Analysis of trades and tips on trading EUR

Many traders incurred losses due to Friday's sideways channel. The lack of proper entry points and target levels did not allow speculators to end the week with gains. The only test of 1.0820 occurred at the moment when the MACD indicator moved away significantly from the zero level. In my opinion, it limited the upward movement of the pair. For this reason, I did not open long positions on the euro. As it turned out, it was the right decision. A sell signal according to scenario No. 2 did not appear as the price did not break again through 1.0820.

Inflation data for France and Italy did not spur market activity. In France, the figure coincided with economists' forecasts, while in Italy, inflation slowed down. It was quite surprising for analysts. US industrial data turned out to be better than predicted. However, the euro/dollar pair was unable to break out of the sideways channel amid this upbeat report. Low volatility remained until the end of the day. It may happen again today. In the first half of the day, there is no data for the eurozone, so there will be no drivers. The US Nahb Housing Market Index is of little importance to speculators. Fed official James Bullard will deliver a speech. It will hardly affect the market as he is likely to talk about the future plans of the Fed. However, they are already quite clear. The US dollar will only benefit from the hawkish comments. If so, the euro/dollar pair could decline to new lows.

Buy signal

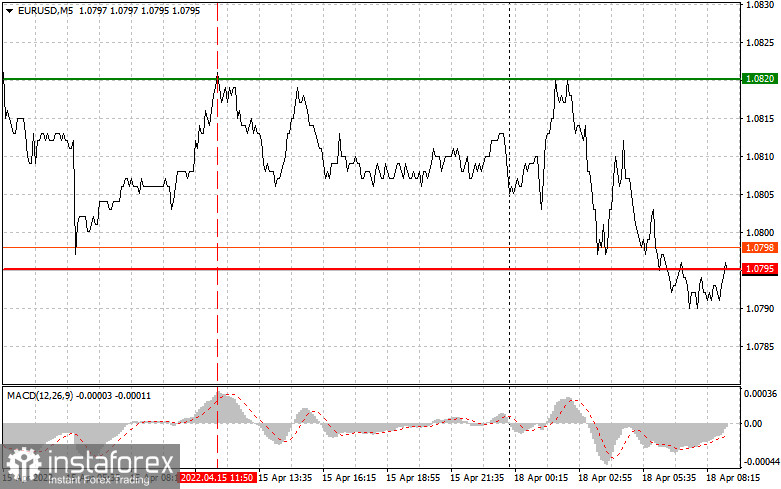

Scenario No.1: it is recommended to open long positions on the euro today if the price reaches 1.0820 (the green line on the chart) with an upward target of 1.0881. I would advise closing long positions at this level and opening short ones, keeping in mind a 20-25 pip downward correction from the given level. The euro is unlikely to climb significantly today as trading floors in Europe are closed on the Easter holidays. However, in the afternoon, the US will release economic reports. If the figures are positive, the US dollar is sure to advance higher. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to rise from this level.

Scenario No.2: it is also possible to buy the euro today if the price approaches 1.0786. At this moment, the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may also trigger an upward reversal. The pair is expected to grow to the opposite levels of 1.0820 and 1.0881.

Sell signal

Scenario No.1: it is recommended to open short positions on the euro if the price hits 1.0786 (the red line on the chart). The target level will be 1.0745. I would advise closing short positions at this level and opening long ones, keeping in mind a 20-25 pips upward correction from the given level. Pressure on the euro may increase at any moment as traders refrain from taking risks. Analysts are betting on a big sell-off of the trading instrument. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from this level.

Scenario No.2: it is also possible to sell the euro today if the price drops to 1.0820. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also trigger a downward reversal. The pair is expected to slide down to the opposite levels of 1.0786 and 1.0745.

Description of the chart:

The thin green line indicates the entry point where you can buy a trading instrument;

The thick green line is the estimated price where you can place a take profit order or lock in profit manually as the price is unlikely to rise above this level;

The thin red line is the entry point where you can sell a trading instrument;

The thick red line is the estimated price where you can place a take profit order or lock in profit manually as the price is unlikely to decline below this level;

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. It is better to stay out of the market before the release of important fundamental reports. It helps you avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for effective trading you need to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous decision making based on the current market situation is a losing strategy of an intraday trader.