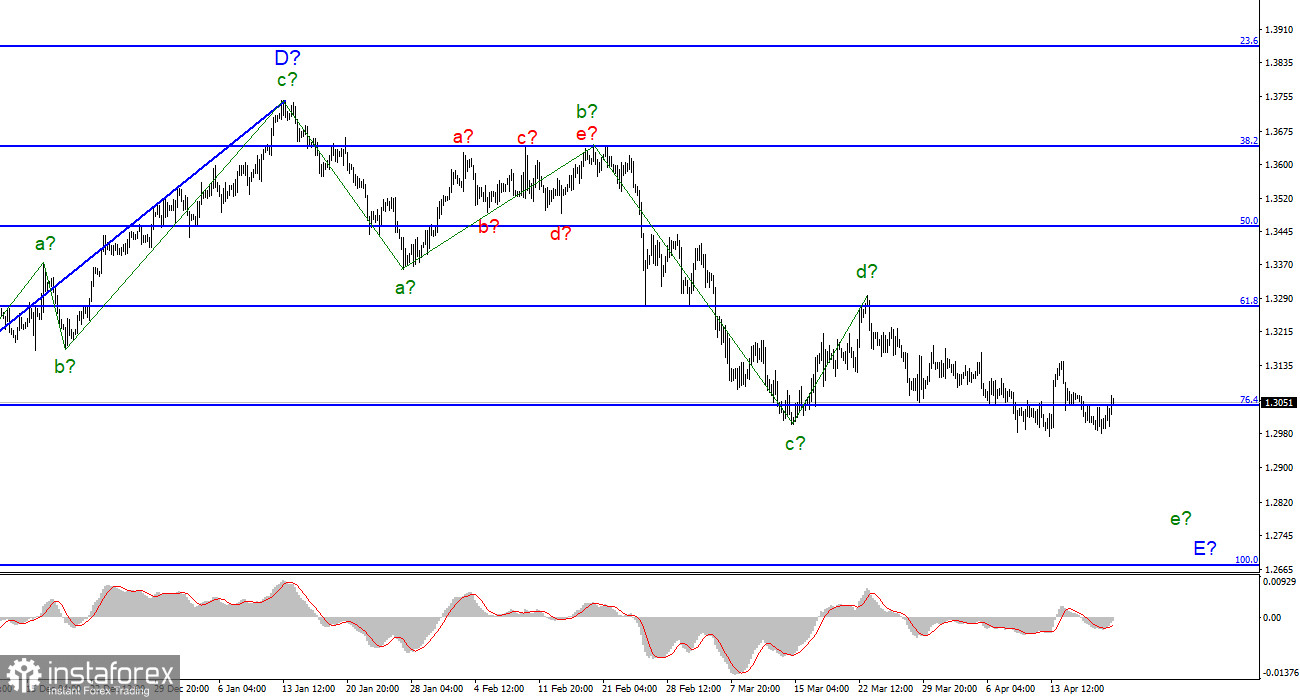

For the pound/dollar instrument, the wave markup continues to look very convincing, even taking into account the unexpected growth last week. The assumed wave d-E is completed, and there should be five waves in total inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time within the wave e-E. An unsuccessful attempt to break through the low wave c-E does not allow the market to continue selling the instrument. Near this mark, the instrument turned sharply upwards and began a powerful increase, which also quickly ended. Thus, the wave e-E should be more extended than it is now. Since the low of the supposed wave c-E is still broken, then theoretically the wave e-E can end at any moment. However, I still expect that the decline in the British dollar within this wave will be much stronger, given the current situation in Ukraine and the economic background in the UK, USA, and Europe. I am not considering alternative options for wave marking yet, but I admit that in the near future the downward section of the trend may complete its construction.

Moscow has sent new proposals to Kyiv

The exchange rate of the pound/dollar instrument increased by 60 basis points on April 20. Thus, the instrument moved away from the previously achieved low and once again failed to continue building the proposed wave e-E. The longer the construction of this wave is delayed, the higher the chances that the entire downward trend section will be completed. After all, his last wave is being built now. Nevertheless, I believe that the market is still not counting on the purchases of a Briton or a European. The news background remains quite negative for these currencies. Today, during the day, a message was received from Dmitry Peskov about new proposals to Kyiv for a peaceful settlement of the conflict. A little later, Mikhail Podolyak commented on this message and said that the proposal would be considered. And although the chances of peace are catastrophically small, the market still reacted to this news, which gives a little hope. Let me remind you that the deterioration/continuation of the Ukrainian-Russian conflict is a downward factor for both instruments. But any news indicating an improvement in the situation can increase demand for the euro and the pound.

My opinion is that there is absolutely nothing to be happy about right now. Negotiations between Kyiv and Moscow have officially stalled. And even if this did not happen, many issues cannot find compromise between the parties. Thus, you can continue negotiations as long as you like, but Moscow will not give up Crimea, and Kyiv will not recognize Crimea as Russian. I believe that the special operation will continue for a very long time, and negotiations are hoping for good luck. According to many military analysts, everything will be decided on the battlefield. Negotiations that can produce results are possible only after the battle in the Donbas, which began a few days ago and whose purpose is to define the Luhansk and Donetsk regions along their administrative borders, is over.

General conclusions

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave e-E does not look fully equipped yet. Maybe this wave won't be too long, but it doesn't look complete right now.

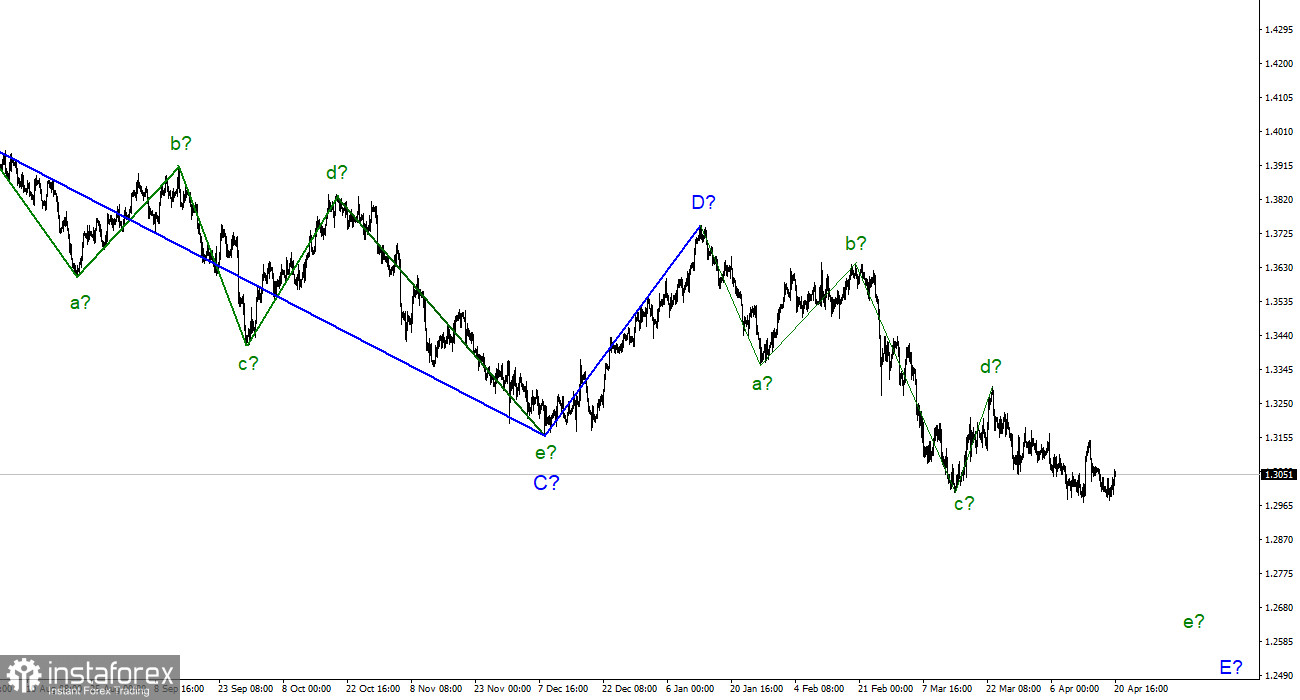

On the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the instrument to continue to decline with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.