As I have already mentioned in my review on EUR/USD, the previous week was marked with a number of speeches by global central bank leaders and other officials. It is not a secret that the US Federal Reserve consistently signals the aggressive tightening of its monetary policy. In particular, last week, Fed Chairman Jerome Powell once again confirmed his commitment to such a strategy. Naturally, this is the main factor to support the US dollar.

Last week, Andrew Bailey, Governor of the Bank of England, said that the target inflation rate in the UK is now more vulnerable than ever, and the bank is paying close attention to this aspect. Bailey also emphasized that reducing the central bank's balance sheet by selling assets is only advisable if the market is stable. Yet, he did not elaborate on what exactly this stability meant. Nevertheless, the head of the BoE made it clear that the central bank intends to reduce its balance sheet. Andrew Bailey will give another speech on Thursday. Now let's have a look at how the pound/dollar pair ended the week to April 22.

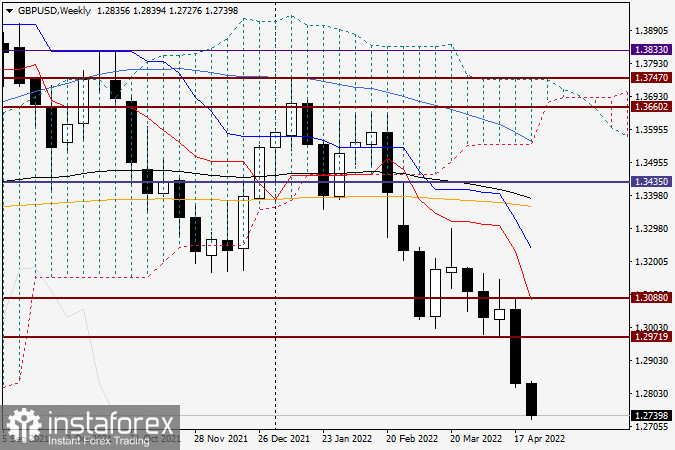

Weekly chart

Unfortunately, the British pound is not doing well. All attempts of the bulls to recover and settle above the key psychological and technical level of 1.3000 failed completely. Despite the fact that the pair rose to 1.3088 at one point, it failed to hold at the reached highs. As you can clearly see on the weekly chart, the price made a sharp reversal from 1.3088 and slumped rapidly, closing the previous week at 1.2834. Such a clear failure of GBP/USD to trade above 1.3000 and even above another strong technical level of 1.2900, demonstrates strong bearish sentiment in the market. A deep close below 1.3000 suggests that this level has been truly tested. The same is true about the support level of 1.2971. I am not sure whether the price will pull back to the tested levels of 1.2971 and 1.3000. However, selling the pair after corrective pullbacks looks like the most appropriate strategy.

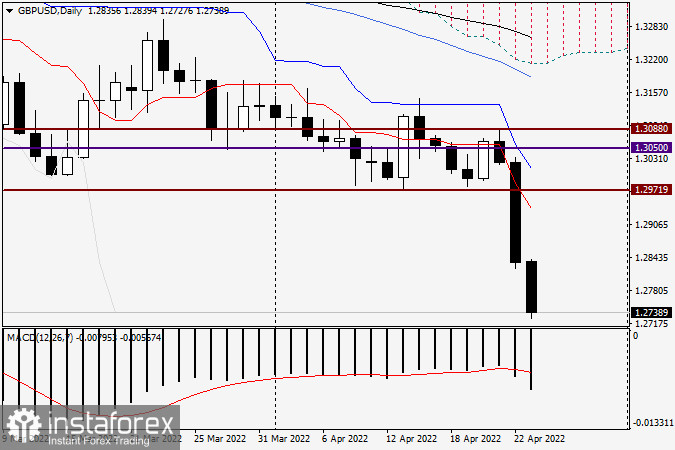

Daily chart

On the daily chart, it is worth mentioning a big bearish candlestick formed on Friday. It helped the pair to leave a relatively narrow sideways channel, where it had been stuck for quite a long time, and move downwards. Judging by the situation on both time frames, bulls are very unlikely to suddenly take over and reverse the trend. I believe that this will be extremely difficult to do in the current conditions. As for trading ideas, I recommend waiting for at least some kind of a correction before opening a sell trade. Tomorrow, I will analyze lower time frames for GBP/USD. In the meantime, these are the possible levels for correction and the targets to consider for going short: 1.2900, 1.2930, 1.2955, and 1.2970.

Good luck!