EUR/USD

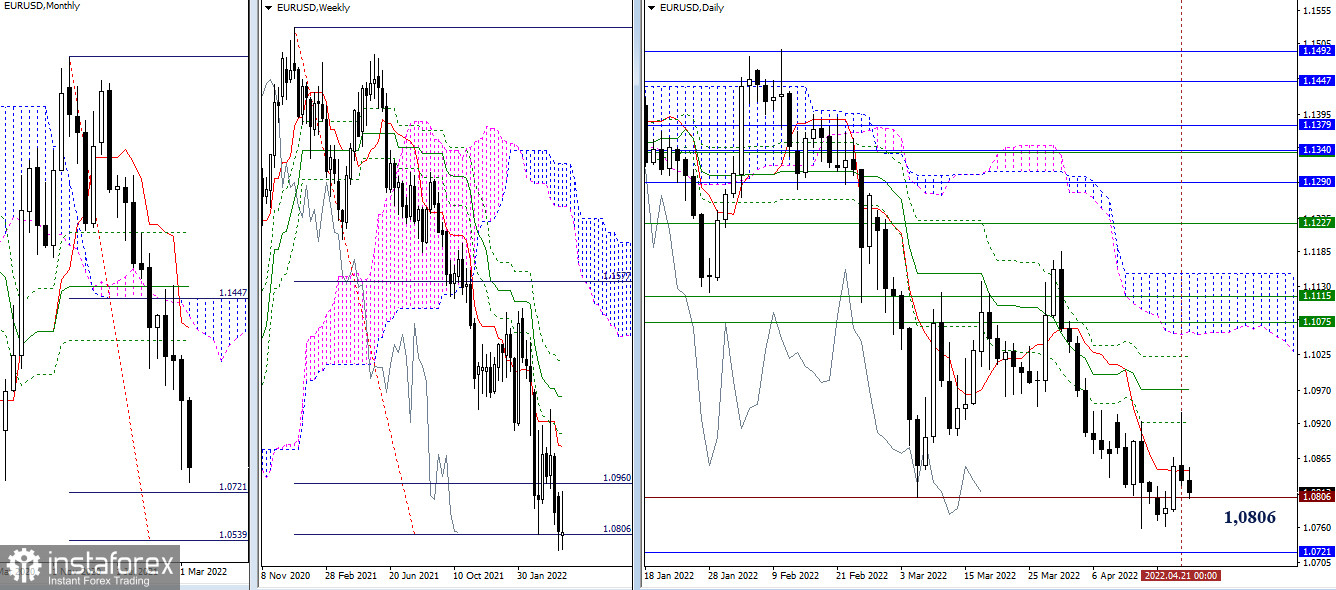

Higher timeframes

The corrective upward movement, which originated the day before, formed a daily rebound during testing of the daily resistance (1.0921) yesterday. Confirmation of the rebound will help strengthen bearish sentiment. At the moment, bears target the breakdown of the support of the weekly target (1.0806) and the restoration of the downward trend (1.0758). Further attention will be directed to the fulfillment of the monthly target for the breakdown of the Ichimoku cloud (1.0721 - 1.0539). If another failure and uncertainty do not allow to confirm the formed rebound, then the attraction and the influence of the weekly support (1.0806) can once again prevent the bearish scenario, as a result of which the situation will return to the possibility of an upward corrective movement after some time.

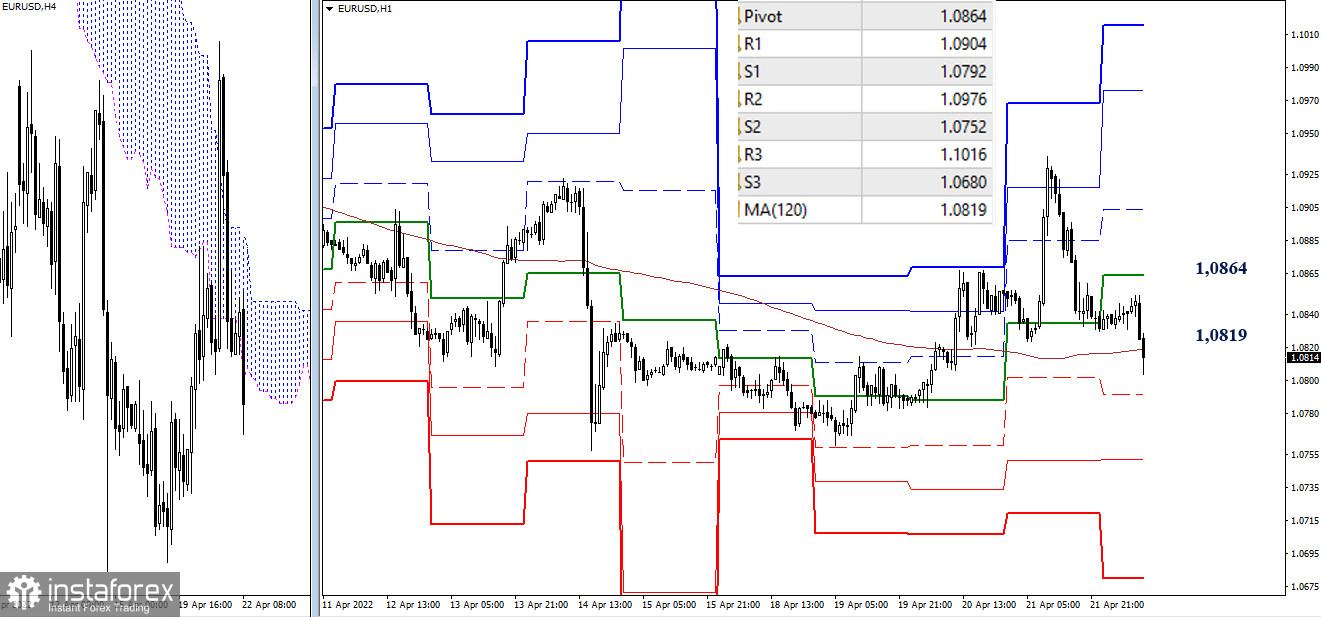

H4 - H1

Bears continue to dominate the lower halves after bulls failed to achieve their target. The key levels for today are located at 1.0819 (weekly long-term trend) and 1.0864 (central pivot point of the day). Working above these key levels favors the bulls. Upward targets within the day are the classic pivot points resistance (1.0904 – 1.0976 – 1.1016). Consolidation and work below the levels will contribute to the strengthening of bearish sentiment, and the reference points for this will be the classic pivot points support (1.0792 - 1.0752 - 1.0680).

***

GBP/USD

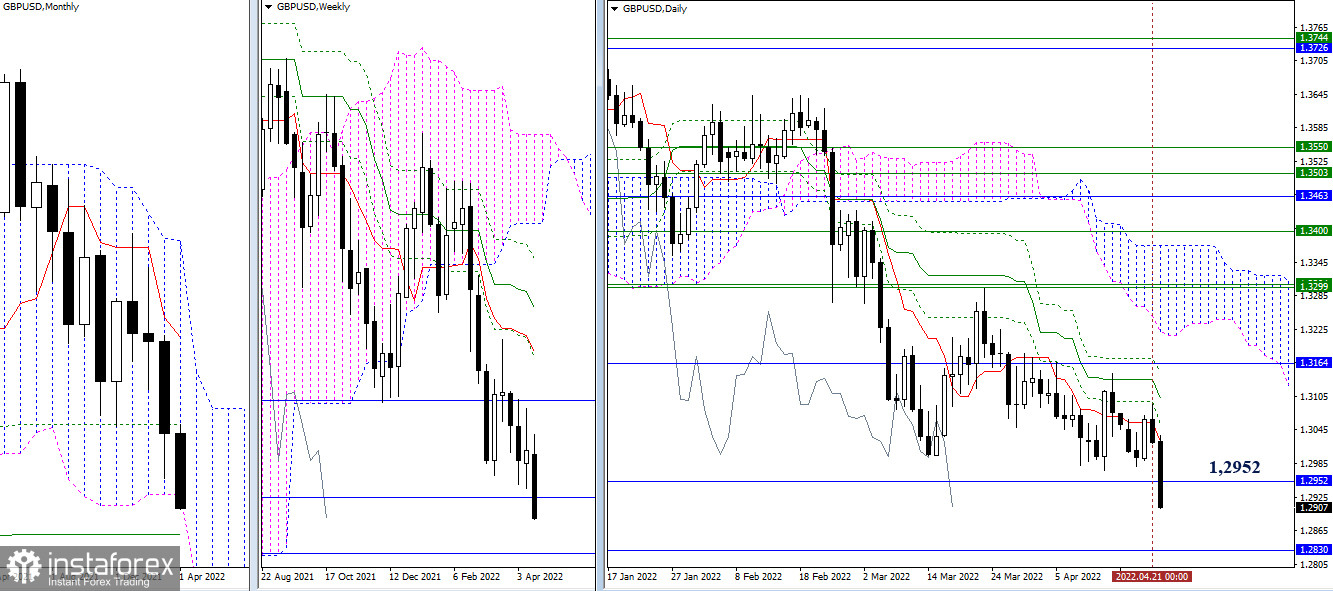

Higher timeframes

Bullish players on GBP/USD also failed to achieve dominance. Bears not only returned to the market and stopped the corrective rise, but at the same time, updated the lows and claims not only to test the monthly support (1.2952) but also to break it. In the current situation, the next support and reference point is at 1.2830 (monthly medium-term trend).

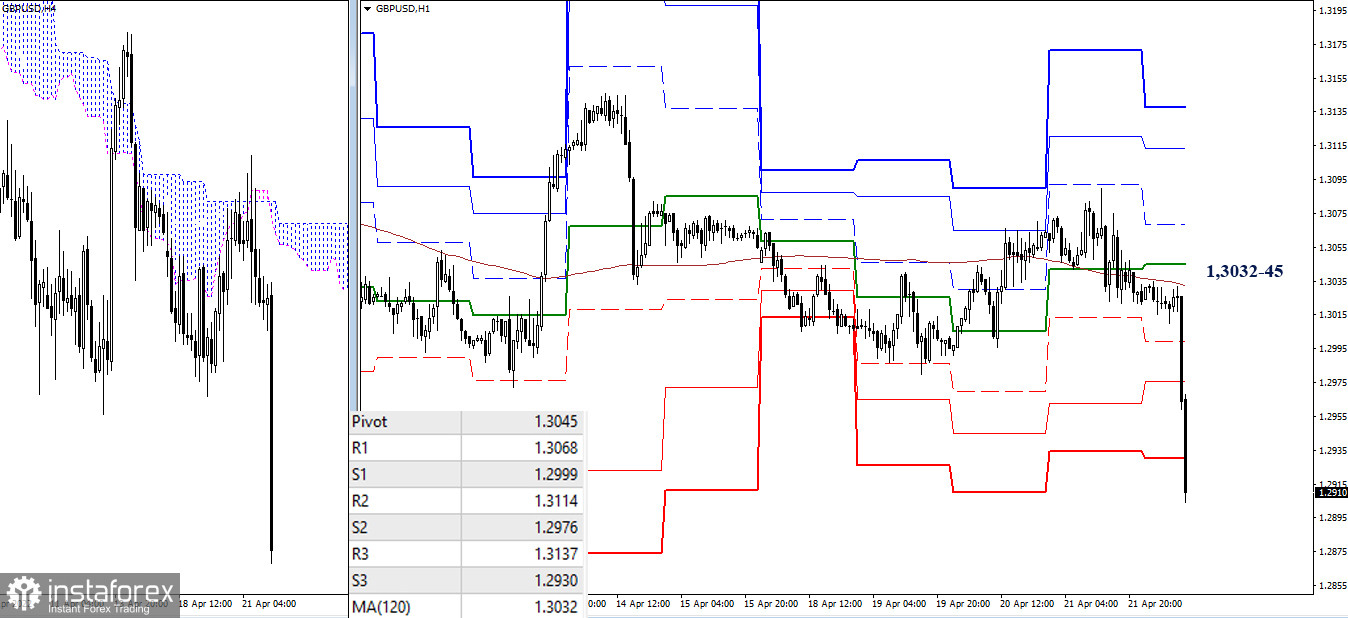

H4 - H1

Bulls failed to hold above the key levels of the lower halves. After consolidation below the key levels, they can now be noted at 1.3032 (weekly long-term trend) and 1.3045 (central Pivot level). The advantage has shifted to the side of the bears, who are currently implementing a rather sharp and effective decline. All downward reference points of lower halves have already been worked out. They can now act as resistance (1.2930 - 1.2976 - 1.2999) in case of deceleration and restoration of positions. The downward reference in case of continuation of the decline in the current conditions is the support of the higher halves at 1.2830 (monthly medium-term trend).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)