The GBP/USD currency pair continued its downward movement on Thursday in the same way as the EUR/USD pair. In the article on the euro/dollar, we used such an expression as "the fall of the euro to hell." Although this is not exactly a literary expression, it most accurately describes what is happening in the foreign exchange market in the last week. So it is also quite applicable to the pound sterling since the British currency has already lost 650 points over the past 6 days. The reasons are the same as for the euro currency. There are no local ones, global ones are still the same. Earlier we have repeatedly said that the conflict between Ukraine and Russia is a military confrontation for many years. Everything will not end in the next month or two, no peace agreement will be signed. This confrontation will last until one of the parties suffers a complete military defeat or the government in Kyiv or Moscow changes. All the latest news, although not significant for provoking the fall of the euro and the pound by hundreds of points, very accurately indicates that the conflict will only continue to grow.

Let's not even talk about the sanctions war now, thanks to which more sanctions have been imposed against the Russian Federation than against the DPRK or Iran, and the entire European Union has already faced an energy crisis (it will also face a food crisis). The problem is that almost all Western countries have started a race called "who will supply more weapons to Ukraine". Moreover, we are talking not only about defensive weapons "if only Ukraine would stand," we are talking about armored vehicles, tanks, planes, howitzers, and other various "heavy" complexes. For example, yesterday the lower house of the German parliament voted "for" a petition on the supply of heavy weapons to Ukraine. Earlier, German Chancellor Olaf Scholz personally banned the supply of such weapons to Ukraine, fearing a direct conflict with Russia. However, Scholz was immediately criticized and even managed to resign "in words", and all the opposition parties in Germany unanimously decided to create an appropriate legislative act to cancel the "blocking" of Scholz.

Ukraine is becoming stronger militarily

We already talked about the Lend-Lease program yesterday. It means that now the entire US military industry will work for Ukraine, money for weapons will not be considered at all, no bureaucracy, and Kyiv will be able to almost choose the types of weapons it needs and their quantity. This program can be adopted from day to day, although it has already been approved by Congress since the US Senate voted unanimously for it. The lower house is unlikely to block the senators' decision. Against this background, the adviser to the President of Ukraine, Mikhail Podolyak, has already publicly stated that Ukraine is entering a completely new phase, "which no one could even dream of two months ago" - the Armed Forces of Ukraine began to switch to NATO weapons, to NATO standards. Some weapons have already passed into the hands of the Armed Forces of Ukraine and are actively involved in the protection of Ukrainian territory. Given that Western countries have almost unanimously decided to supply weapons and equipment to Ukraine in any quantities until they fully arm it so that the APU can go on a counteroffensive, this means that the conflict will just not end in the near future, it may continue for a very long time.

Ukraine has probably already decided to retake Donbas and Crimea at any cost. In Kyiv, they openly declare the "demilitarization of Russia", and in Russia itself, in the last few days, there have been several large-scale fires at various military facilities located near the borders with Ukraine. The United States openly stated that Kyiv has the full right to strike at fuel and military depots on the territory of Russia since it is from there that the resources for aggression come. And what does all this information say? Only that the conflict will continue to escalate. And it is completely unclear how it will end because Moscow understands that with such support from the West, it will be difficult to "demilitarize" Ukraine.

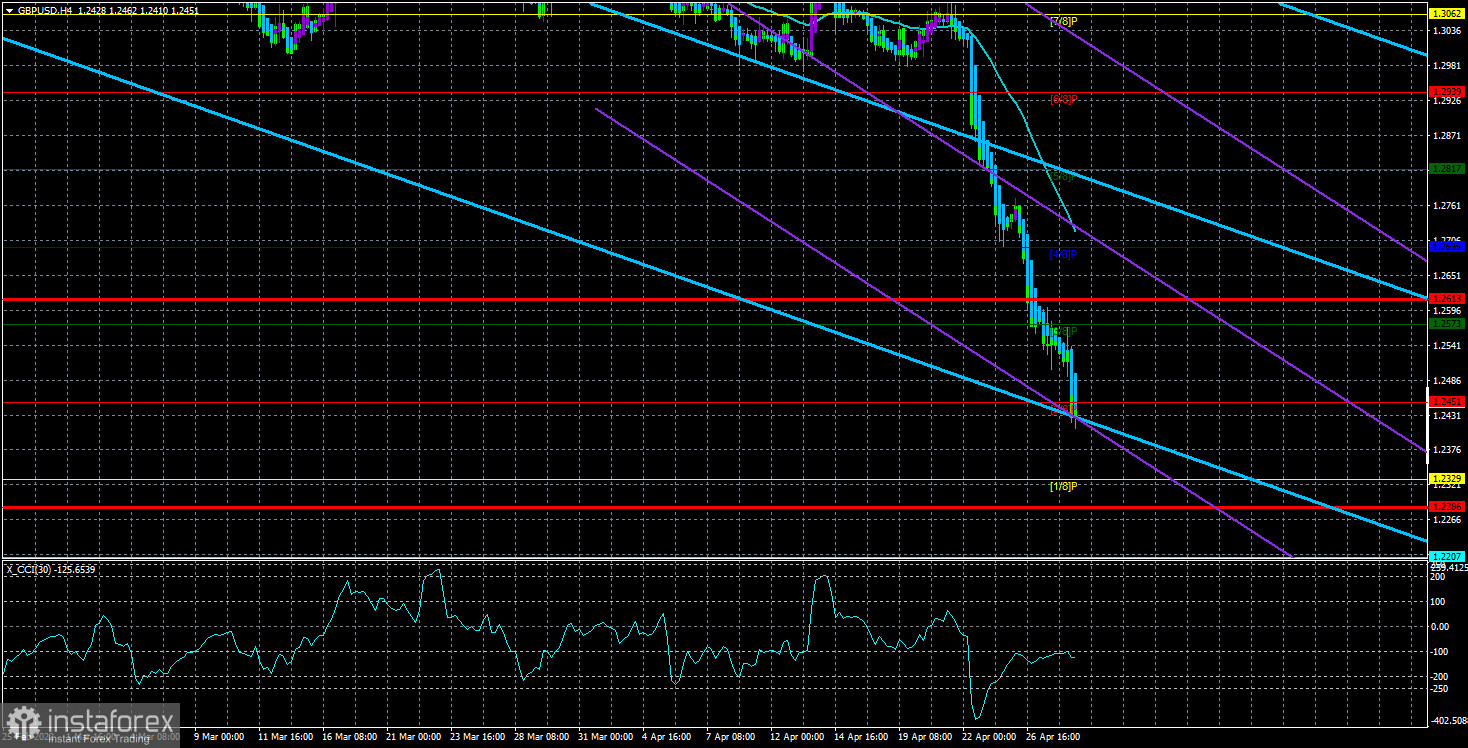

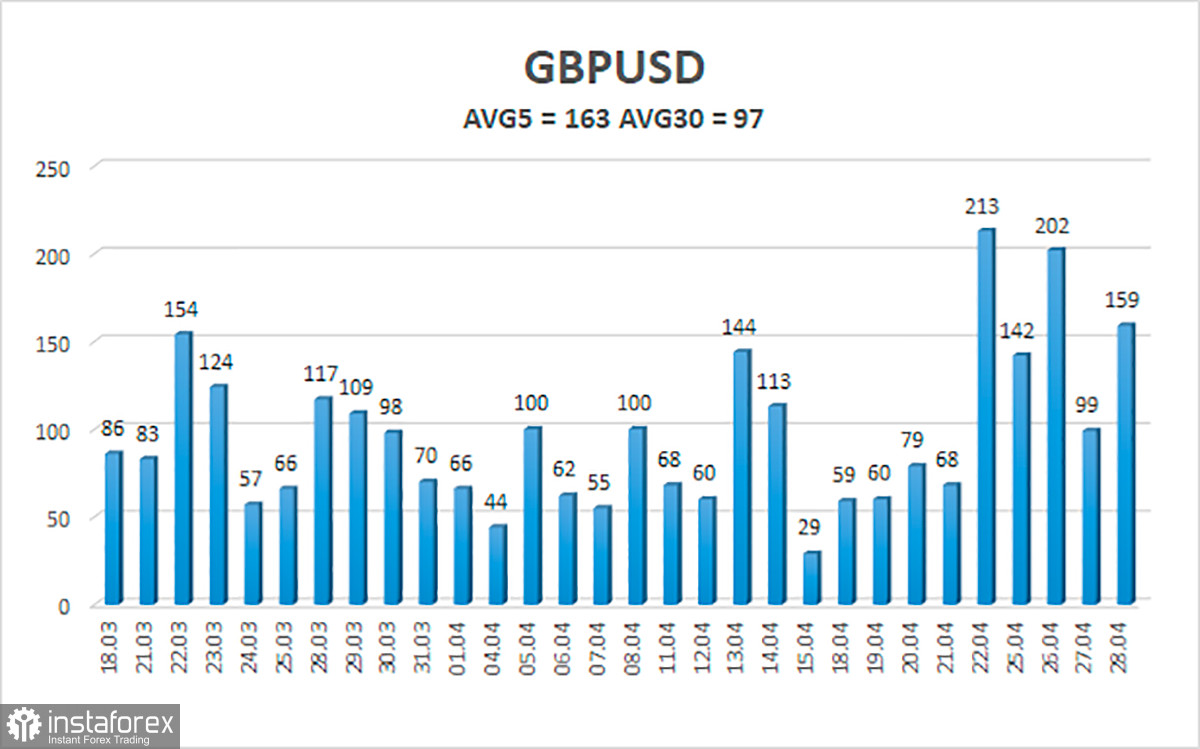

The average volatility of the GBP/USD pair over the last 5 trading days is 163 points. For the pound/dollar pair, this value is high. On Friday, April 29, thus, we expect movement inside the channel, limited by the levels of 1.2286 and 1.2613. The upward reversal of the Heiken Ashi indicator signals the beginning of an upward correction.

Nearest support levels:

S1 – 1.2451;

S2 – 1.2329;

S3 – 1.2207.

Nearest resistance levels:

R1 – 1.2573;

R2 – 1.2695;

R3 – 1.2817.

Trading recommendations:

The GBP/USD pair continues its strong downward movement in the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.2329 and 1.2286 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2817.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.