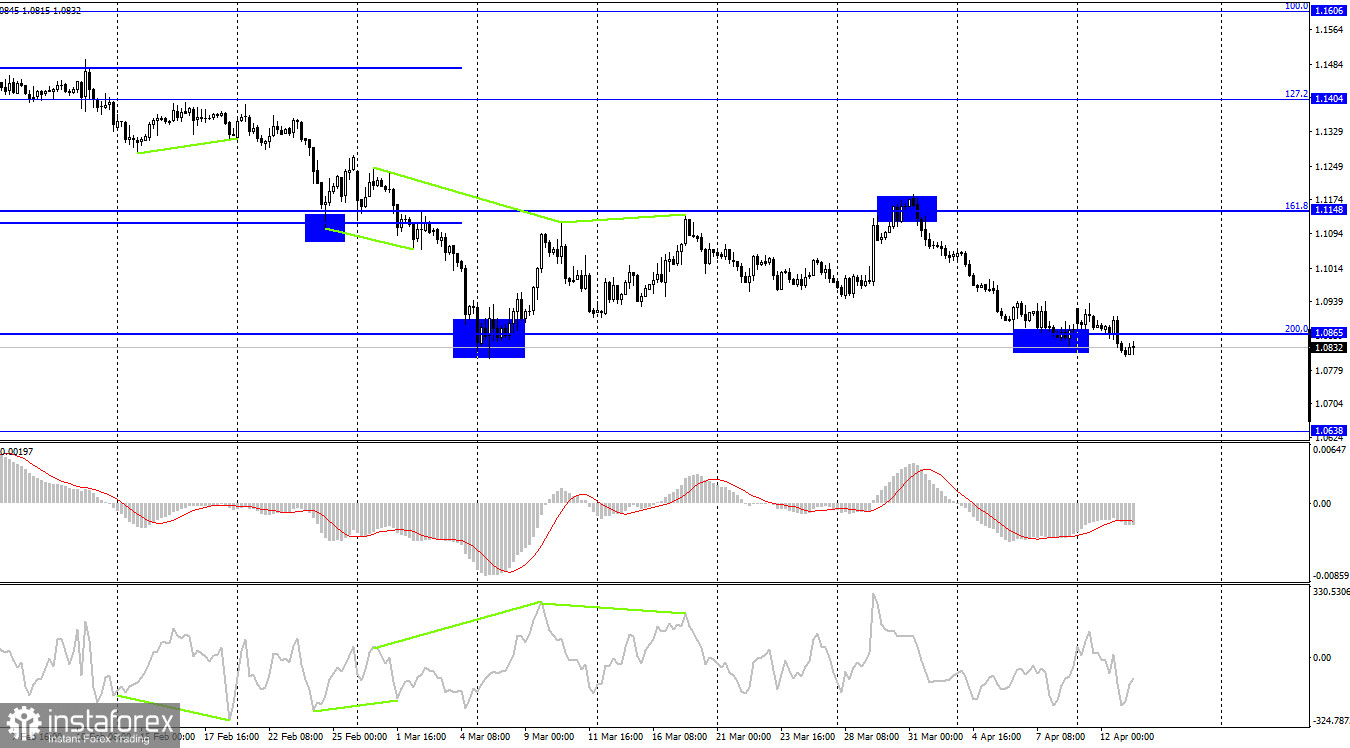

The EUR/USD pair on Tuesday and Wednesday continued a not too strong process of falling in the direction of the corrective level of 0.0% (1.0808), which at the moment is almost worked out. The rebound of quotes from this level will allow the European currency to pause for a while, but it seems that nothing will save it from further decline. Fixing the pair's rate below the level of 1.0808 will lead to a change in the grid of Fibo levels, and the fall will continue in the direction of the next corrective level. I believe that the option with a further fall is now the most likely. Another inflation report was released in the US yesterday. It showed that prices in the US continue to rise, despite some actions on the part of the Fed, statements from FOMC members. By the end of March, prices increased by 8.5% y/y. Now it doesn't even make sense to say that such high inflation has not been seen in America for more than 40 years, since starting with 7% inflation, the same can be said in each subsequent report.

Nevertheless, it should be noted that the US dollar, albeit with some delay, rose on the inflation report, which, from my point of view, is quite logical. Now it remains to wait for the next Fed meeting, which will take place only in early May. The rate will be raised almost one hundred percent on it, and immediately by 0.5%, and FOMC member Lael Brainard said yesterday that the Fed's balance sheet may begin to decrease as early as June. In the last FOMC protocol, it was said that the monthly reduction in the balance sheet would be $ 95 billion. In the meantime, traders are waiting for the next meeting, it remains only to observe the new and new growth of the US dollar. At the moment, this growth is based only on economic factors. But at any moment, geopolitical factors can also join them. There are more and more reports that Russia is pulling troops to the East of Ukraine, and Kyiv is actively evacuating the population of the Donetsk and Luhansk regions, expecting a new attack. Negotiations continue without much hope of reaching a peace agreement.

On the 4-hour chart, the pair secured under the corrective level of 200.0% (1.0865). As a result, the process of falling quotes can now be continued in the direction of the next level of 1.0638. Maturing divergences are not observed in any indicator today. Consolidation above the level of 1.0865 will work in favor of the EU currency and some growth of the pair, which is unlikely to be strong.

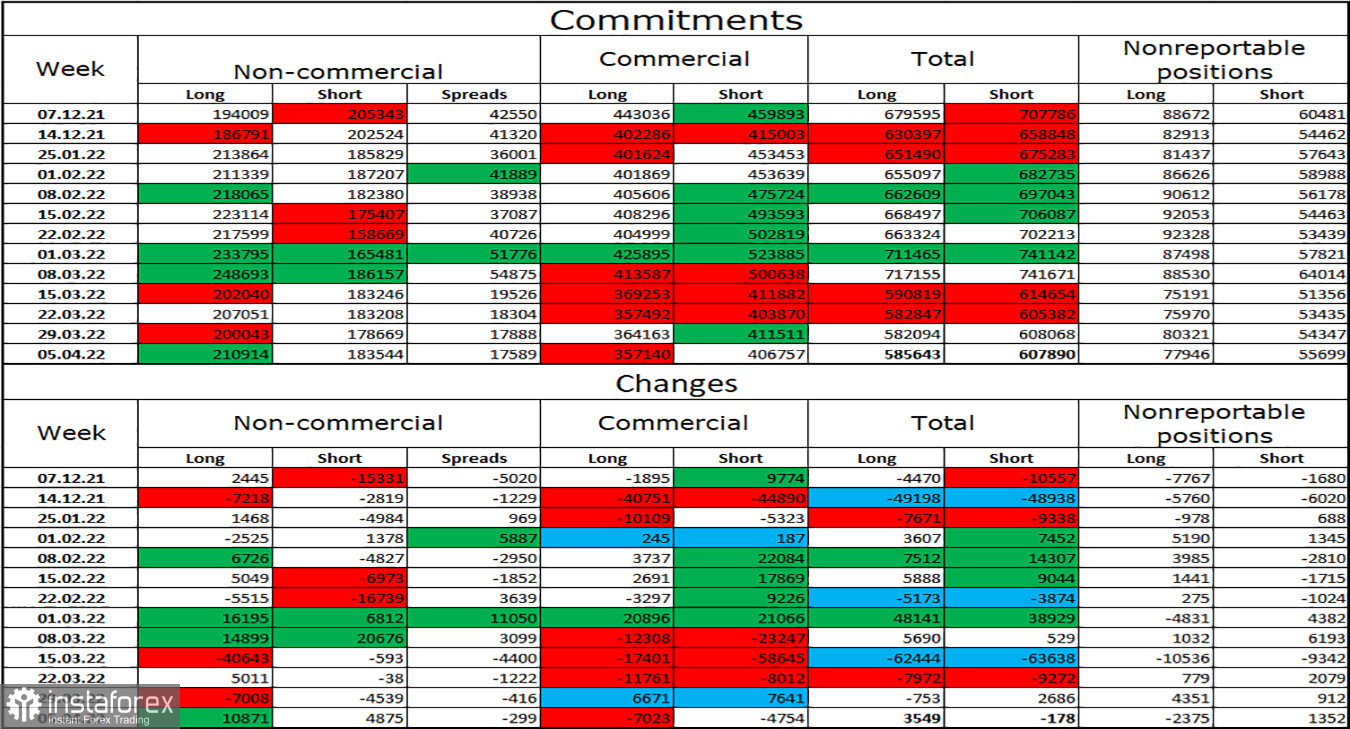

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 10,871 long contracts and 4,875 short contracts. This means that the bullish mood of the major players has intensified. The total number of long contracts concentrated on their hands now amounts to 211 thousand, and short contracts - 183 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is characterized as "bullish". In this scenario, the European currency should show growth. But it should have been showing it for several weeks, and instead, it continues to either fall or is just very low. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders from geopolitics and the status of the dollar as the "world reserve currency".

News calendar for the USA and the European Union:

On April 13, the calendars of economic events in the United States and the European Union do not contain a single interesting entry. Thus, today the information background will not have any effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair if a close is made under the level of 1.0865 on the 4-hour chart with a target of 1.0638. New sales - when closing at 1.0808 on the hourly chart with the same goal. I recommend buying a pair if there is a rebound from the 1.0808 level on the hourly chart with a target of 1.0970.