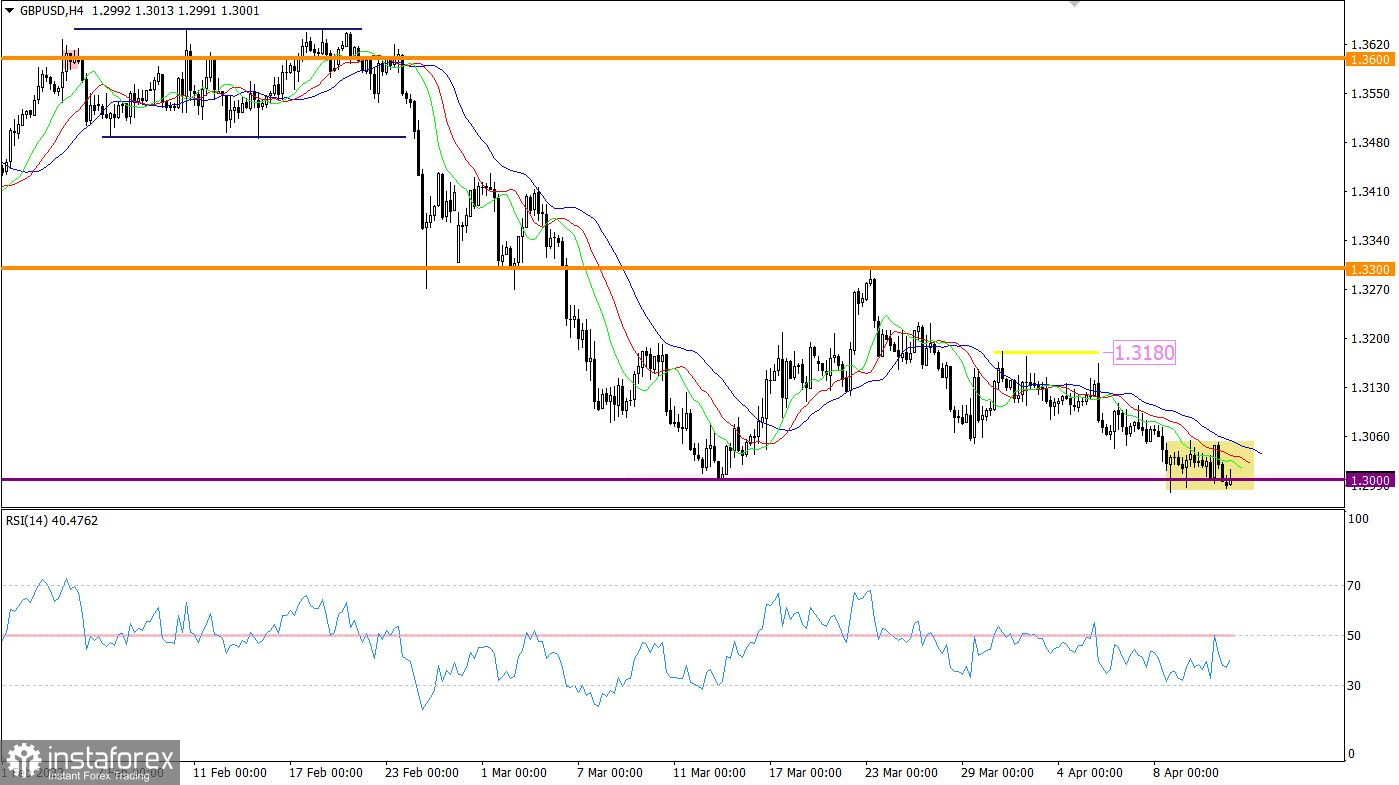

The GBP/USD pair has been hovering near the psychological level of 1.3000 for the third day in a row. The treading range is quite narrow, which indicates the accumulation of trading forces. It may signal the upcoming upward reversal.

The RSI indicator is moving below 30/50 on the 4H chart, indicating a strong bearish sentiment.

The Alligator H4 and D1 indicators show that the moving averages are pointed downwards, which confirms the sell signal on the British currency. The Alligator has a lot of intersections between the moving averages on the D1 chart. It once again confirms the accumulation of trading forces.

On the daily chart, the quotes may extend the medium-term downtrend.

Outlook

The pair is likely to break out of the flat near 1.3000 soon. There is a high chance that the pair may perform an upward reversal. The signal of prolongation of the downtrend will be confirmed only if the price drops below 1.2950 on the 4H chart. The pair is likely to gain momentum if the price rebounds from the support level of 1.3000. To do so, it needs to consolidate above 1.3055. If so, the pair may hit the 1.3105 level. After that, a downward reversal may occur.

The complex indicator analysis gives a mixed signal on the short-term and intraday charts due to the narrow range. Technical indicators show a sell signal in the medium term due to a downtrend.