Hello, dear traders!

Last week, the heads of the world's leading central banks delivered speeches, including the Bank of Japan's Haruhiko Kuroda. At the IMF summit, he once again confirmed the dovish stance of Japan's regulator. Mr. Kuroda also hinted that the central bank would make further moves to loosen monetary policy. It should be noted that inflation in Japan is lower than in the United States and the eurozone. This is also the reason why the Bank of Japan is going to continue its dovish rhetoric. Mr. Kuroda additionally emphasized that rising commodity prices were behind an outflow of capital from Japan.

In this light, the regulator's monetary policy should focus on price stability and economic recovery. As we may notice, the Fed's and the BoJ's policy stances are completely the opposite, which is clearly reflected in the quotes of USD/JPY. So, prior to analyzing charts, I'd like to remind you that the Bank of Japan will announce its interest rate decision already this Thursday. In fact, no policy changes are expected to be made. The benchmark rate is highly likely to remain at the level of minus 0.1% and the regulator to remain dovish. Therefore, it would be unwise to anticipate the yen getting stronger.

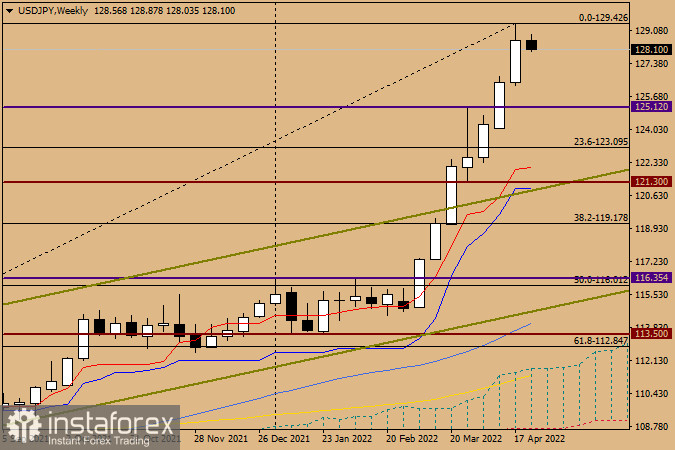

Weekly

In the weekly time frame, we can see a clear uptrend on USD/JPY. In fact, this move is only getting stronger. The pair has been on the rise for seven weeks now. Above all else, the market shows absolutely no reaction to any reversal signals and continues to be bullish. Thus, the pair closed the previous week at 128.5518. Should the uptrend extend, the price will touch the important psychological and historical technical level of 130.00. If so, a corrective pullback may take place. So far, the uptrend looks strong enough in the weekly time frame, so it is unlikely to be over any time soon.

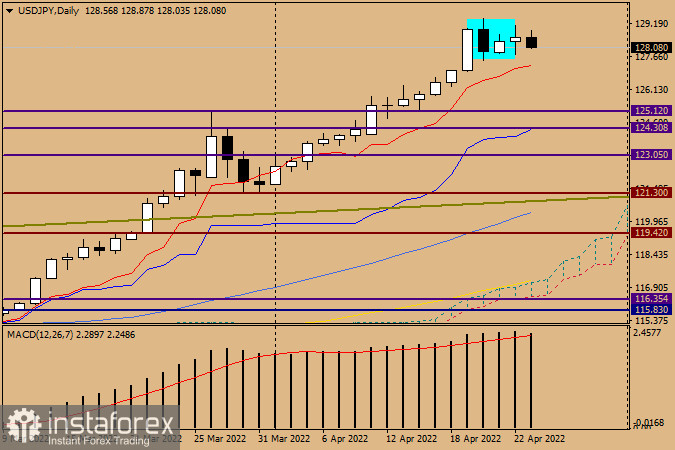

Daily

Speaking of the daily time frame, the bullish trend has somewhat slowed down. Since April 20, the pair has been trading in a relatively narrow range. Bears' attempts to push the price down should be interpreted as a signal to go long from the red Tenkan Line of the Ichimoku indicator. This line passes slightly above the 127.00 mark and may provide solid support for the yen and resume growth. Long positions could also be considered from the strong technical level of 127.50. Anyway, in order to determine entry points more accurately, lower time frames should be considered. This is what we are going to do when we analyze USD/JPY next time. All in all, it would be wiser to open trades along with the current uptrend.

Have a nice trading week!