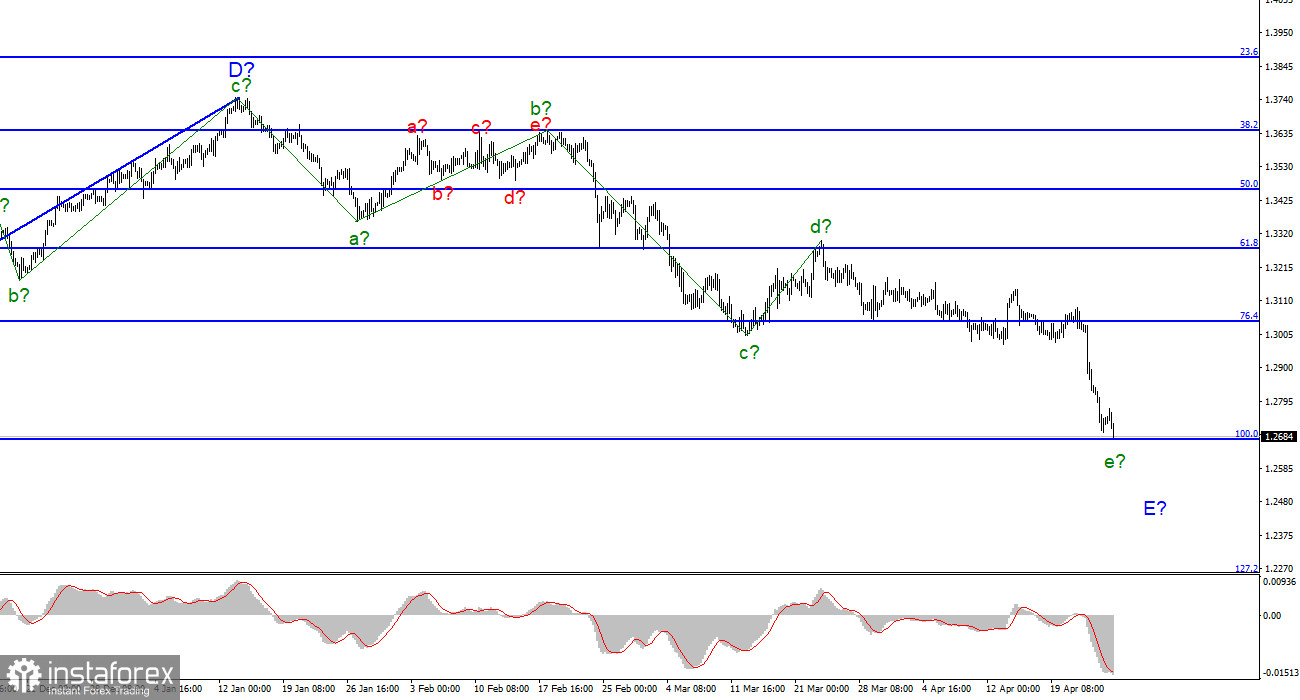

The wave layout for GBP/USD looks very convincing and does not require any adjustments. The descending section of the trend continues its formation within wave e in E, and its internal wave structure looks quite complex. Thus, this wave cannot take a shorter form. On the contrary, it can take a much more extended form than it has now. Demand for the British pound is decreasing. For several weeks, the pound was teetering on the verge of a new fall and finally dropped on Friday. However, wave e in E is the last wave of the current descending section of the trend. The entire section is either nearing its completion or it will have to take on a much more complex and extended form. Everything will depend on the news background, both economic and geopolitical. Some analysts warn that the military conflict between Ukraine and Russia can persist for many months, if not years. The consequences for the European and UK economies will be severe. From an economic viewpoint, the Bank of England appears to have a less hawkish stance on monetary policy than the Fed. And these two factors may continue to weigh on the British pound for a very long time.

UK bans exports to Russia of technology and goods that can be used against Ukraine

On April 26, the GBP/USD pair fell by another 60 points. In total, the British pound has lost about 400 pips over the past few days. There was no news background in the UK on Monday and Tuesday, while in the US, it was of a purely political nature. In other words, nothing could cause such a strong decline in the pound. However, the wave layout indicates that the descending wave and the downward section of the trend are being formed. So, a new drop in GBP is not surprising.

The UK continues to step up sanctions and military support for Ukraine. As was reported today, London imposed a ban on exports to Russia that can be used against Ukraine. The government explained that this includes technologies for tracking, interception and monitoring. At the same time, the UK canceled all tariffs on imports of goods from Ukraine to support the country in a military confrontation with Russia. Britain's armed forces minister James Heappey said on Tuesday that it was completely legitimate for Ukraine to strike Russian logistics lines, fuel and ammunition depots. "Ukraine was a sovereign country that was living peacefully within its own borders and then another country decided to violate those borders and bring 130,000 troops with it," Heappey said. Also, the UK announced new deliveries of weapons, anti-tank missile systems, and heavy weapons to Ukraine. However, the British pound is definitely not supported by this news. Politics aside, there are no economic events right now. Even last week, the importance of the economic background was not enough to send the pound tumbling on the fourth day of trading.

Conclusion

The wave pattern of the GBP/USD pair still suggests the formation of wave E. I recommend selling the instrument with targets located near 1.2676, which corresponds to 100.0% Fibonacci, following each sell signal of the MACD indicator. A successful attempt to break through this mark will indicate that this wave may be even longer and selling with targets around 1.2246 will remain the best strategy.

On the higher time frame, wave D looks complete, unlike the entire descending section. Therefore, in the coming weeks, I expect the instrument to extend its decline towards the targets well below the low of wave C. Wave E takes on a five-wave form but still does not look complete. So, I expect to see the British pound around the 1.23 area.