Hi, dear traders!

First, let us have a look at the performance of USD/CHF last week.

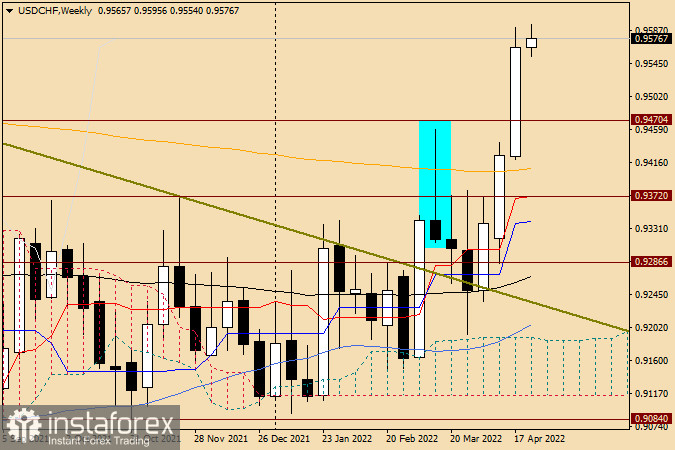

Weekly

The pair's further trend is now absolutely clear. Bullish traders have finished last week at 0.9565, breaking through the key resistance level of 0.9470 and rising above the highlighted bearish reversal candlestick pattern. USD/CHF finished last week above the key psychological and technological level of 0.9500 and could rise even further. The next targets for bulls are 0.9600, 0.9640, 0.0980, 0.9700, and 0.9755.

If the pair somehow retreats below 0.9470, it would make the breakout a false one, indicating USD/CHF would decrease in the future. However, the hawkish plans of the Federal Reserve are giving strong support to the US dollar. The Fed is preparing to tighten its policy and hike the Fed funds rate faster than previously anticipated, making such scenario unlikely. Bullish traders have the upper hand at the beginning of this week. Early on Monday, the pair was moving upwards near 0.9590, aiming to surpass the previous high of 0.9591. The weekly chart suggests USD/CHF is likely to rise even higher.

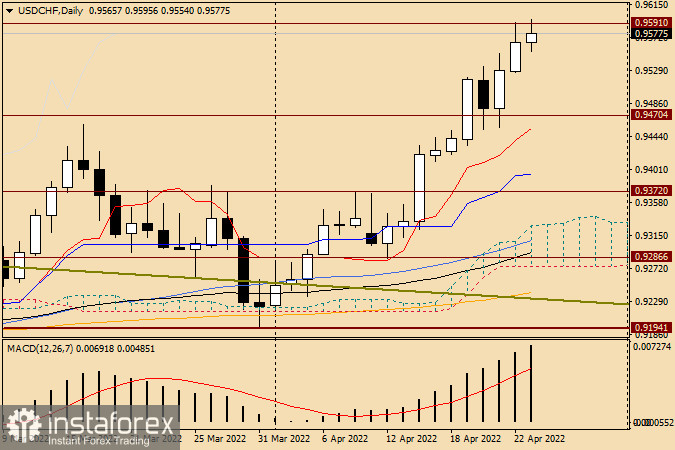

Daily

According to the daily chart, the pair is testing the resistance level it had encountered on Friday, April 22. If USD/CHF breaks above this level, long positions could be opened once it retraces into the 0.9600-0.9590 area. Bullish reversal patterns at lower timeframes in this area would serve as a buy signal. However, it should be noted that the Swiss franc is also a safe haven asset - depending on market sentiments, CHF could attract strong demand from traders. As a result, traders are recommended to observe the pair's performance after it rises into the strong technical area of 0.9600-0.9640. Short positions should be opened if bearish reversal candlestick patterns appear in this area at daily or lower timeframes. At this point, opening long positions is the main trading strategy for USD/CHF - going short during downward corrections would be quite risky at the moment.

Good luck!