During the current week, bitcoin has fallen by $ 3,000. From our point of view, there is absolutely nothing surprising in this, because we continue to support the corrective scenario of the development of events. We expect that the "bitcoin" will be able to gain a foothold below the ascending channel, and also fall in the near future to its local minimum near the level of $ 34,267. Next, we expect a fall to the minimum of last year around $ 31,100. We still don't see any reasons why bitcoin can show serious growth this year. Let's carefully analyze the last month and a half, during which another significant factor was added to the cryptocurrency market, which could not be ignored by its participants.

Of course, we are talking about the military conflict between Ukraine and Russia, which began on February 24. We look at the chart and see that on February 24, bitcoin opened at $ 37,500, showed a strong drop during the day, but closed it anyway in the black. At the moment, the quotes of the "bitcoin" are trading at $ 40,000, and the maximum they went above the current mark is $ 8,000, which is not so much for the first cryptocurrency. Thus, the main conclusion is that bitcoin was adjusted before the start of the military conflict, it was also adjusted in the first month and a half of the "special operation". It is impossible to say that the conflict somehow affected the movement of bitcoin. Many experts and investors have noted that the geopolitical conflict may even increase the demand for cryptocurrencies, but we believe that this is another attempt by bitcoin owners to artificially increase demand to make bitcoin and its "brothers" grow. As we can see, nothing worked out for them.

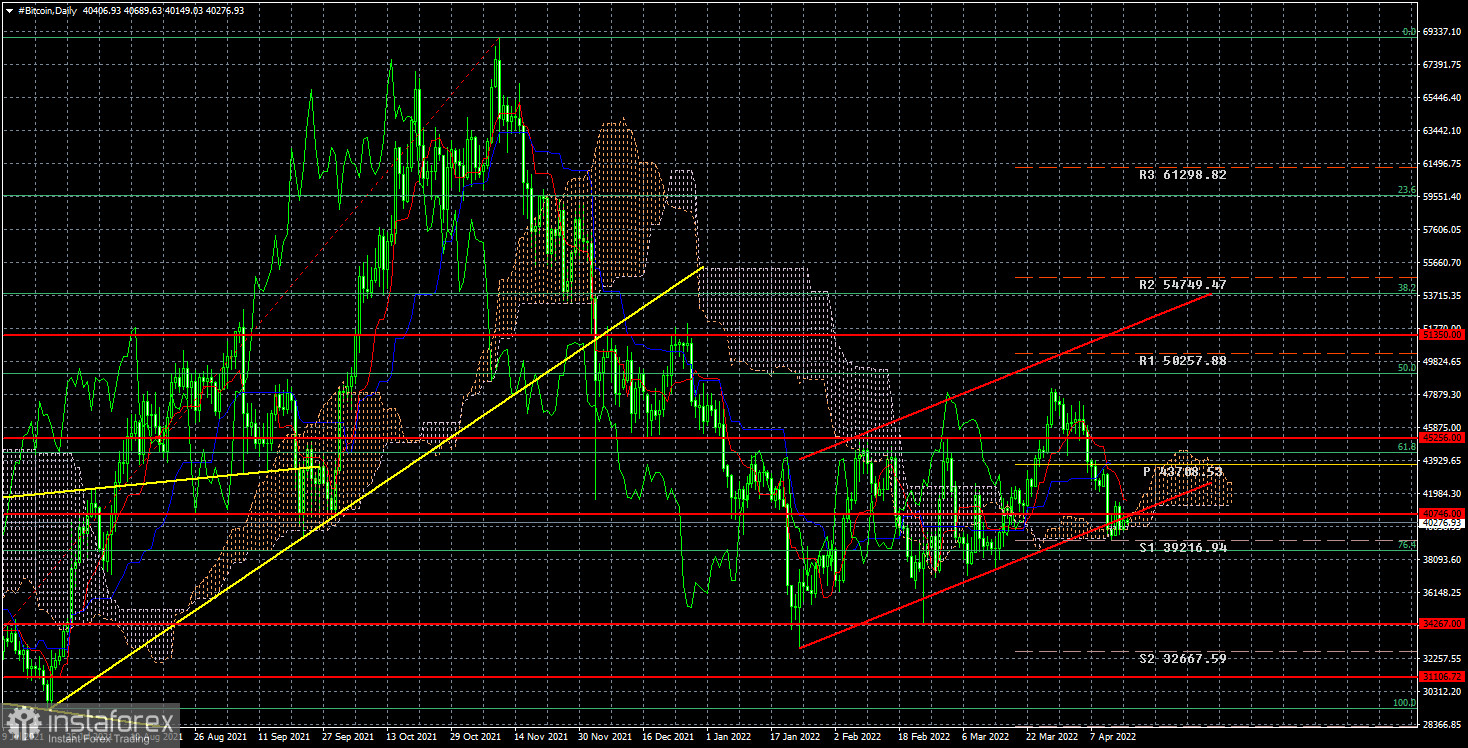

At the moment, the cryptocurrency has fallen to the lower boundary of the Ichimoku cloud, as well as to the lower boundary of the ascending channel. If it fails to overcome these two lines, then we can witness a new round of upward movement with a goal of about $ 50,000 per coin. But all these are "technical" movements that are not based on a fundamental background. The fundamental background is now quite simple and is "long-playing": the geopolitical situation in Europe, the consequences of the conflict between Ukraine and the Russian Federation, and the Fed's plans to tighten monetary policy in 2022 are all negative factors for bitcoin. They just can't act continuously. If the Fed raises the rate for another year or a year and a half, it does not mean that bitcoin will only fall all this time. Therefore, we believe that BTC is being adjusted now, but under the pressure of the fundamental background, it will resume falling. This can happen even tomorrow if the price is fixed below the Ichimoku cloud. Or maybe in a few weeks. The point is that there are no global reasons for the powerful growth of "digital gold" now. Those investors from Ukraine and Russia who sought to save their capitals and bring them abroad through cryptocurrencies have long done so. They no longer have an impact on demand.

In the 24-hour timeframe, the quotes of the "bitcoin" dropped to the lower limits of the Ichimoku cloud and the ascending channel. A rebound with an upward reversal may occur from these lines, after which the cryptocurrency may begin another round of growth. If this signal is generated, it can be used for purchases with goals of $ 45,256 and $ 49,066. Sales should be considered when anchoring below the ascending channel with targets of $ 34,267 and $ 31,100.