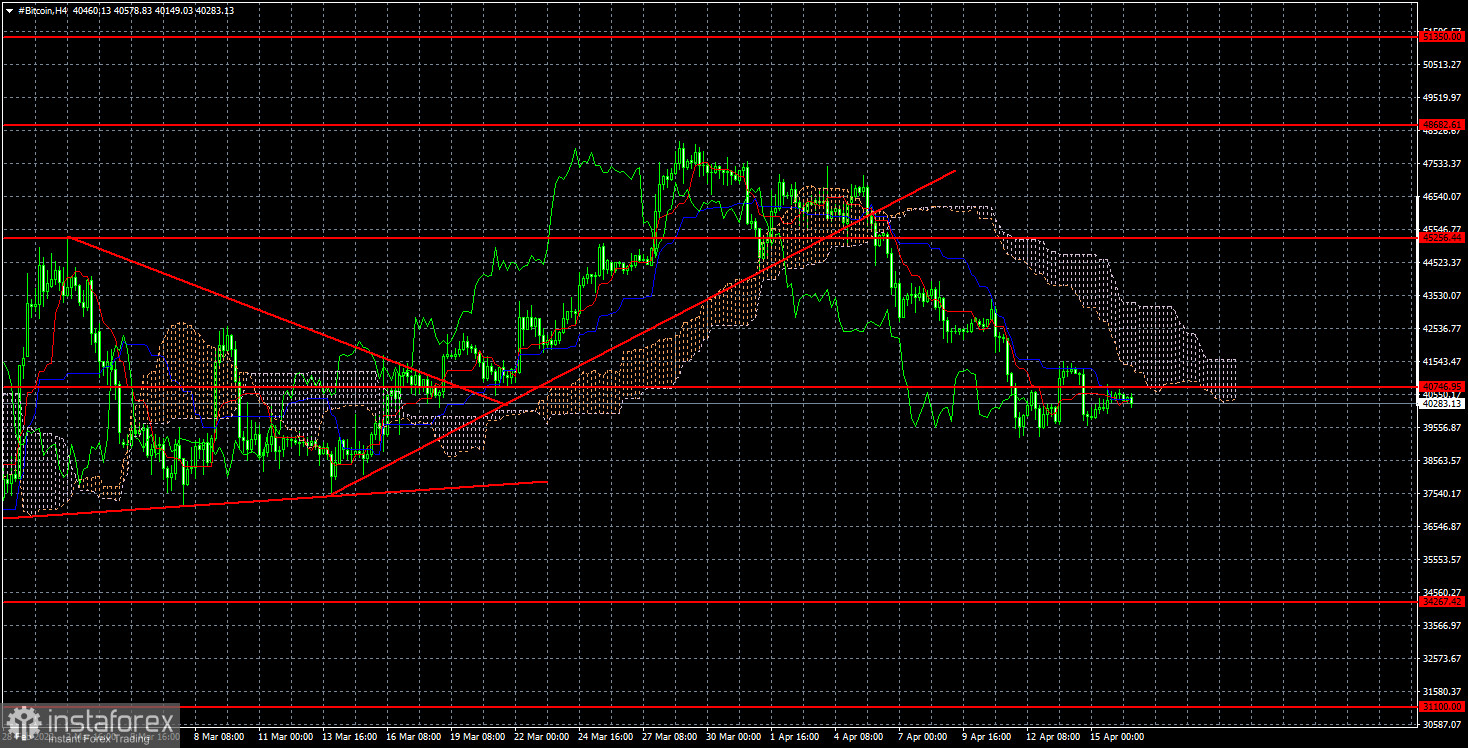

At the 4-hour TF, bitcoin gained a foothold below the ascending trend line, but it was already a relatively long time ago. Since then, the decline has continued and at the moment the Ichimoku indicator indicates a downward trend without any questions. Cryptocurrency quotes are located below all the indicator lines, as well as below the level of $ 40,746. However, we remind you that on the 24-hour TF, the price rested on two important lines that can become an obstacle to further decline. Thus, in the next few days, it is necessary to pay more attention to the daily TF.

Bitcoin: slowly, but surely, down.

Let's briefly recall what has been happening in the markets in the last month or two. The yield of American treasuries has grown to 2.6% (10-year), oil has risen in price to $ 106 per barrel, gas is breaking cost records almost every day and now costs an average of $ 1,500 per 1,000 cubic meters, the US stock market (shares of major companies and indices) are falling. Thus, if we take into account the movements of the last few months, it becomes clear that serious changes are taking place in the markets. For example, the riskiest assets are adjusted, and the safest ones are growing in profitability. We have not yet mentioned deposits, the profitability of which will grow as the Fed increases its key rate. And this is the first key moment for all markets. The Fed rate will rise in 2022 and it is already almost 100% clear that by the end of the year it will be 2.5%, which is a neutral value (at which the economy is not threatened by the recession). Inflation will begin to slow down, but the Fed is already envisaging a general rate hike to 3.5%. Monetary policy tightening will continue until inflation falls to the target level of 2%. Beyond that (the second key point), the Fed will unload its balance sheet by $ 100 billion every month (the "anti-QE" program). These two points will increase the profitability of safe assets and the demand for them. Risky ones will lose investments. And it is very difficult to find a riskier asset than bitcoin.

The most important thing to understand here is that the Fed has not even begun to tighten monetary policy. The reduction of the balance sheet will begin only in June, and the rate has been raised only once at the moment and remains at an ultra-low value. Therefore, the worst is yet to come for the stock and cryptocurrency market. Consequently, Bitcoin may fall significantly below current levels. And this fall can continue for a very long time, a year and a half completely freely. It is worth recalling that each "bullish" trend ended up with a drop in the cryptocurrency by 80-90%.

On the 4-hour timeframe, the quotes of the "bitcoin" are fixed below the trend line and continue to fall. Now we need to wait for the overcoming of two important lines on the 24-hour TF, after which it will be possible to continue selling with the goals of $ 34,267 and $ 31,100.