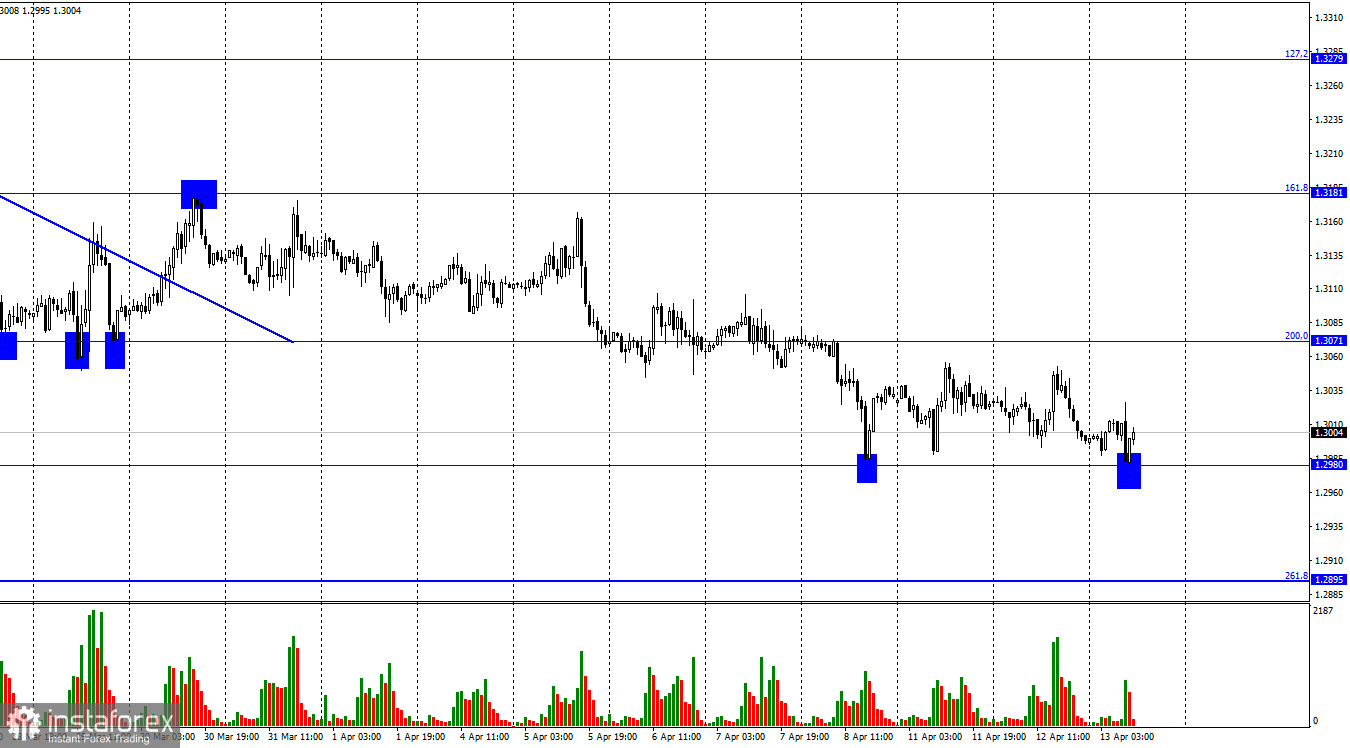

According to the hourly chart, the GBP/USD pair performed a new fall to the corrective level of 1.2980 on Wednesday. Another rebound from it allows us to count on a new reversal in favor of the British and some growth in the direction of the Fibo level of 200.0% (1.3071). Fixing the pair's rate below the level of 1.2980 will increase the chances of a further fall of the British dollar towards the next corrective level of 261.8% (1.2895). Yesterday, immediately after the release of the US inflation report, the US dollar fell, and an hour later it began to grow. Today, after the release of British inflation, the pound fell, but an hour later it began to grow. In both cases, inflation exceeded traders' expectations. In both cases, it is already completely cosmic values, very high for the "Western world". However, neither the first nor the second reports were able to dramatically affect the mood of traders. For the last four days, the pound/dollar pair has been between the levels of 1.2980 and 1.3071, that is, in a rather narrow side corridor.

Thus, bear traders still hold the Briton and his fate in their hands, and bull traders still have nothing to oppose them. If the bears attacked every day, then the Briton would already be getting close to the level of 1.2000. Instead, we see a gradual sell-off of the pound sterling, which leads to a rather slow decline. Now, as in the case of the Fed, we should expect new comments from members of the monetary committee of the Bank of England. Although the British regulator has already raised the interest rate three times, inflation continues to rise. Thus, the Bank of England should continue to raise the rate, but is it ready to do so, and is the economy ready to face a slowdown, because the tightening of the PEPP inevitably leads to a slowdown in the economy? The latest UK GDP report showed a one percent increase in the fourth quarter. It's not much. A further increase in the rate may lead to a drop in economic growth. The absence of an increase leads to an even greater increase in inflation.

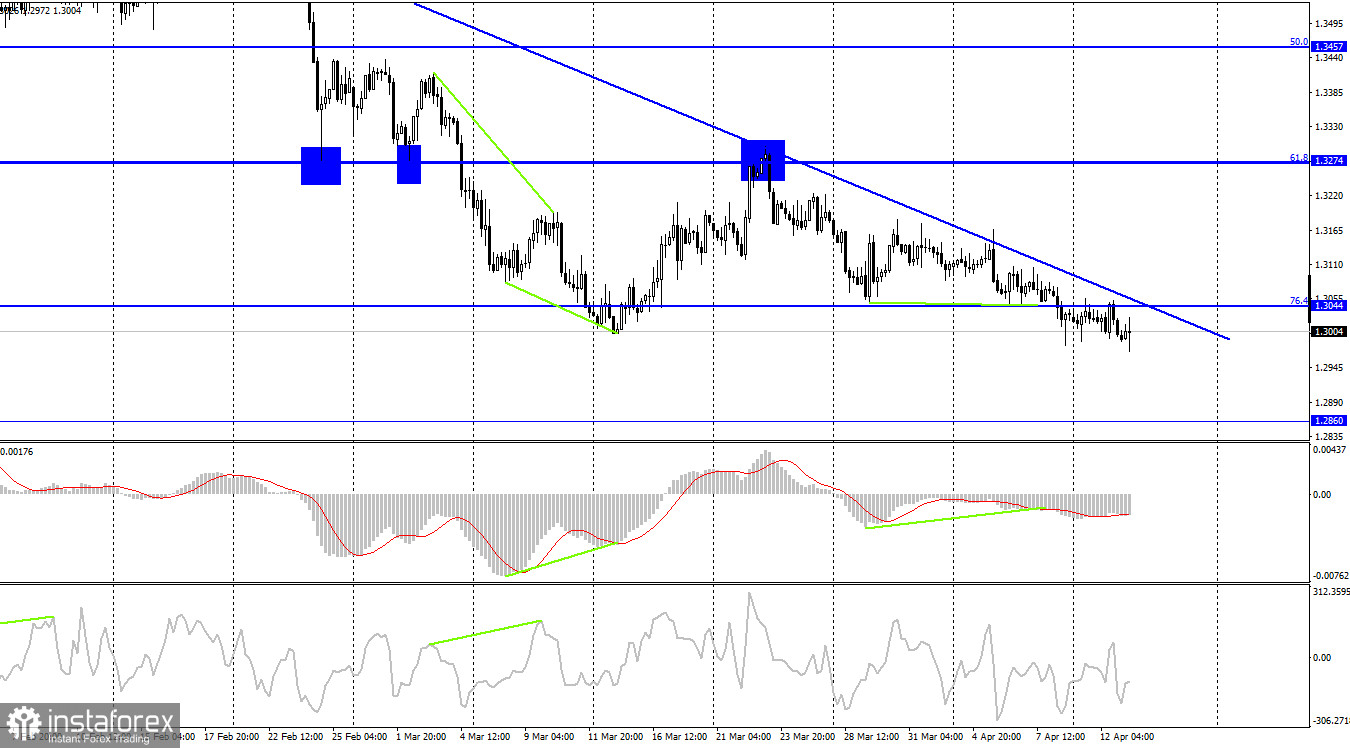

On the 4-hour chart, the pair secured under the corrective level of 76.4% (1.3044). Thus, the process of falling quotations can be continued in the direction of the next level of 1.2860. The downward trend line characterizes the mood of traders as "bearish". Closing the pair's rate above the trend line will change it to "bullish" for a while, and the British dollar may rise to the Fibo level of 61.8% (1.3274). There are no brewing divergences today.

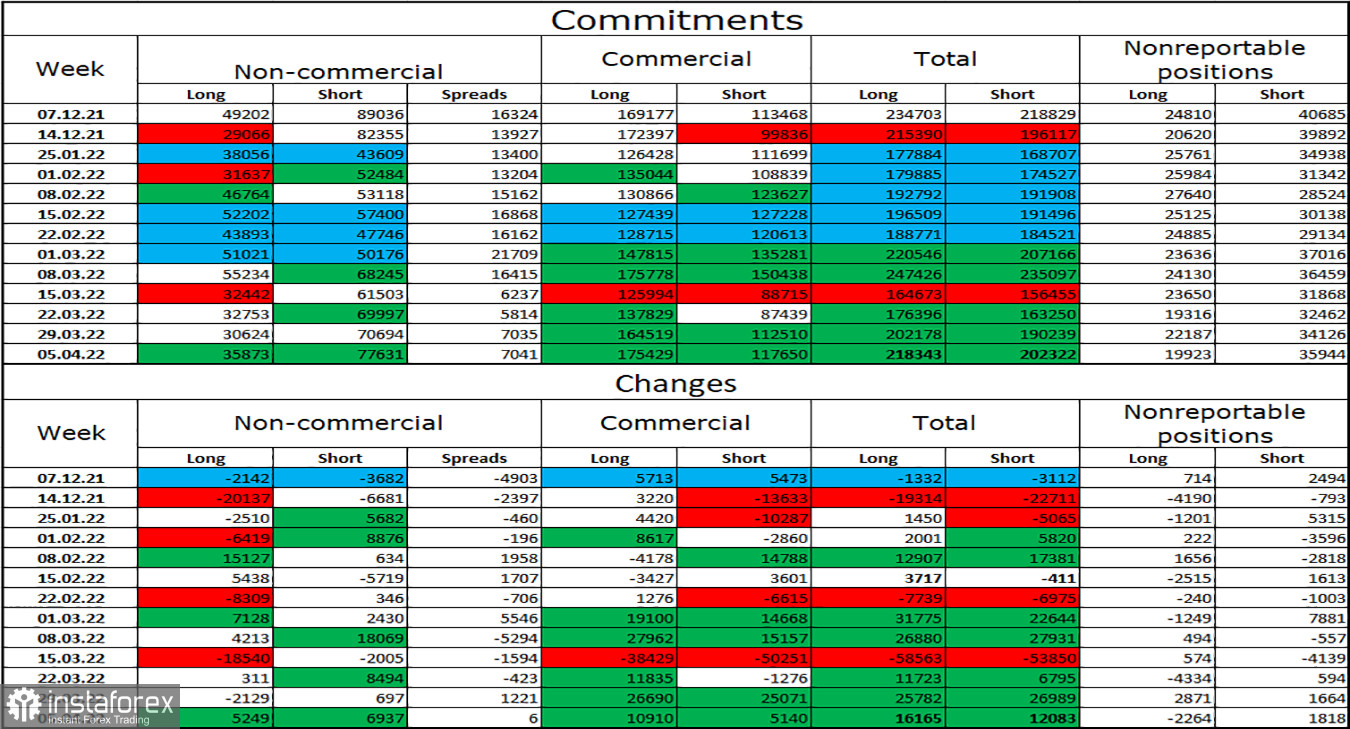

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has not changed much over the last reporting week. The number of long contracts in the hands of speculators increased by 5,249, and the number of shorts - by 6,937. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators corresponds to the real state of things on the market - longs are 2 times more than shorts. The British dollar is falling, and major players are more likely to sell the pound than buy it. Thus, I expect the pound to continue its decline. This forecast is based on geopolitics, based on COT reports, and based on graphical analysis.

News calendar for the USA and the UK:

UK - consumer price index (06:00 UTC).

On Wednesday in the UK, all the reports of the day have already been released. The inflation report turned out to be important, but the reaction of traders was not too strong. The second half of the important entries in the calendars of events of the USA and Great Britain do not appear. Thus, the influence of the information background will be absent today.

GBP/USD forecast and recommendations to traders:

I now recommend selling the British dollar with a target of 1.2895, if consolidation is made under the level of 1.2980 on the hourly chart. I recommend buying the British when closing above the trend line on a 4-hour chart with targets of 1.3181 and 1.3274.