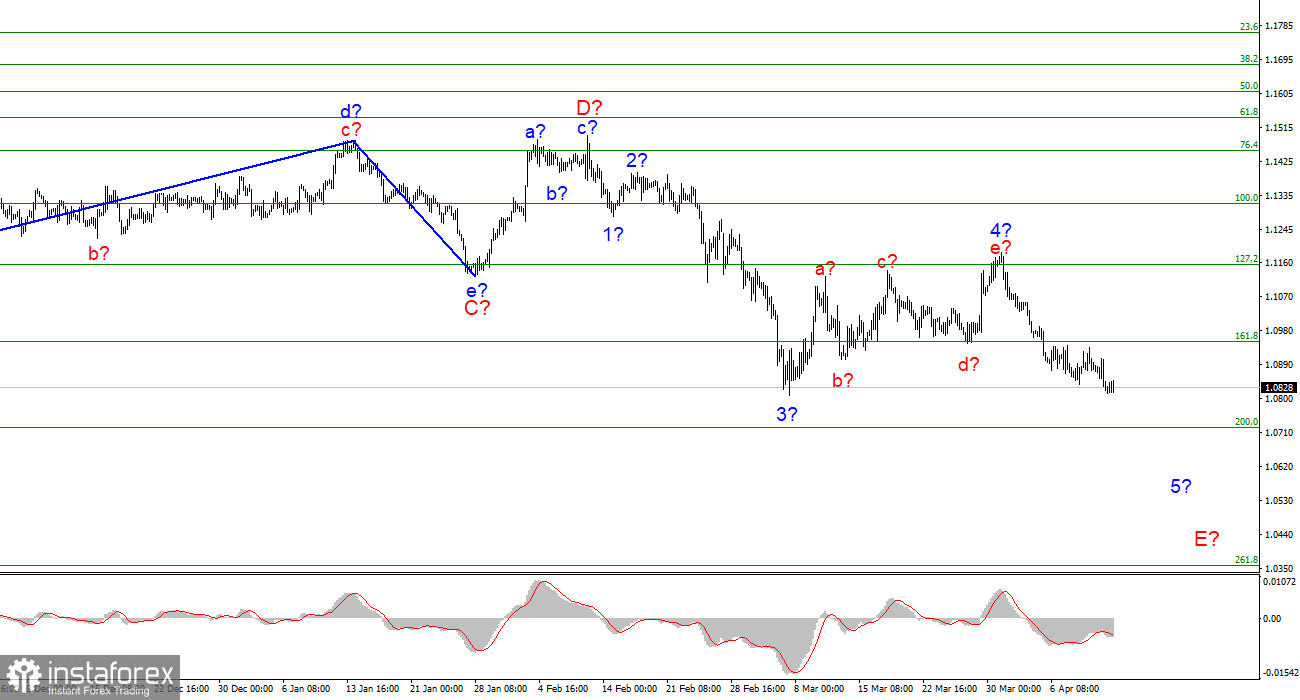

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The proposed wave 4 took a five-wave form and turned out to be completely different from wave 2. Nevertheless, now this wave is recognized as complete, and the wave pattern does not require any changes. Accordingly, the instrument has started and continues to build the expected wave 5-E. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks. At the moment, the entire wave structure of the descending trend section looks almost fully equipped, but wave 5-E is likely to also take a five-wave form. If this is the case, then at the moment, the construction of only the first wave consisting of 5-E has been completed. If this does not happen, then the quotes have not yet fallen under the low of wave 3-E, that is, wave E cannot yet be considered completed in absolutely any case. Thus, the instrument still has a fairly strong potential for decline. The first target is around 1.0721, which equates to 200.0% Fibonacci. At the same time, much of the instrument in the coming months will depend not only on the economy, but also on geopolitics, gas and oil prices, and the expansion of the zone of military conflict on the territory of other countries.

The markets are already getting rid of the euro by inertia

The euro/dollar instrument did not lose or gain a single base point on Wednesday. Thus, the verb "slide" is best suited to the movement of the instrument now. At the current time, the euro quotes are near the low of wave 3, and so far there are no good reasons to expect the completion of the construction of the entire downward section of the trend. Let me remind you that almost every day the market receives news and data that indicate a weak state of the European economy and a much stronger state of the American economy. Every day there is news that indicates the Fed's readiness to raise the interest rate to 2.5-3.5% in the next year or two. In addition, a quantitative tightening program will begin in May or June - the reverse of the QE (quantitative easing) program. This means that the Fed will attack inflation on two flanks at once.

The European Union and the ECB don't even think about anything like that. The current state of the European economy is such that any rate hike will lead to a recession. And the rate now, who does not remember, is negative. However, many foreign analysts believe that the European economy is already on the verge of recession and stagflation. Inflation in the European Union is at the level of Britain or the United States, but the pace of economic growth is much more modest. In addition, I remind you that it is the European Union that most of the above-mentioned "trinity" depends on Ukraine and the Russian Federation. Food is imported from Ukraine, energy is imported from Russia. Sanctions, war, changes in market conditions - all this will affect consumers from Europe, inflation, markets, prices for goods and services. Thus, the European Union now has nothing to fight inflation, which means that the demand for the euro currency may continue to decline. If wave 5-E turns out to be a five-wave, then everything will turn out very nicely from a wave point of view.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". In the next few days, a correction wave of 5-E may begin to be built, after which I expect a new decline in the instrument.

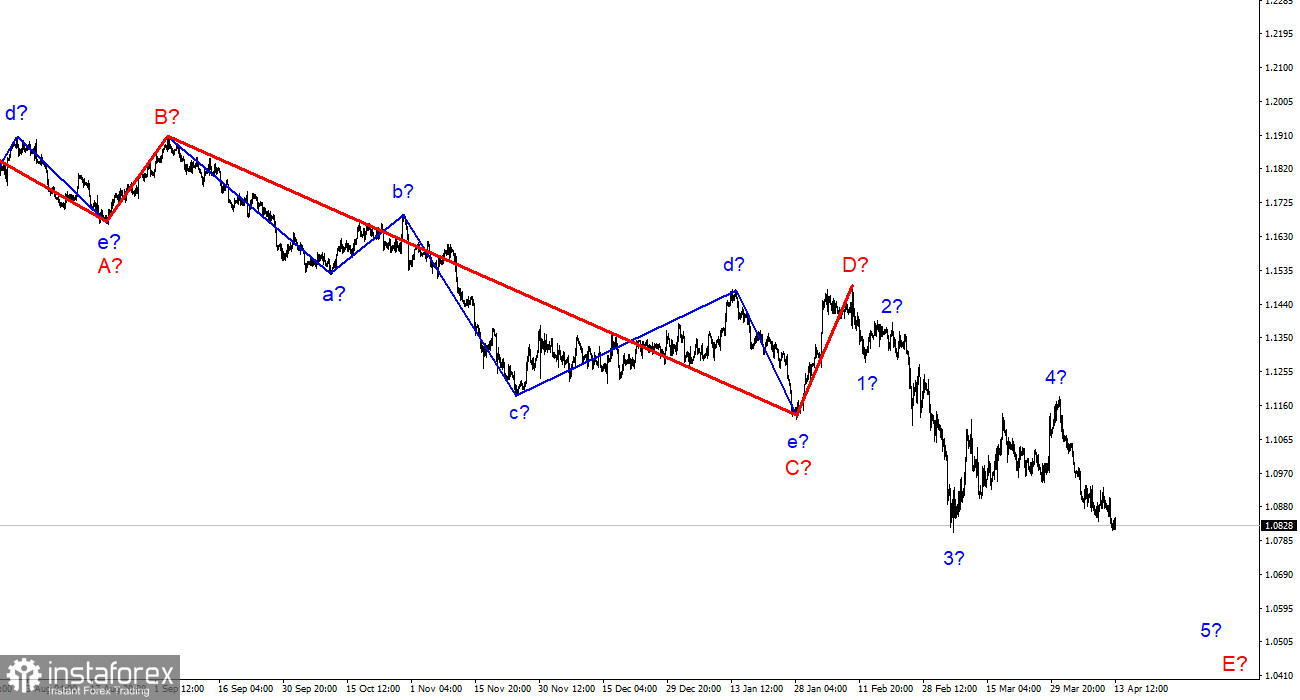

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.