Overview of yesterday's trading and tips on EUR/USD

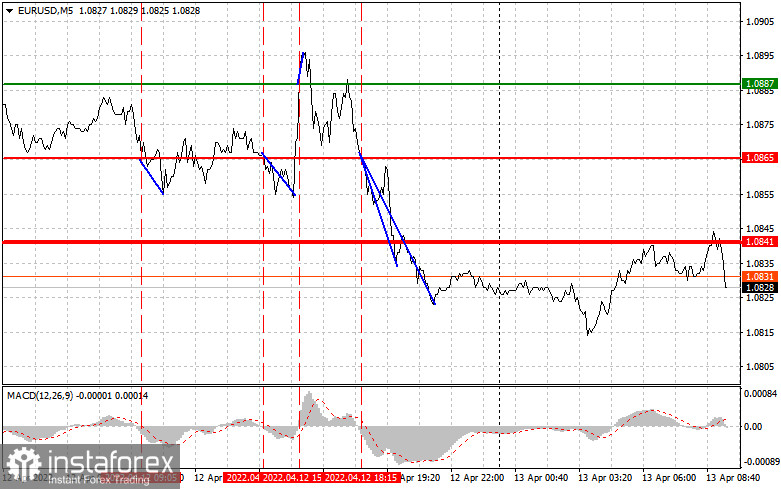

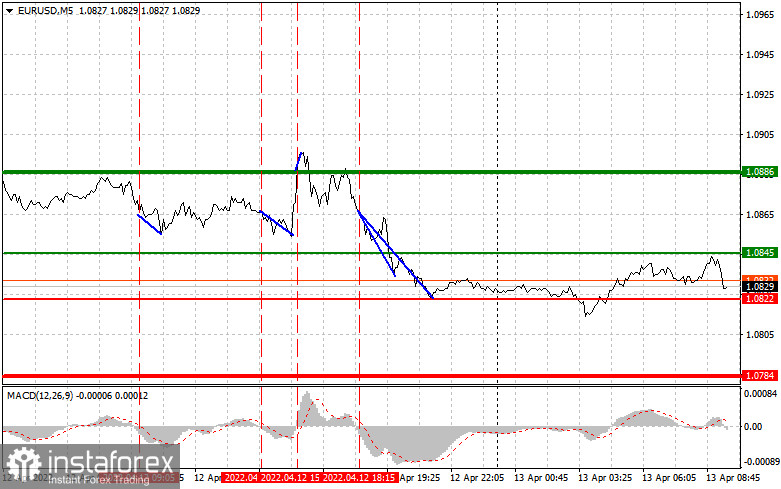

The level of 1.0865 was tested at the moment when MACD began its downward move from the zero level. This price move proved that the decision was right to sell EUR following the downtrend. Unfortunately, after the pair had declined 10 pips, the selling pressure ebbed away and the price did not make a deeper drop. Later on, the same scenario took place. Following a 10-pips drop, the sellers left the market that allowed EUR to gain ground after the US inflation data. The test of 1.0887 coincided with the moment when MACD began its upward move from the zero mark. It seemed the perfect scenario for buying EUR. Nevertheless, long positions opened at that time brought losses. In the middle of the American session, I recognized a good signal to sell EUR after the third test of 1.0865. As a result, EUR/USD fell more than 40 pips. This move enabled traders to make up for the morning decline and earn something.

As for the economic calendar, German CPI as well as ZEW business sentiment index for Germany and the Eurozone did not spring any surprise though the actual ZEW readings turned out to be better than expected. In the US, the Labor Department reported that the CPI jumped to 8.5% on year in March following a 7.9% increase in February. Consumer inflation rose 1.2% from a month ago. Remarks from Fed's Vice Chair Lael Brainard reinforced the US dollar in the second half of the day. The economic calendar reminds us about Italy's industrial production data and Spain's CPI that are on tap during the European trading hours. The reports will hardly influence market sentiment. For this reason, I expect EUR/USD to remain under pressure. So, I would recommend trading plan No 1 to sell the pair.

In the second half of the day, the US will report on its factory inflation, including both PPI and core PPI. Upbeat data will cement the US dollar's strength and hopes for aggressive monetary tightening by the Federal Reserve.

Buy signal

Scenario 1. Today we can buy EUR if the price reaches 1.0845 plotted by the green line on the chart. The upward target is seen at 1.0886. 1.0886 is the level to exit the market and sell EUR, bearing in mind a 20-25 pips downward move from the entry point. However, there are catalysts for strong EUR's growth today. At the same time, soaring inflation in the US confirms the hawkish Fed's rhetoric on monetary policy. Important! Before buying EUR/USD, make sure the MACD indicator is above the zero mark, beginning its growth from it.

Scenario 2. We could buy EUR today on condition the price reaches 1.0822, but the MACD indicator should be in the oversold zone. This would limit the bearish move and reverse the trajectory upwards. The price might rise to 1.0845 and 1.0886.

Sell signal

Scenario 1. We could sell EUR after the price reaches 1.0822 plotted by the red line on the chart. The downward target is defined at 1.0784 where I recommend leaving the market. Hence, we could buy EUR during the opposite move, bearing in mind a 20-25 pips move in the opposite direction. EUR is set to trade under selling pressure because geopolitical tensions drag down risky assets. There are no fundamentals for buying EUR. Indeed, rampant inflation in the EU will lead to recession sooner or later. Important! Before selling, make sure that the MACD indicator is below the zero mark, beginning its decline from that.

Scenario 2. Besides, we could sell EUR on condition the price climbs to 1.0845, but the MACD indicator should be in the overbought zone that will put a lid on the upward move and reverse the trajectory downwards. The currency pair is likely to decline to 1.0822 and 1.0784.

Description of the chart:

What's on the chart:

The thin green line shows the entry point where you can buy a trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikely to rise above this level.

The thin red line is the entry point where you can sell the instrument.

The thick red line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important! Novice traders need to make very careful decisions when entering the market. It is best to stay out of the market before the release of important fundamental reports. It will help avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that to earn successfully, beginners should have a clear trading plan like the one I presented above. Spontaneous trading decisions based on the current market situation are a losing strategy of an intraday trader.