EUR neglects signs of hawkish ECB rhetoric

Hi, dear colleagues!

Last week, market participants took notice of comments from top official of the US and the EU monetary authorities. They made some impact on the trajectory of EUR/USD. Nevertheless, the technical picture sets the tone in the currency market for the time being. At least, this is my personal opinion. Let's gain insight into the matter. ECB President Christine Lagarde stated that the APP program could be terminated in full by Q3 2022. Meanwhile, bond buying is tapered by EUR 40-20 billion per month. Moreover, the policymaker did not rule out the scenario that interest rates might be increased this year because there are no signs of stagflation in the EU. No doubt, this remark from the ECB President was tinted hawkish. The question is whether it helped the single European currency. We will answer it, looking at the charts of EUR/USD.

The US Federal Reserve is faithful to its aggressive rhetoric on monetary policy. Fed Chairman Jerome Powell reiterated this message in a few recent speeches. The hawkish Fed cements the US dollar's strength. Markets expects the US central bank to tighten monetary policy at a fast pace. So, rate hikes of 50 basis points are expected at each of the following meetings. US Treasury Secretary Janet Yellen also made a public appearance last week. She believes that inflation has reached its peak. Thus, the time is ripe for more resolute policy moves. Janet Yellen noted that the culprit of inflationary risks is the ongoing hostilities in Ukraine. The Treasury Secretary is certain that the Federal Reserve is holding its finger on the pulse, being able to respond adequately to soaring inflation.

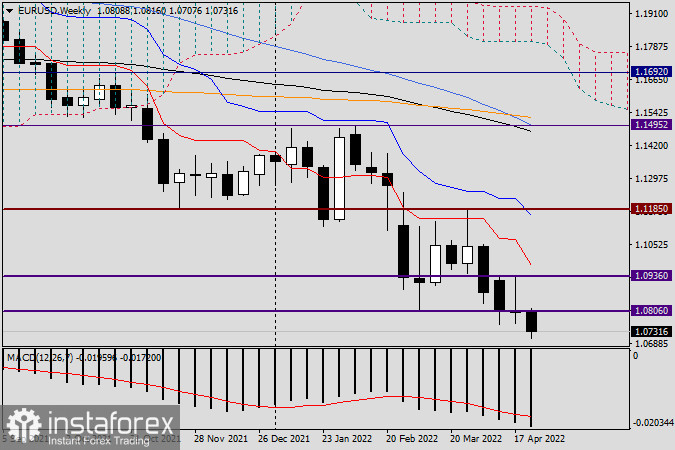

Weekly chart

The weekly chart of EUR/USD clearly displays that last week the currency pair did not bring profits either to bulls or bears. This is evident from the last weekly candlestick that actually lacks a body. The long upper shadow of this candlestick shows that the euro bulls were not able to assert strength and push the price up. The closing price at 1.0801 underscores the importance of the strong technical level of 1.0800. In the previous article, I suggested that the bulls and the bears would be fighting around this level for the closing price last week. This is what actually happened. Now let's discuss briefly the outlook for EUR/USD. If the euro bulls are capable of lifting the price above the previous highs of 1.0936 on condition that the pair closes above this level, traders could predict a further upward move. If the currency pair closes this trading week below 1.0800, the downtrend could get a second wind and the next downward target is seen at the technically meaningful historic area of 1.0745-1.0700.

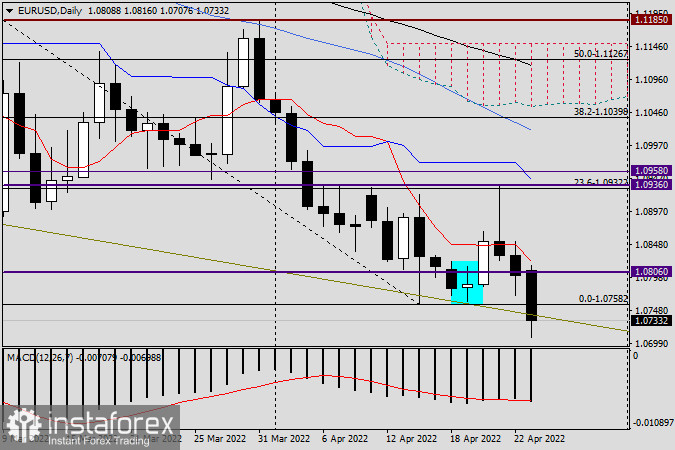

Daily chart

According to the daily chart, 1.0847, the red Tenkan line of the Ishimoku indicator, serves as the nearest resistance. However, only a genuine breakout of this line will open the door to higher prices. Until it happens, the euro bears are focused on lowering support to 1.0758 that matches the lows of April 14. From my personal viewpoint, the main strategy remains selling EUR/USD. We could plan short positions as soon as the price climbs to the area of 1.0820-1.0840. Tomorrow, I will come up with analysis on shorter time frames. I will adjust my trading ideas if necessary.

Good luck in trading!