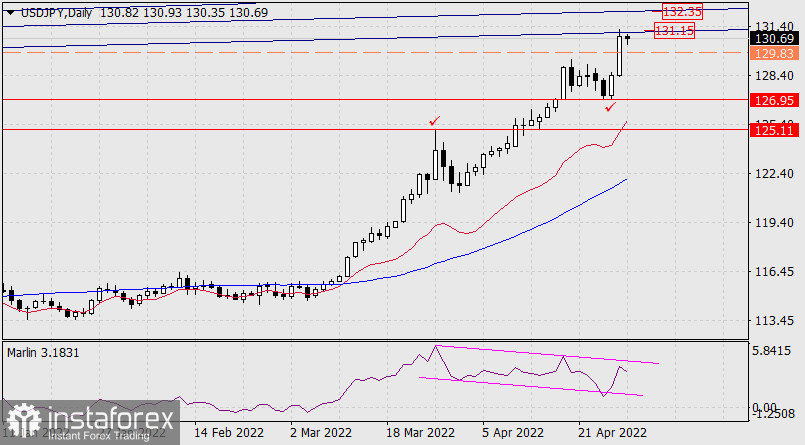

The dollar's growth against the yen from yesterday had amounted to 240 points. The price has fulfilled its obsessive goal of reaching the upper border of the green price channel (above 129.83), and now, since its upper border has been overcome, this channel is being abolished. The price continued to rise, the embedded line of a steeper and larger blue growing channel, which originated from the summer of 2012, was worked out.

A double price divergence with the Marlin Oscillator has already been formed on the daily chart, but the price may not stop there and try to work out the resistance of the nearest blue price channel line at 132.35, which will reshape the divergence itself. Also, the price may start a correction from the reached level of 131.15. The current situation has no clear signs of one or another scenario, the risk of uncertainty is high. Nevertheless, the Bank of Japan's actions and the increased correlation of the yen to the dollar, and not to the stock market, put forward the growth of the USD/JPY pair as a priority. Any decline is seen as a correction.

Let's look at the correction levels on the H4 chart. The nearest level at 129.41 is the peak on April 20, the MACD line is approaching it. The second correction level at 126.95 is the low of April 27th. Exit above 131.15 opens the 132.35 target.