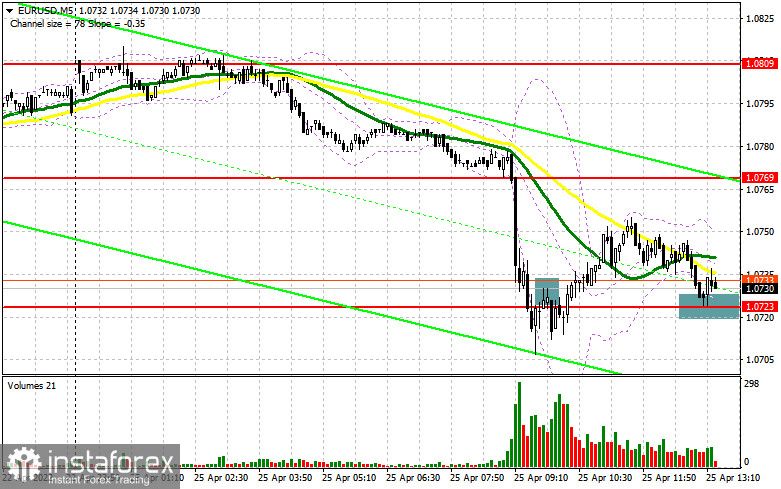

In my morning forecast, I paid attention to the level of 1.0723 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened there. The breakthrough and consolidation below 1.0723 with a reverse test from the bottom-up led to the formation of an excellent entry point for the sale of the euro in the continuation of the bear market, but the data on Germany led to the fixing of losses on the transaction. More than good reports from the Ifo Institute helped the euro to regain its position against the US dollar a little, but the demand did not last long. A return and a false breakdown at 1.0723 led to a signal to buy the euro, but in the afternoon the technical picture was revised - this should be taken into account when making new decisions. And what were the entry points for the pound this morning?

To open long positions on EURUSD, you need:

There are no statistics during the American session, so there is a chance that buyers will be able to pull the market. To do this, you need to take control of the new resistance of 1.0753, but you should not forget about the protection of 1.0710 either. The speech of ECB Executive Board member Fabio Panetta is unlikely to help buyers much. Therefore, if EUR/USD declines again to the support of 1.0710, only a false breakdown at this level will lead to a buy signal. While trading will be conducted above this range, we can expect an upward correction to the area of 1.0753. A breakout and consolidation above this range will certainly affect the stop orders of speculative sellers, and a reverse test from top to bottom of this level will give a new buy signal, opening up the possibility of restoring the pair to the 1.0785 area, where the moving averages are playing on the sellers' side. A more distant target will be the 1.0815 area, where I recommend fixing the profits. If EUR/USD declines in the afternoon and there are no buyers at 1.0710, it is best to postpone long positions. The optimal scenario for buying would be a false breakdown in the area of 1.0682. It is possible to open long positions on the euro immediately for a rebound only from 1.0636, or even lower - around 1.0572 with the aim of an upward correction of 30-35 points within a day.

To open short positions on EURUSD, you need:

Sellers continue to exert pressure and cope with it quite successfully. A slight rebound from 1.0710 does not indicate in any way the feeling of the bottom or the end of the bear market. The primary task of the bears for today is to protect the nearest resistance of 1.0753, formed by the results of the first half of the day. The hawkish statements of Panetta, the representative of the European Central Bank, will surely lead to a test of this level. Therefore, only the formation of a false breakdown there forms a sell signal to reduce to the area of 1.0710. A breakdown and a bottom-up test of this range will lead to a new sell-off of the euro, followed by a fall to 1.0682. The longer-range target remains the lows of 1.0636 and 1.0572, where I recommend fixing the profits. If the euro rises in the second half of the day and there are no bears at 1.0753, I expect a sharper upward jerk of the pair. In this case, the optimal scenario will be short positions when forming a false breakdown in the area of 1.0785, where the moving averages also pass. You can sell EUR/USD immediately for a rebound from 1.0815, or even higher - around 1.0844 with the aim of a downward correction of 25-30 points.

The COT report (Commitment of Traders) for April 12 recorded a sharp increase in long positions and a slight reduction in short ones. All this is characterized by positive expectations of new measures from the European Central Bank, which Christine Lagarde told us about last week. The fact that the ECB plans to fully complete the bond purchase program by the third quarter of this year and at the same time start raising interest rates indicates clear measures to combat high inflation in the eurozone, which seriously affects household incomes. But there is no such problem in any eurozone. Last week's data showed that in the US, the consumer price index also reached its maximum in the last 40 years. This forces the Fed to act more aggressively than before. Everyone expects an increase in interest rates by 0.5% immediately at the May meeting. Thanks to this, the US dollar continues to be in demand, which will continue to push the EUR/USD pair down. Russia's new active actions on the territory of Ukraine and the lack of progress in resolving the conflict also put pressure on the euro and will continue to do so. The COT report indicates that long non-commercial positions increased from 210,914 to 221,645, while short non-commercial positions decreased from 183,544 to 182,585. Despite the growth of long positions, the COT report is always secondary, and given how quickly the market situation is changing, these figures now do not reflect the whole picture. On the other hand, the decline of the euro makes it more attractive to investors, so the accumulation of long positions is not surprising. At the end of the week, the total non-commercial net position increased to 39,060 against 27,370. The weekly closing price fell by almost 100 points - from 1.0976 to 1.0877.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates the likelihood of a resumption of the bear market.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator around 1.0815 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.