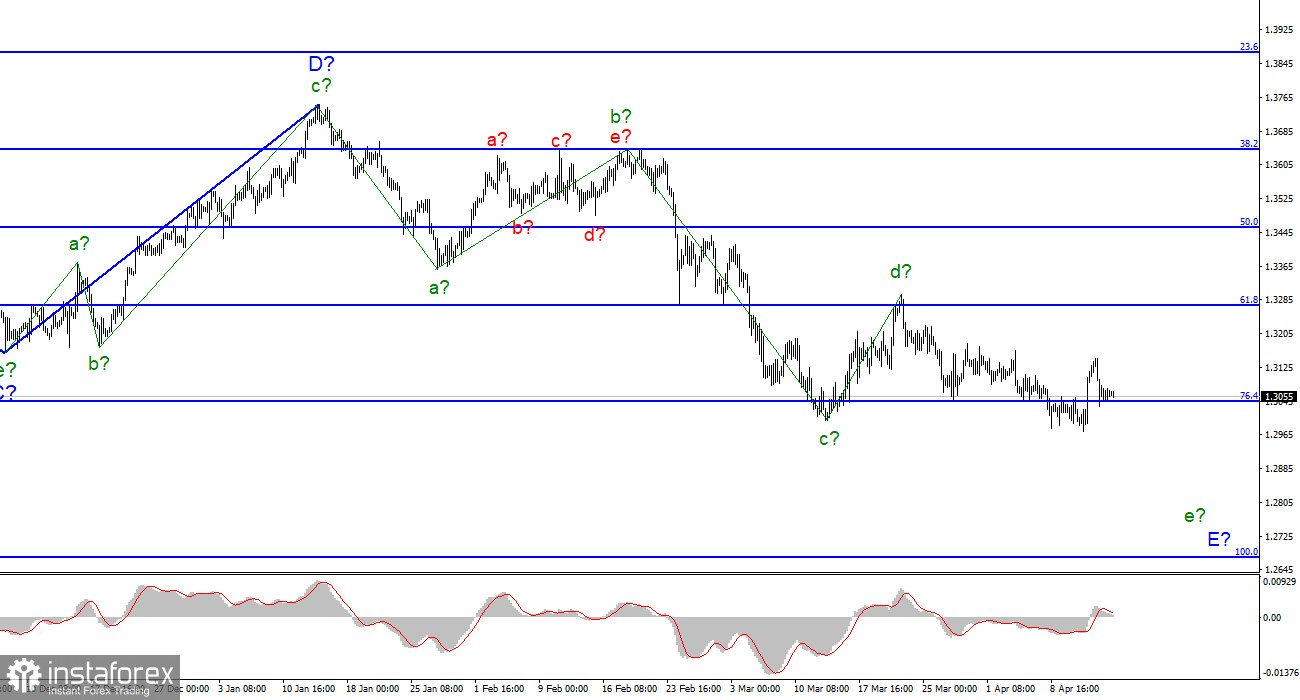

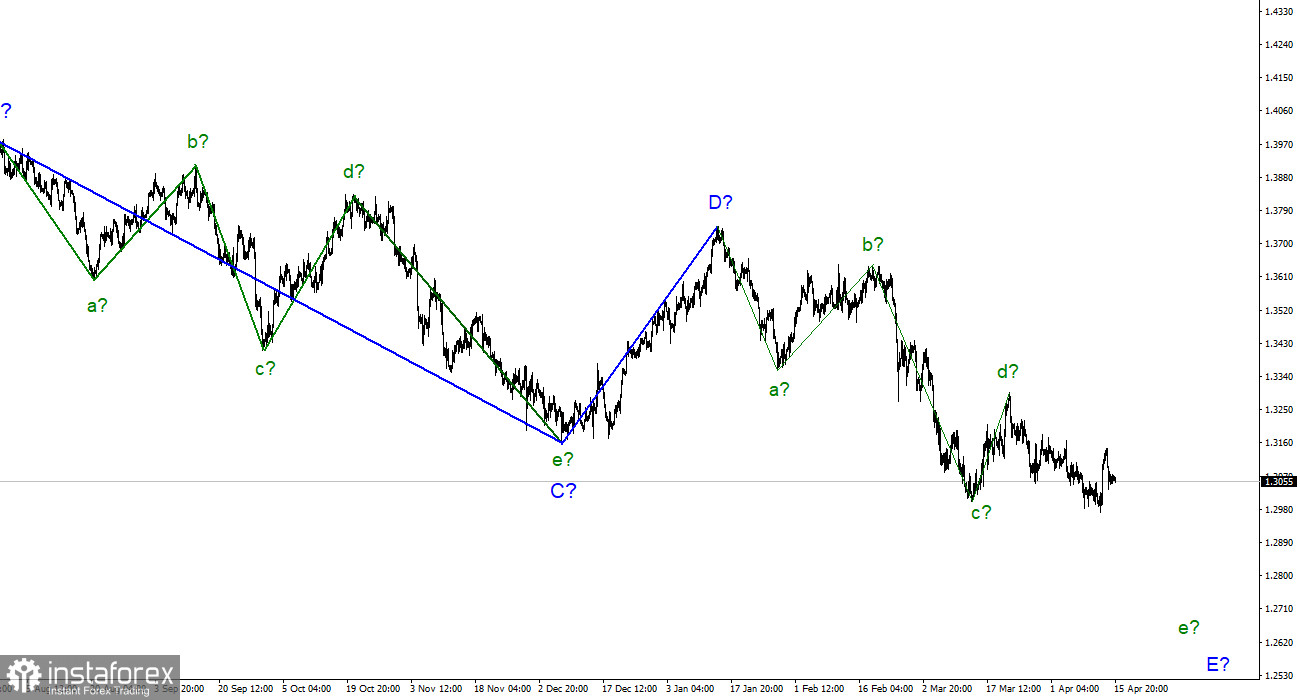

For the pound/dollar instrument, the wave markup continues to look very convincing, even taking into account the growth on Wednesday. The expected wave d-E is completed, and there should be five waves in total inside wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time within the framework of wave e-E. An unsuccessful attempt to break through the low wave c-E did not allow the market to continue selling the instrument. Near this mark, the instrument turned sharply upwards and began a powerful increase. Thus, the wave e-E may be extended, or it may be shortened. Since the low of the supposed wave c-E is still broken, the wave e-E can end at any moment. However, I still expect that the decline in the British dollar within this wave will be much stronger, given the current situation in Ukraine and the economic background in the UK, USA, and Europe. In general, the wave pattern still looks very organic. I am not considering alternative options yet.

Britain will increase gas supplies to the European Union.

The exchange rate of the pound/dollar instrument on April 15 decreased by literally 20 basis points, a more powerful decline was observed a day earlier. At the time of writing, the pound is still not far from the low of the wave C-E, so I think that the demand for the pound will continue to decline. Consequently, the construction of the wave e-E will also be continued. On Friday, there was no news in the UK, and a report on industrial production was released in the US, which increased by almost 1% month-on-month in March. The markets did not respond to this report with new purchases of the US currency and retreated more from the movements on Wednesday and Thursday.

At the same time, it became known that in the coming months, the UK will begin to turn into a gas hub for the European Union. Let me remind you that Europe has not officially imposed an embargo on Russian gas yet, but has promised to reduce dependence on it by 2/3 only during 2022. The shortage of gas will be filled by the UK, as well as other countries that export LNG, in particular, the United States. Part of the gas will come from Britain, which produces it in the North Sea, part of the gas will flow to Europe in transit through Britain from Norway. And part of it will come from merchant ships in the form of liquefied natural gas, which will be converted back into gaseous form at special terminals in Wales and Kent and sent via gas pipelines to EU countries. It is also reported that the US is ready to compensate for most of the gas losses of the European Union and the UK. Thus, this is a real solution to the gas problem for the European Union, which loosens its hands a little. Before the start of the next heating season, the European Union will pump maximum volumes of gas into its underground storage facilities. If this plan is implemented, the gas embargo may be imposed against the Russian Federation by the end of this year. Things are more complicated with oil. America, the European Union, Venezuela, Saudi Arabia, and Iran continue to negotiate on the replacement of Russian oil on the market. But there are no results yet.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located near the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave e-E does not look complete yet. Maybe this wave will not be so long, but it does not look complete now.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.