According to the latest results of the weekly gold survey, the sentiment of analysts does not give a clear direction of price movement in the near future.

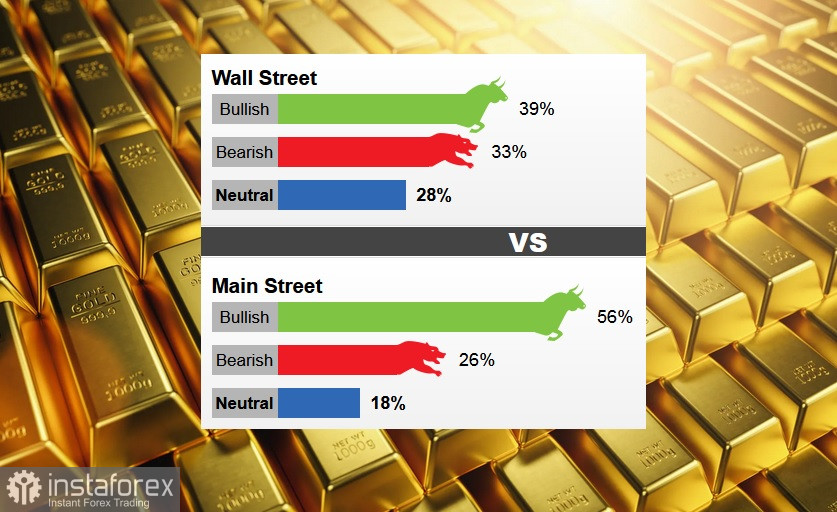

Retail investors remain firmly optimistic, but Wall Street analysts are almost in a three-way tie.

David Madden, market analyst at Equiti Capital, said he remained bullish on gold but would not buy the precious metal at current prices.

Last week, 18 Wall Street analysts took part in the gold survey. Among the participants, seven of them, or 39%, voted in favor of rising gold prices. At the same time, six analysts, or 33%, were bearish. And five, or 28%, reacted neutrally.

Meanwhile, 647 votes were cast in Main Street online polls. Of these, 363 respondents, or 56%, expected gold prices to rise. Another 170 voters, or 26%, announced a reduction, while 114 voters, or 18%, were neutral.

Some economists say gold prices may continue to consolidate further in the near term as the US dollar and bond yields continue to rise after Federal Reserve Chairman Jerome Powell confirmed that the US central bank is on track to raise interest rates by 50 basis points.

According to Adrian Asset Management President Adrian Day, gold prices may experience further selling pressure as investors react to the Federal Reserve's aggressive plans to tighten monetary policy. However, he added that any drop in prices should be seen as a buying opportunity.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is bearish on gold in the near term as US dollar and bond yields rise.

Last week, the US dollar rose above 101, hitting a new two-year high.

The yield on 10-year US bonds is close to 3% for the first time since 2018.

However, Bannockburn Global Forex Managing Director Mark Chandler believes that gold prices will rise in the near future; however, profits may be limited.